-

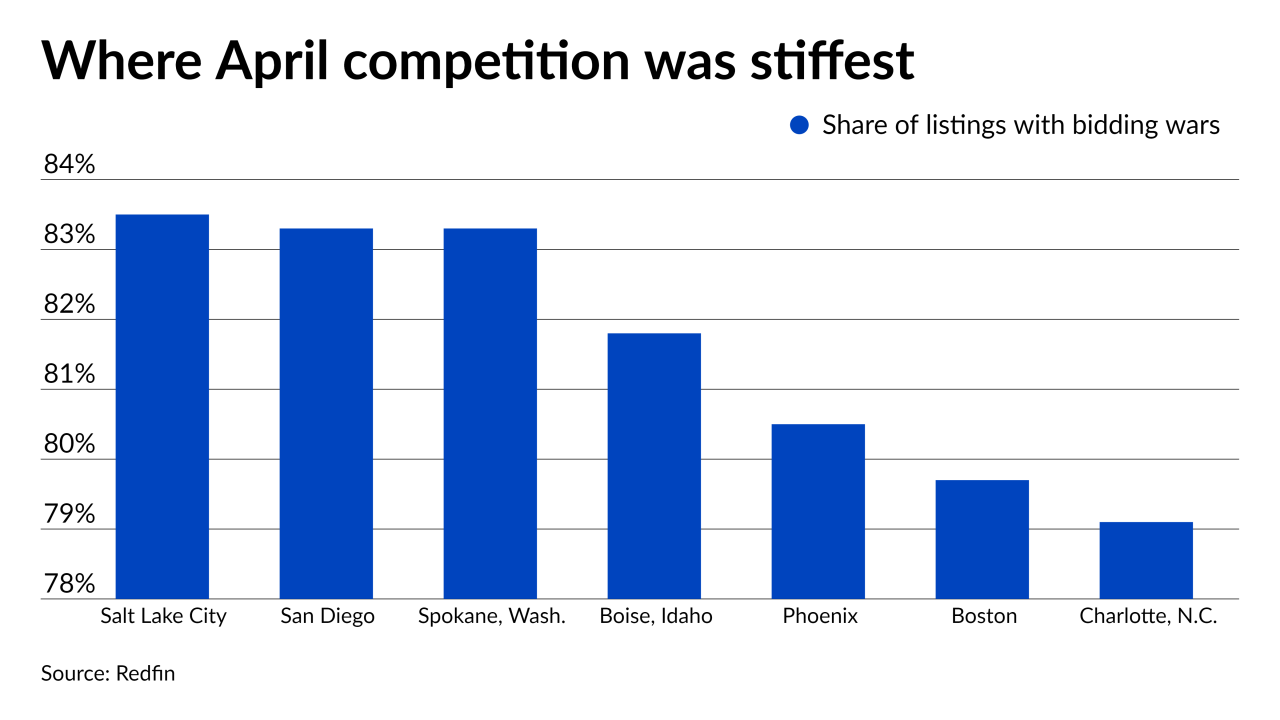

Homebuyer competition reached new heights right as the purchase market hits its busiest time of year, according to Redfin.

May 14 -

Residential value growth in March reached heights not seen since the lead up to the housing bubble, according to CoreLogic.

May 4 -

As consumers search for homebuying advantages, local lenders discuss the 12 metro areas where it’s more affordable to purchase a property rather than rent a comparable house, according to Realtor.com data.

April 30 -

Mom-and-pop residential real estate investors are seeing more competition from citizens looking to buy homes than from their traditional competitors, large public institutional investors, according to a new survey from real estate data firm RealtyTrac.

