-

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6 -

Housing construction in the Twin Cities increased slightly last month, with most of the gain coming from a hefty increase in apartment construction.

September 6 -

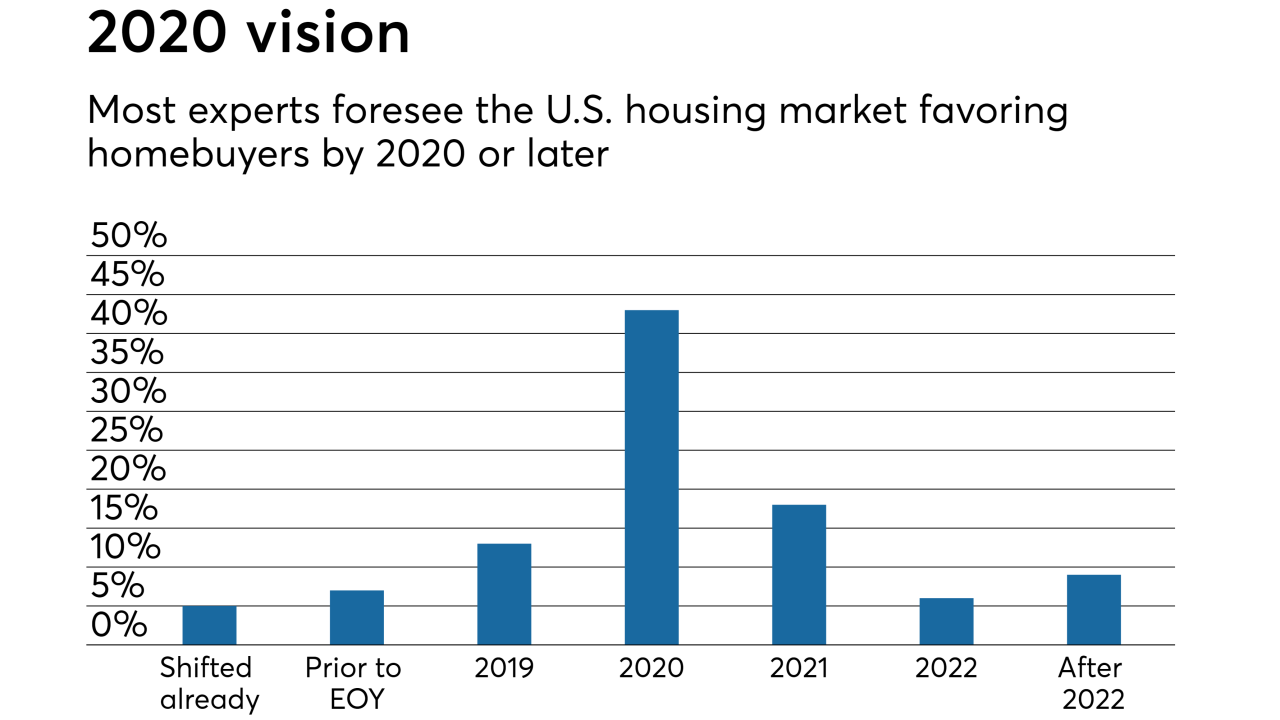

After home prices soared due to a lack of inventory and a recovering economy, three-quarters of experts believe the shift to a buyer's housing market should come in two years.

September 5 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

September 4 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

Almost $50 billion. That's how much Spokane County, Wash., is worth, according to this year's property assessments, up $4.1 billion over last year.

August 23 -

Sales of previously owned homes unexpectedly slumped for a fourth month to the weakest in more than two years, signaling higher prices and tight supplies continue to squeeze demand, a National Association of Realtors report showed.

August 22 -

Here's a look at the cities where house hunters and sellers have been the busiest during this summer's home buying season.

August 16 -

There would be over six million more new homes built in the last decade if new construction remained at the same pace prior to the housing boom, according to Zillow.

