-

Homebuyer interest dipped slightly in November, but remains well above year-ago levels, according to Redfin.

December 27 -

Seattle Mayor Jenny Durkan announced a $100 million-plus investment by the city in affordable-housing projects, including nine new apartment buildings and 26 homes for first-time buyers.

December 21 -

Sales of previously owned homes rose in November to an almost 11-year high, indicating demand picked up momentum heading into the end of the year.

December 20 -

Here's a look at the 11 housing markets where the share of entry-level homes for sale is greater than the share of first time home buyer shoppers.

December 19 -

Supply constraints tempered real estate and title professionals' outlook for the home purchase market over the next year, according to First American Financial Corp.'s fourth quarter Real Estate Sentiment Index.

December 13 -

Nonbank mortgage employment fell for the second consecutive month, according to the Bureau of Labor Statistics.

December 8 -

On the cusp of a new year — and winter — Twin Cities housing construction posted stellar late-season gains.

December 6 -

New Penn Financial has entered into a pilot program to provide mortgage financing to participants in Home Partners of America's Lease Purchase program.

November 29 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

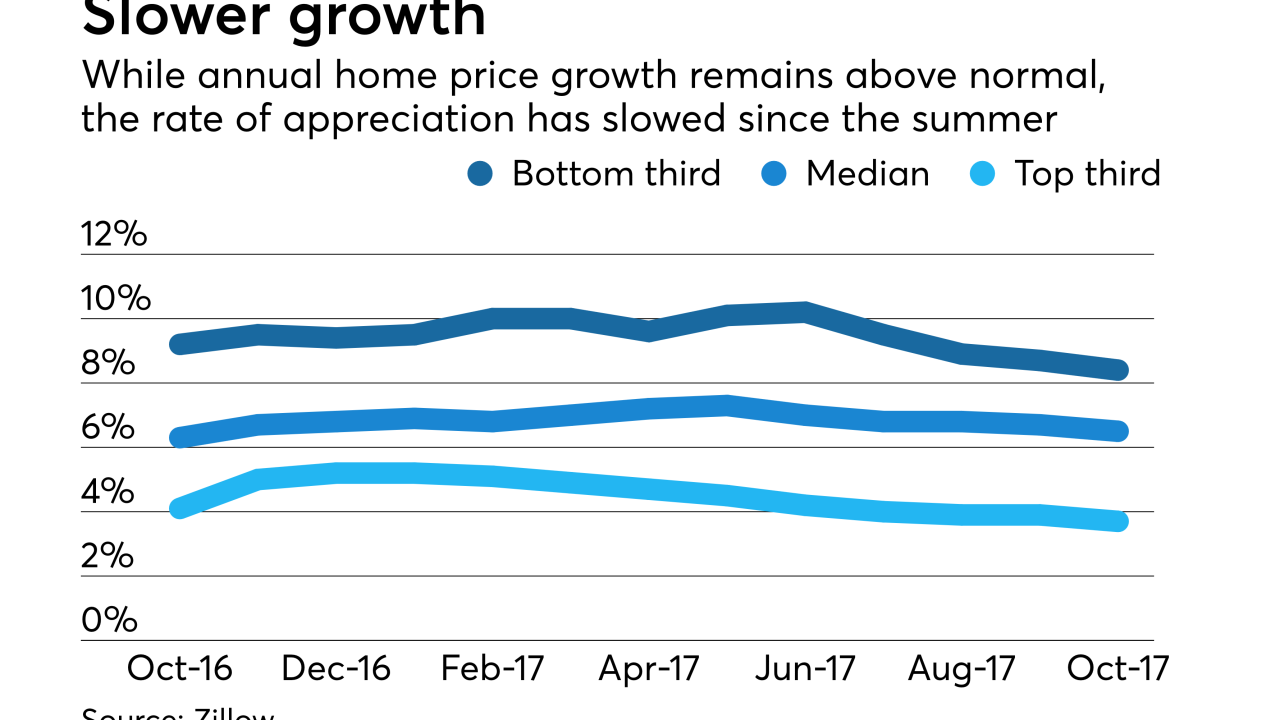

Home price appreciation continues to increase at a much higher than normal pace, although the rate of growth has been slowing since the summer.

