-

Fannie Mae will add an appraisal waiver option for mortgages in regions that its Duty to Serve program designates as high-needs rural areas, but only if home inspections are completed instead.

September 24 -

The CEOs of Fannie Mae and Freddie Mac are stepping down because the job they were hired to do — return the GSEs to profitability — is done. But attracting top-flight candidates to lead the mortgage giants into a new phase may not be easy.

September 24 -

Brian Brooks, the mortgage giant's general counsel, is leaving this week to head the legal team at Coinbase.

September 19 -

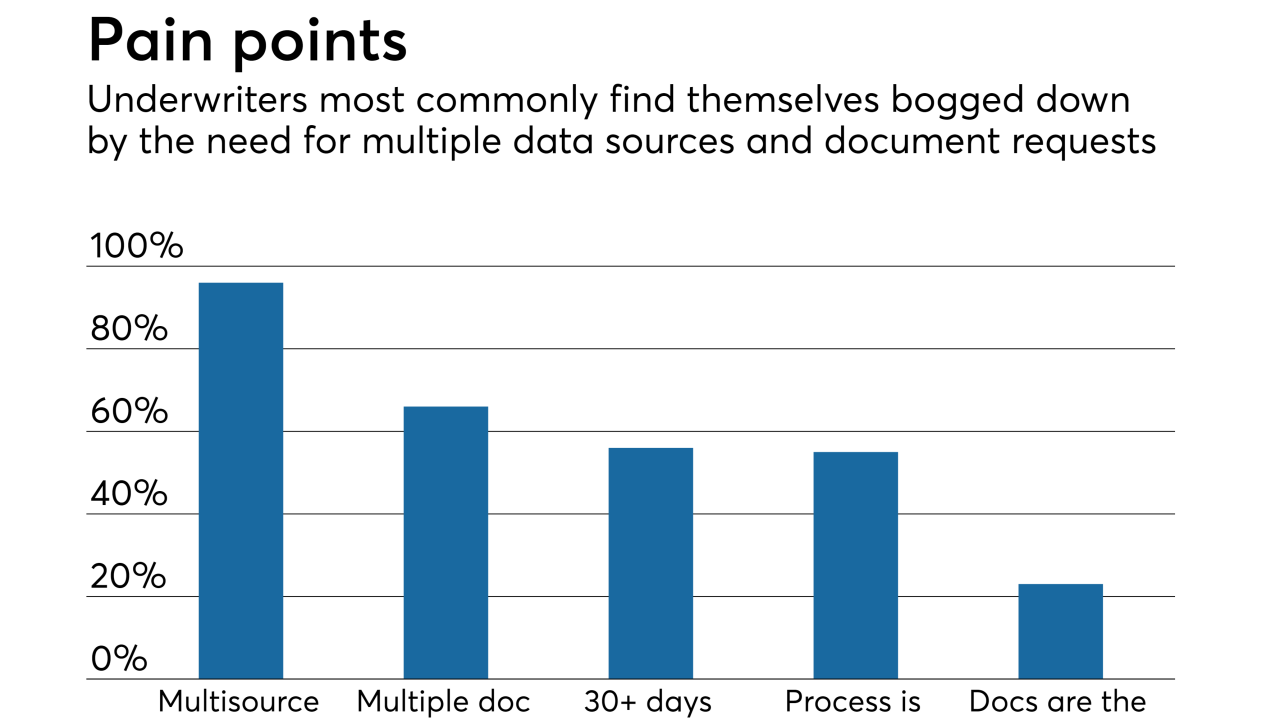

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

The agency’s director has been under pressure to quit as he is investigated for sexual harassment allegations, but an agency spokesperson says he still plans to testify at a housing finance hearing slated for later this month.

September 14 -

The federal conservatorship of Fannie Mae and Freddie Mac was never supposed to be permanent. Leaving the situation unresolved keeps the agencies undercapitalized and taxpayers exposed to their risk.

September 14

-

New Penn Financial has launched a condo loan program that features more flexible property restrictions than what's allowed under Fannie Mae and Freddie Mac guidelines.

September 13 -

The Federal Housing Finance Agency issued a proposal Wednesday that would require mortgage giants Fannie Mae and Freddie Mac to align their policies on cash flows for current mortgage-backed securities, and eventually for a uniform security when it is implemented next year.

September 12 -

Housing finance reform is still likely years away, but a growing chorus of lawmakers say the government guarantor has the ability to clear the path to a final plan.

September 11 -

Fund manager Varde Partners wants to grow its partnerships with lenders and servicers interested in selling off their excess mortgage servicing rights.

September 11 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

The proposal by Reps. Jeb Hensarling and John Delaney is a sign that a bipartisan consensus is building on how to move on from Fannie and Freddie.

September 6 -

Freddie Mac is promoting Executive Vice President David Brickman to president and will consider him among possible candidates to be the agency's next CEO after Don Layton retires next year.

September 5 -

As the demand for home rentals continues to rise, regulatory burdens could decrease the multifamily housing supply and drive up costs, witnesses said at a congressional hearing.

September 5 -

The Treasury Department and a key housing regulator are preparing to fill a second possible vacancy atop a U.S.-controlled mortgage giant, a move that could strengthen the Trump administration's hand in addressing unfinished business from the 2008 credit crisis.

September 5 -

Maybe political winds or another downturn will spark housing finance reform. But 10 years after the conservatorships began, the companies are still in perpetual limbo.

September 3 -

The Congressional Budget Office has found that restructuring the mortgage market would save the government billions of dollars but may increase the cost of housing.

August 27 -

The agency said the market for larger rental investors may not need additional liquidity from Fannie Mae and Freddie Mac.

August 21