August 15 -

As housing affordability continues eroding on growing property values and mortgage rates, nearly a quarter of millennials believe they need to delay having children to afford a home purchase.

August 15 -

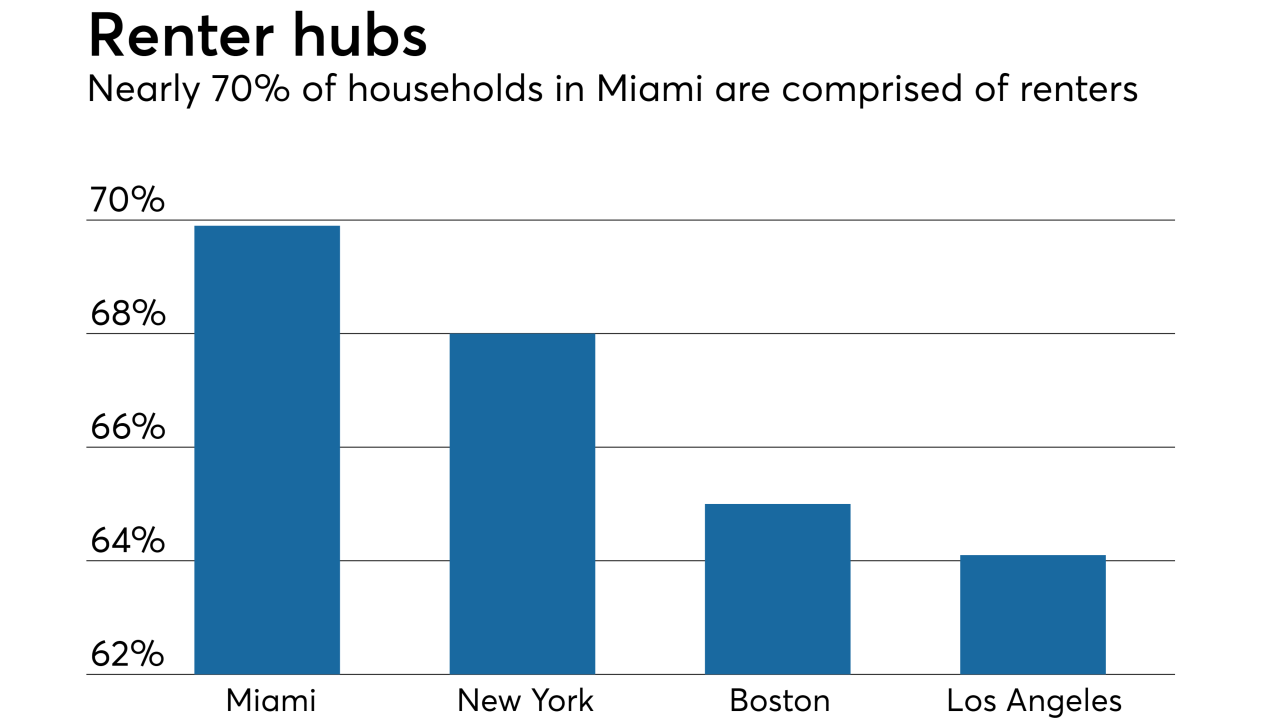

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8 -

Dallas-area home prices are up by less than the national average in another new housing report.

August 8 -

Growth in home prices continued wearing down affordability at the start of the season, preventing first-time buyers from entering the housing market.

August 7 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

Tight home supply remains a top challenge for house shoppers, but the slowing pace in which inventory is declining could signal more favorable conditions for homebuyers.

July 26 -

Sales of previously owned homes unexpectedly fell in June, indicating a shortage of affordable listings and rising prices continue to limit demand, a National Association of Realtors report showed.

July 23 -

The summer of 2018 is stacking up to be the most competitive on record for Twin Cities homebuyers.

July 19 -

Confidence among homebuilders held steady in July, matching the lowest level of the year, as solid job gains support demand while elevated material costs pressure developers.

July 17