November 22 -

Sales of previously owned U.S. homes rose to a four-month high, indicating demand was firming at the start of the quarter as the impact from the late summer hurricanes faded, according to a National Association of Realtors report.

November 21 -

Potential first-time home buyers can save money for a down payment if they are able to use a special account just for that purpose.

November 17 Bilt Rewards

Bilt Rewards -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

As the economy improves and millennials move around the country in search of jobs, some are finding themselves far from the youth culture they learned to expect from city life in other parts of the country.

November 9 -

With home values projected to rise in every major U.S. metro in 2018, a 20% down payment will cost thousands of dollars more, according to Zillow.

November 9 -

Serious delinquencies on Federal Housing Administration loans popular among first-time home buyers with affordability constraints have improved this year, but may be reaching a plateau.

November 6 -

Millennials took advantage of lower interest rates in September to refinance their mortgages, according to Ellie Mae.

November 1 -

Homes on Staten Island are reaching "unaffordable levels," at a time when there are less homes on the market than buyers who want to purchase them.

October 31 -

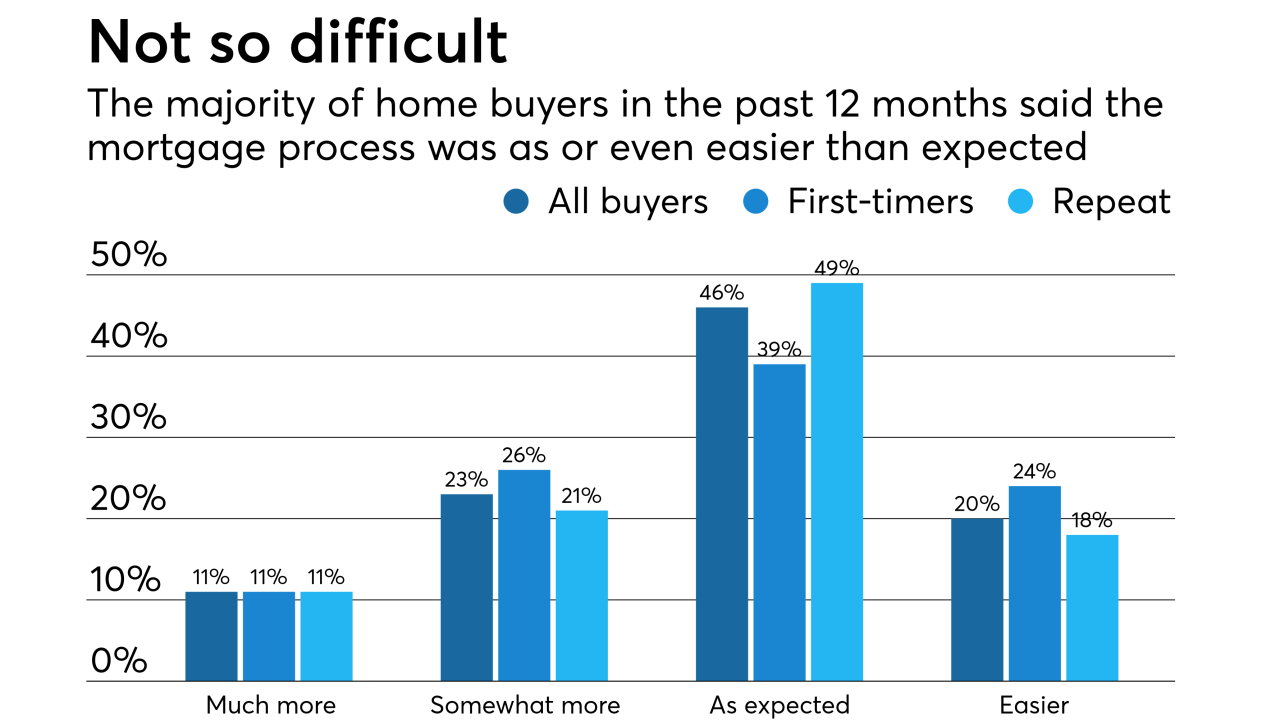

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

A flurry of new townhouses and suburban starter homes is helping boost homebuilding in the Twin Cities metro.

October 30