-

Metro Denver's chronic shortage of existing homes for sale will push more buyers towards new home communities this year. But those buyers won't find much relief from tight supply and rising prices.

February 22 -

Sales of previously owned homes unexpectedly fell in January to a four-month low, indicating a shortage of available properties is increasingly hindering the real estate industry.

February 21 -

Efforts to move out of the Bay Area continued in recent months, with 16,000 residents packing up and taking to the road for cheaper housing and new opportunities.

February 8 -

Home prices will continue to increase this year, albeit at a slower pace, as inventory is expected to remain tight and demand will continue to rise.

February 6 -

The Palm Beach County, Fla., housing market continued to favor sellers in December, a month when home prices ticked up and inventory remained tight.

January 31 -

Metro Atlanta's housing market showed its fifth consecutive year of solid gains last year, but the shrinking supply in homes for sale has continued to drop into the red zone.

January 31 -

Home prices in 20 U.S. cities increased in November by the most in more than three years, underscoring a lingering scarcity of housing inventory.

January 30 -

A larger standard deduction could help renters become homeowners faster, and builders' lower taxes could expand inventory that competes with single-family rentals, according to Fannie Mae Chief Economist Doug Duncan.

January 29 -

Credit score damage is a chief regret among consumers, but among financial goals it impedes, buying a home lies further down the food chain than other priorities.

January 29 -

Sales of previously owned homes fell in December for the first time in four months, as the market struggles with record-low supply and rising prices.

January 24 -

In 2017, Spokane County reported the second-highest number of home sales in 30 years.

January 22 -

From San Francisco to Dallas, here's a look at the 10 top housing markets where homes sell above the asking price.

January 16 -

The new cap on the mortgage interest deduction should help the first time home buyer market by forcing sellers to lower prices, at least in the near term.

January 10 -

Consumer credit scores are improving, but many qualified borrowers are still hesitant about buying a house. New tools are helping lenders better assess risk and show consumers with lower credit scores they can qualify for mortgages.

January 8 -

Jeanne D'Arc Credit Union has begun thanking home buyers for their business by throwing housewarming parties for them once the process is complete.

January 5 -

The recently enacted tax reform bill is likely to encourage more consumers to rent instead of buy and tamp down the rapid rise in home prices.

January 4 -

Millennials who want affordable home prices in an urban market may want to check out the Gem City.

January 4 -

The gap between the average credit score for homebuyers and other consumers has widened to its highest point in 12 years, and lenders don't know what, if anything, to do about it.

