-

A long list of "preparatory steps" means that any potential Fannie Mae and Freddie Mac initial public offerings are at least three to four years away, according to Raymond James.

June 6 -

With the Trump administration appearing willing to shake up Fannie Mae and Freddie Mac without Congress, Reps. Lacy Clay, D-Mo., and Sean Duffy, R-Wis., said legislative action should be a priority.

June 4 -

The assumption that conservatorship can end without significant changes in how the GSEs operate may be the most dangerous one of all.

June 4 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The consolidation of the two companies' securitization platforms into a single bond market became official on Monday.

June 3 -

There's been chatter about whether the government-sponsored enterprises should be considered systemically important. But supporters must consider that such a designation would put the Fed in charge of their supervision, a step that would do more harm than good.

June 3 American Enterprise Institute

American Enterprise Institute -

The head of Fannie Mae and Freddie Mac’s regulator blamed “burdensome” local regulations for a lack of housing supply, and also provided an update on the administration’s plan for GSE reform.

June 3 -

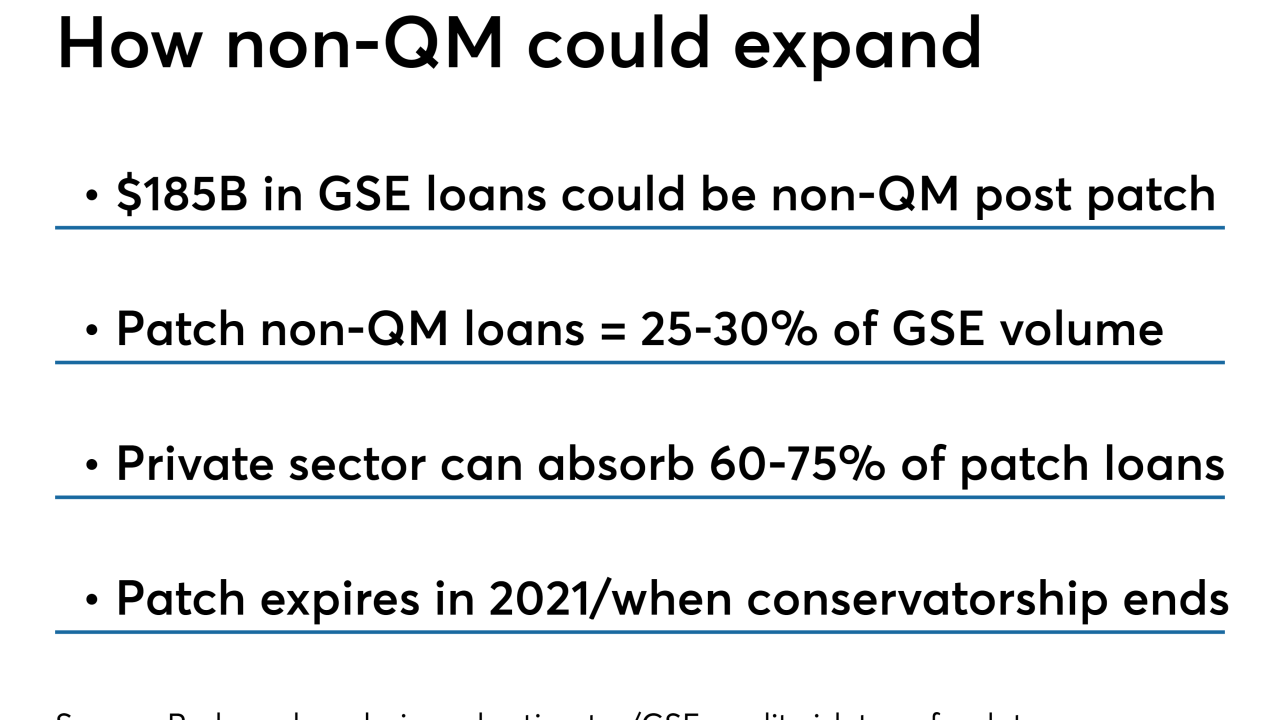

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

The launch of a combined securitization platform for Fannie Mae and Freddie Mac is meant to ease the transition to a new housing finance system. But questions remain about how the mortgage sphere will adapt to the single security.

May 31 -

Freddie Mac uncovered a growing number of fraudulent school records and work histories in California, where Fannie Mae also has noted increasing instances of falsified employment information.

May 29 -

Kushner Cos., the real estate firm owned by the family of President Donald Trump's son-in-law Jared Kushner, has received about $800 million in federally backed debt to buy apartments in Maryland and Virginia.

May 24 -

The FHFA director’s recent comments about whether the government-sponsored enterprises should be designated as SIFIs tees up a potentially significant element of the mortgage finance debate.

May 24 American Banker

American Banker -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

Four real estate professionals could face up to 30 years in prison and hefty fines after being indicted on charges related to allegedly defrauding Fannie Mae, Freddie Mac and multifamily lenders.

May 23 -

FHFA Director Mark Calabria should ensure the government-sponsored enterprises hold at least 4% of total assets as part of housing finance reform.

May 23

-

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

Government-sponsored enterprise executives say they want to continue to offer credit risk transfers and guarantee-fee parity after the GSEs are released from conservatorship, but they might not be able to.

May 22 - LIBOR

The development of a replacement index for the London interbank offered rate brought back memories for one secondary market participant of the technology disaster worries many had at the turn of the century.

May 22 -

Regulators want Fannie Mae and Freddie Mac to build up massive amounts of capital before being freed from government control. Don Layton, Freddie's departing chief executive officer says that's easier said than done.

May 21 -

One of the hardest financial parts of buying a new home is coming up with the initial down payment on the mortgage loan.

May 20 -

With prospects for government-sponsored enterprise reform improving, players in the private residential mortgage-backed securities market are starting to think about how they could better compete against the GSEs while awaiting change.

May 20