April 30 -

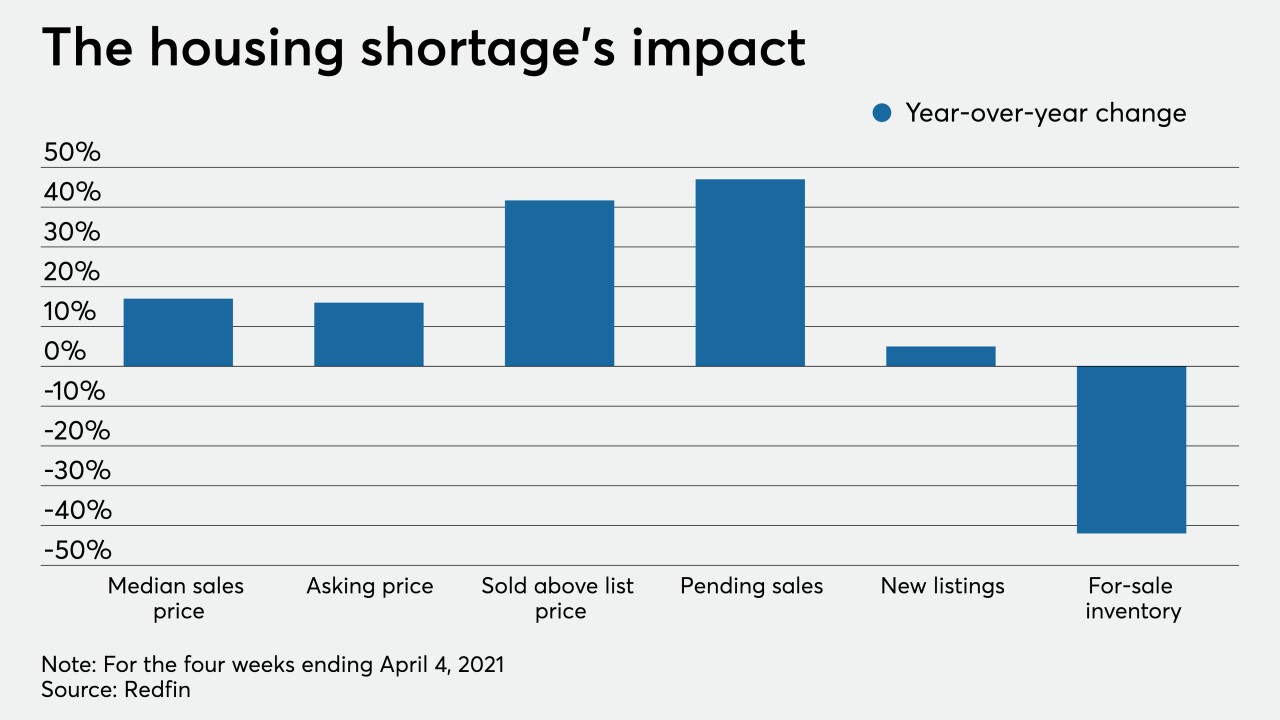

“Low inventory has been a consistent problem,” Lawrence Yun, chief economist at the NAR, said in a statement. “With mortgage rates still very close to record lows and a solid job recovery underway, demand will likely remain high.”