January 3 -

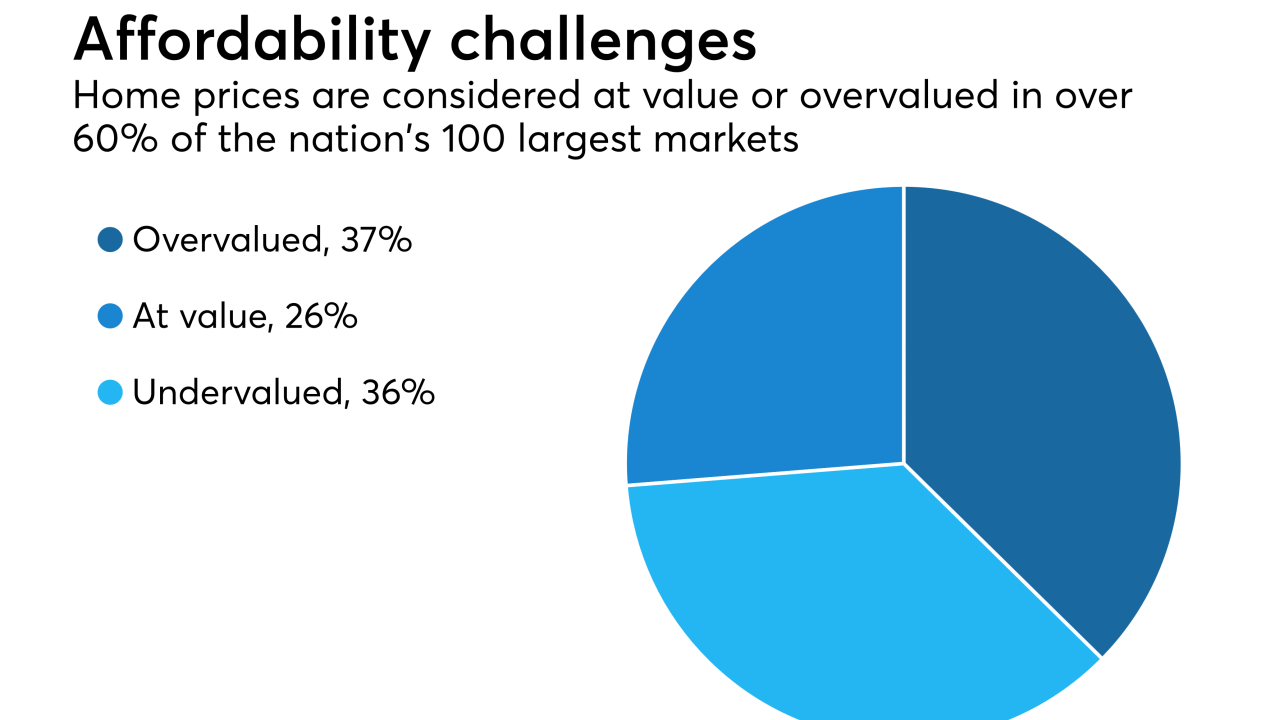

Home price growth is likely to slow in the near future but affordability remains a concern, especially at the lower end of the market, according to CoreLogic.

January 2 -

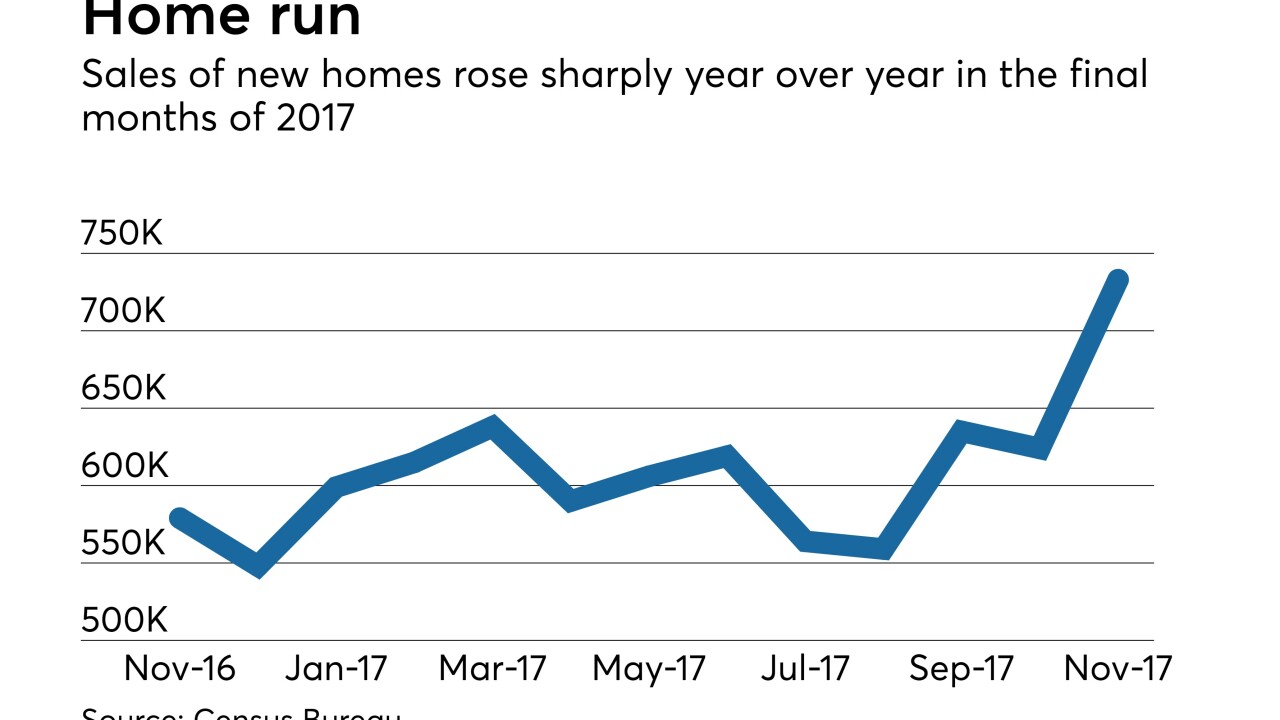

Home values grew during 2017 at their fastest pace in four years and the same supply and demand dynamics behind that increase remain in place for 2018.

December 28