-

While boosting origination volume for lenders and providing financial benefits for borrowers, the refinance boom could have adverse effects down the road, according to TransUnion.

February 12 -

Officials in Lakeland, Fla., are hoping they've found a strategy to lure private developers to build affordable single-family homes and apartments in the city.

February 11 -

A city agency that in recent years lost its luster as a place where low-income New Orleanians could go for low-interest mortgages is set to re-emerge as a key player in plans to develop more affordable housing in the city.

February 10 -

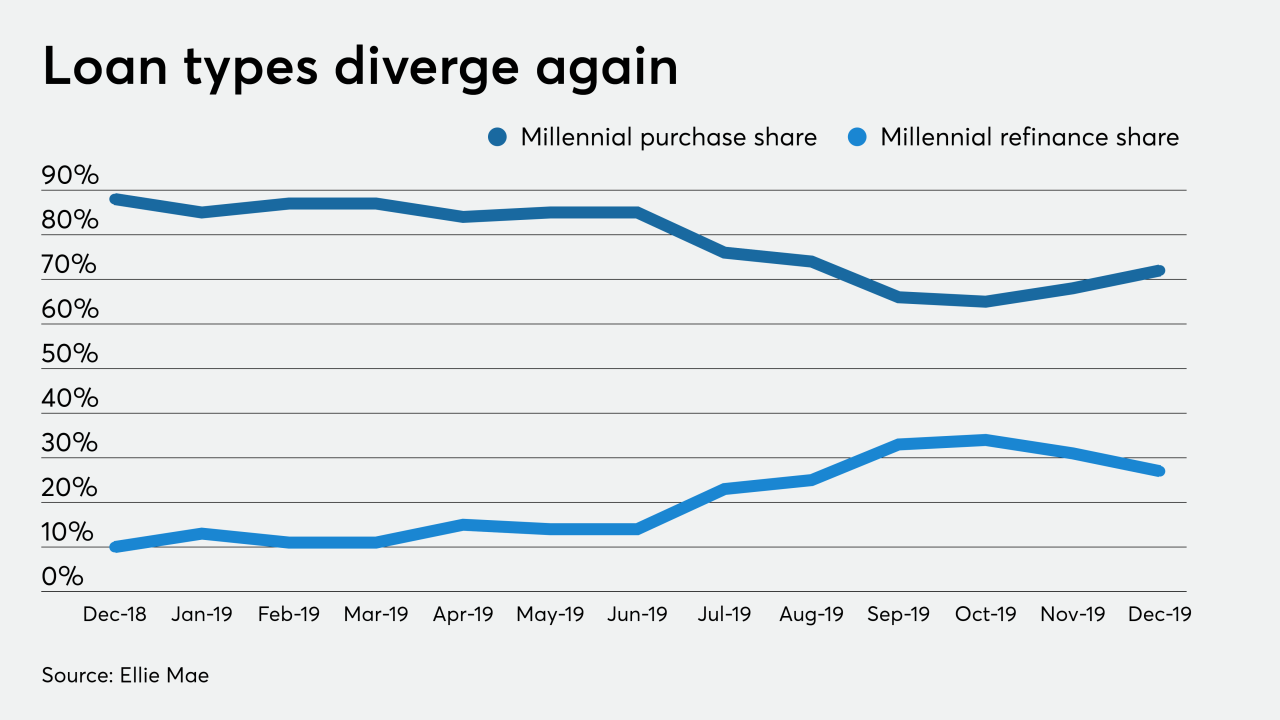

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

While down from the year before, December's housing value appreciation kept churning and should climb in 2020 to a new all-time high, according to CoreLogic.

February 4 -

The prevention of wire fraud and cybercrime being perpetrated against the mortgage business is the latest passion for Regina Lowrie, longtime industry executive and the first woman to head up the Mortgage Bankers Association.

February 3 -

Homeownership is one of the fastest ways for people to build wealth and giving down payment assistance provides creditworthy borrowers an opportunity to buy a house they otherwise wouldn't have, according to the CBC Mortgage Agency.

January 31 -

After a months-long slump in Bay Area home prices, the market appears poised to drive higher as buyers act on low interest rates and fight for scarce inventory.