April 29 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

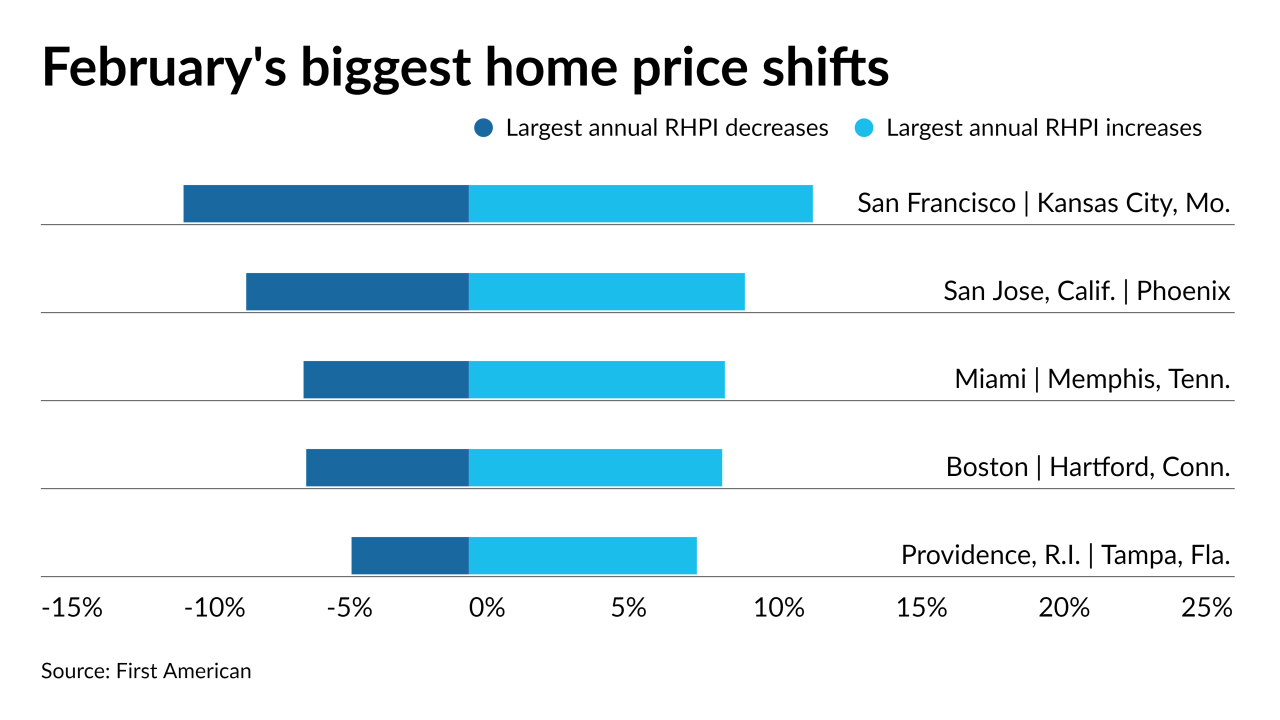

Despite home purchasing power growing for the 14th consecutive month in February, rising property values and mortgage rates are likely to influence would-be sellers to stay put, according to First American.

April 27 -

Property values climbed 12% in February, according to the S&P CoreLogic Case-Shiller index.

April 27 -

Even in the best-case scenario, it would take 45 years to achieve an equal amount of housing-related capital between Blacks and whites.

April 26 -

Purchases of new single-family homes increased 20.7% last month to a 1.02 million annualized pace after an upwardly revised 846,000 rate in the prior month, government data showed Friday.

April 23 -

“We know that home prices have been rising, mortgage rates inching higher, housing affordability becoming much more challenging, however I would say the softening sales activity is not due to demand going away,” Lawrence Yun, NAR’s chief economist.

April 22 -

The busiest season for home buying took off with a bang last month, as fierce competition among buyers drove prices up and sales soared to one of the highest levels in years.

April 22 -

At the metro level, Buffalo, N.Y., had the worst undervaluation for Black-owned homes at 86% followed by 72% in both Memphis, Tenn., and Indianapolis, Redfin found.

April 20 -

As listings were snagged at near-record speed, inventory hit yet another new low point, according to Remax.

April 19 -

Lumber futures have surged more than 60% to record highs this year, and analysts aren’t expecting any relief until late 2021.

April 13 -

Even as properties spent the least time ever on the market and the average sale-to-list home price ratio broke 100%, some indicators point to a slight reversal, which could head off “runaway home price speculation or a housing bubble,” Redfin chief economist Daryl Fairweather said.

April 9 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

As home values surged at record highs, the latest month-to-month movements indicate price growth could start returning to a pre-pandemic pace, according to the Federal Housing Finance Agency.

March 30 -

Willis, Texas led the list, with the most borrowers who would be likely to default if faced with sudden financial hardship.

March 24