-

“We know that home prices have been rising, mortgage rates inching higher, housing affordability becoming much more challenging, however I would say the softening sales activity is not due to demand going away,” Lawrence Yun, NAR’s chief economist.

April 22 -

The busiest season for home buying took off with a bang last month, as fierce competition among buyers drove prices up and sales soared to one of the highest levels in years.

April 22 -

At the metro level, Buffalo, N.Y., had the worst undervaluation for Black-owned homes at 86% followed by 72% in both Memphis, Tenn., and Indianapolis, Redfin found.

April 20 -

As listings were snagged at near-record speed, inventory hit yet another new low point, according to Remax.

April 19 -

Lumber futures have surged more than 60% to record highs this year, and analysts aren’t expecting any relief until late 2021.

April 13 -

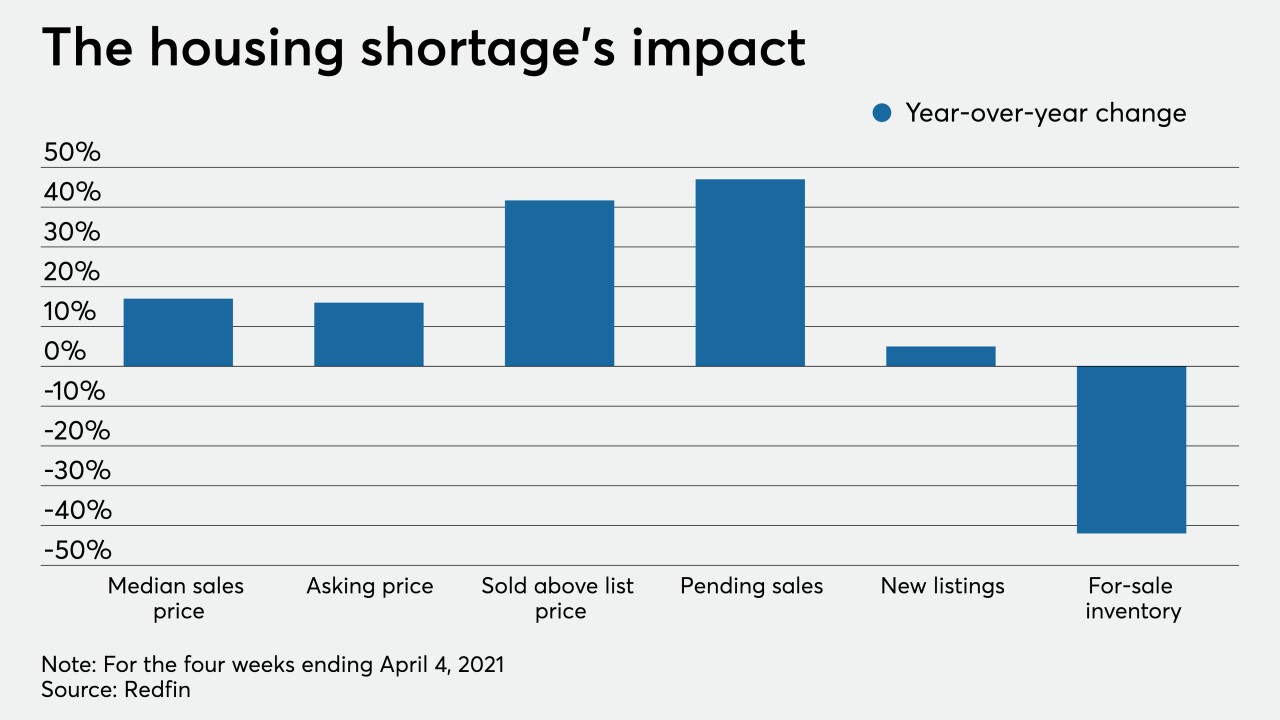

Even as properties spent the least time ever on the market and the average sale-to-list home price ratio broke 100%, some indicators point to a slight reversal, which could head off “runaway home price speculation or a housing bubble,” Redfin chief economist Daryl Fairweather said.

April 9 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

As home values surged at record highs, the latest month-to-month movements indicate price growth could start returning to a pre-pandemic pace, according to the Federal Housing Finance Agency.

March 30 -

Willis, Texas led the list, with the most borrowers who would be likely to default if faced with sudden financial hardship.

March 24 -

Sales in February rose 22.8 percent from the same month in 2020. A total of 1,062 homes changed hands last month compared with 865 the previous February, according to a Maine Listings report released Monday.

March 23 -

Purchases of new single-family homes decreased 18.2% to a 775,000 annualized pace from an upwardly revised 948,000 rate in the prior month, government data showed Tuesday.

March 23 -

Contract closings decreased 6.6% from the prior month to an annualized 6.22 million from a downwardly revised 6.66 million in January, according to National Association of Realtors data released Monday.

March 22 -

A slower rate of appreciation looks more likely than depreciation in most markets, according to the company’s latest report.

March 19 -

As one of the few mortgage firms that finances singlewides, AFR’s decision to offer the product will lend momentum to major government-sponsored loan buyers’ efforts to expand their manufactured housing programs.

March 9 -

The gap between those that considered it a good or bad time to buy narrowed 10 percentage points in February, the tightest spread since last April, Fannie Mae found.

March 8 -

After the coronavirus spurred a great migration in search of literal greener pastures, homebuyers are returning to cities with the end of the pandemic in sight, according to Redfin.

March 5 -

With the pandemic’s radical disruption of the housing market, values grew at the highest rate in eight years, according to CoreLogic.

March 2 -

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

A gauge of U.S. pending home sales fell to a six-month low in January as buyers competed for a limited number of properties.

February 25