-

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

The GSEs began sharing their risk with the private market in new ways during conservatorship, and the Federal Housing Finance Agency’s proposed capital framework currently discourages the use of those strategies. Industry leaders voiced concerns in a FHFA listening session this week.

September 11 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

Neither side opted to invoke their Aug. 31 termination rights and the deal is set to close by the end of September.

September 1 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

Also: NMN analyzes political donations from the industry, foreclosure and eviction ban extended to year's end.

August 28 -

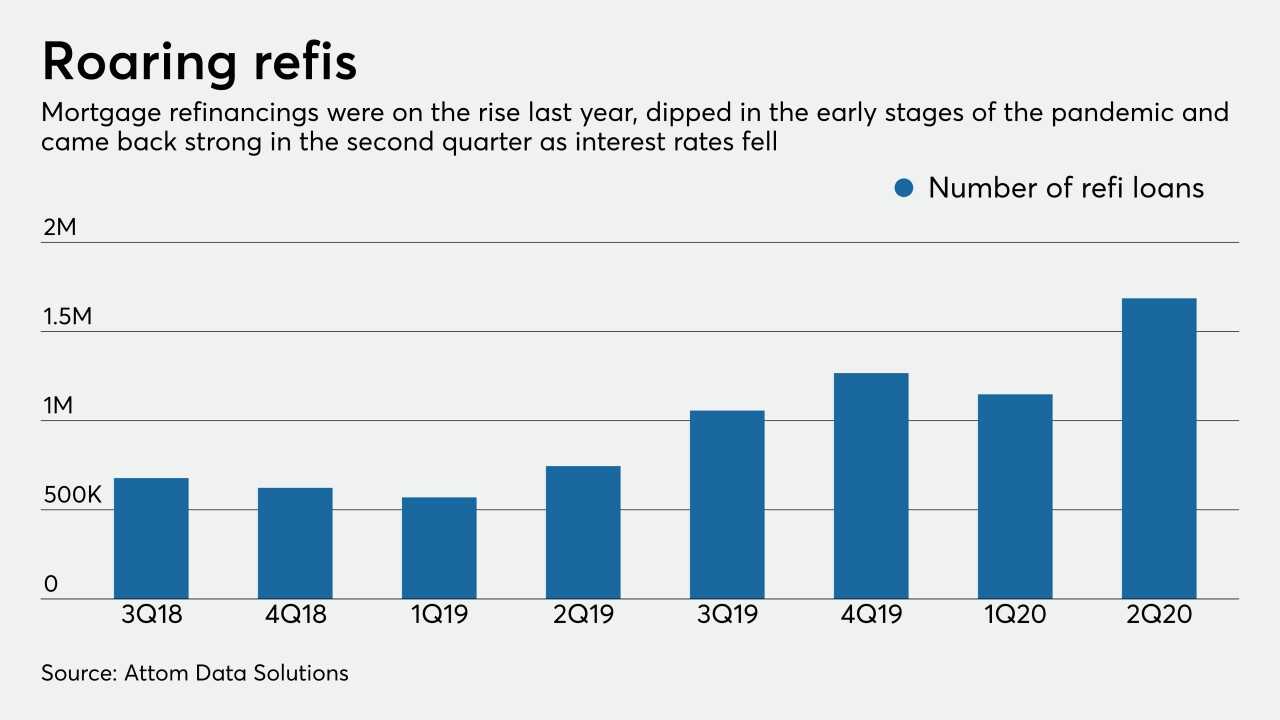

Refinancing has been one of the bright spots in a difficult year for lending, and the industry has concerns that a fee to be imposed by Fannie Mae and Freddie Mac could slow down the business.

August 28 -

As the end of the first six-month forbearance period arrives, the impact of the new cap is coming into focus.

August 27 -

Many mortgage companies are hoping to operate remotely through year-end and are asking regulators for relief to that end.

August 27 -

Both the Federal Housing Finance Agency and Federal Housing Administration are extending relief for homeowners and renters due to the pandemic crisis.

August 27 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

If Trump is reelected, his administration would likely move forward with privatizing Fannie Mae and Freddie Mac and relaxing key rules, while a Joe Biden presidency would likely try to expand homeownership access and borrower protections.

August 24 -

Meanwhile, July saw a record surge in existing-home sales, while mortgages in serious delinquency were on the rise

August 21 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The higher charge on mortgages refinanced through Fannie Mae and Freddie Mac is supposed to cushion against a crisis but could contribute to one as the fees are passed on to struggling consumers.

August 20