January 31 -

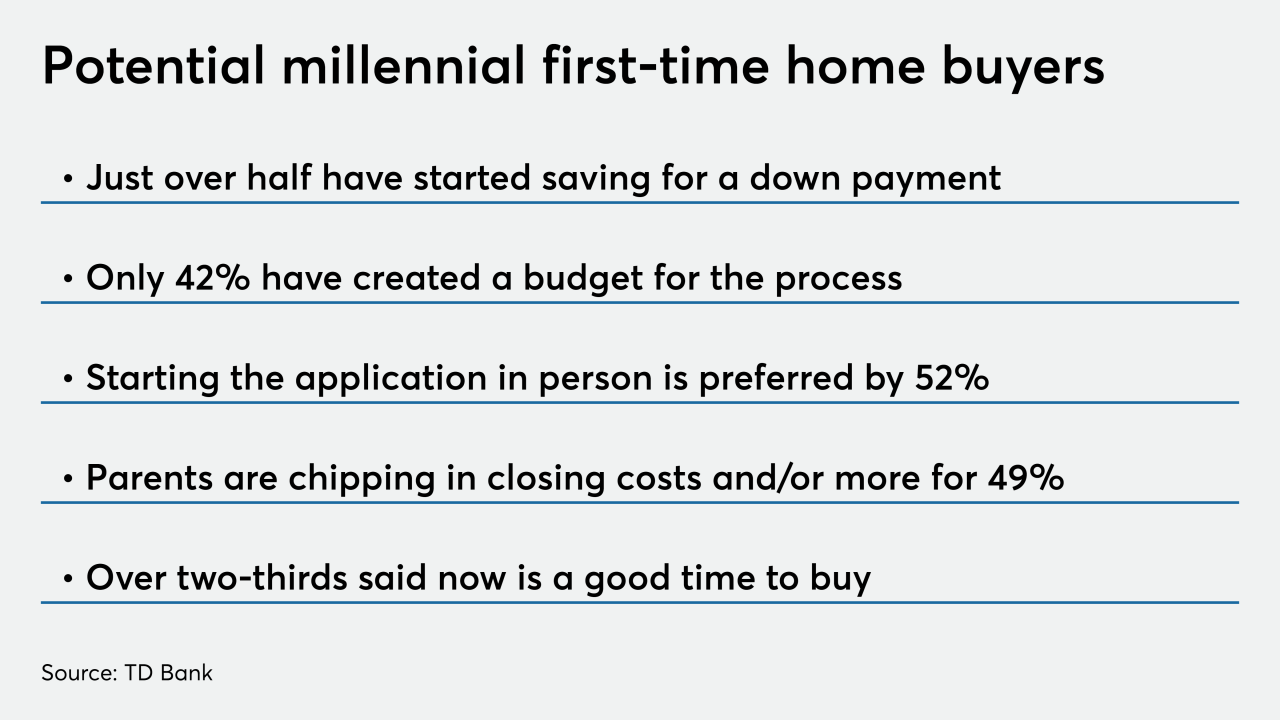

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

Sales of previously owned homes jumped in December to the best pace in nearly two years as historically low interest rates continued to lure buyers despite record-low inventory.

January 22 -

Southern Maine's superheated real estate market is presenting challenges to first-time homebuyers and expanding businesses, but shows no signs of cooling off.

January 17 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

Borrower education stands as a barrier to homeownership for younger consumers and Freddie Mac is trying to change that.

January 6 -

Officials hope a revamped Scranton, Pa., homebuyer program administered by a nonprofit partner will boost homeownership rates and bolster investments in city neighborhoods.

January 3 -

Homebuyer purchase power took another big jump in October as wages grew and mortgage rates stayed low despite continuously tight housing inventory, according to First American Financial.

December 23 -

Sales of previously owned homes declined to a five-month low in November, indicating lean inventories are holding back a residential real estate market that's been supported by low mortgage rates and job growth.

December 19 -

Without the baggage of living through the Great Recession, homeownership rates for Gen Z should exceed that of millennials, a plurality of respondents to a Zillow survey said.

December 17 -

From the Southeast to the Midwestern plains, here's a look at the 12 cities where first-time homebuyers can afford the largest share of houses for sale, according to First American.

December 12 -

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4