-

In the next 30 years, an estimated 802,555 homes worth $450 billion are under the risk of flooding, and in turn becoming distressed mortgages, according to a joint study by Zillow and Climate Central.

August 2 -

Members from states threatened by storms say their proposal is better for consumers than recent legislation passed by the House Financial Services Committee.

July 16 -

Bills to fix the National Flood Insurance Program and combat the money-laundering risks from shell companies enjoyed bipartisan support during a House Financial Services Committee debate.

June 12 -

Lenders are turning to the Farm Service Agency to backstop more loans as their Midwestern customers are beset by flooding in addition to the U.S. trade war with China and volatile crop prices. Can the FSA meet the increased demand?

June 10 -

Fitch Ratings is considering making adjustments to property valuations used in sizing up private residential mortgage securitizations to better account for possible exposure to uninsured, catastrophic risks.

June 6 -

Covius Holdings plans to buy several businesses from Chronos Solutions that support mortgage servicing and origination processes, including three delivery platforms that will increase the breadth of its technology offerings.

June 4 -

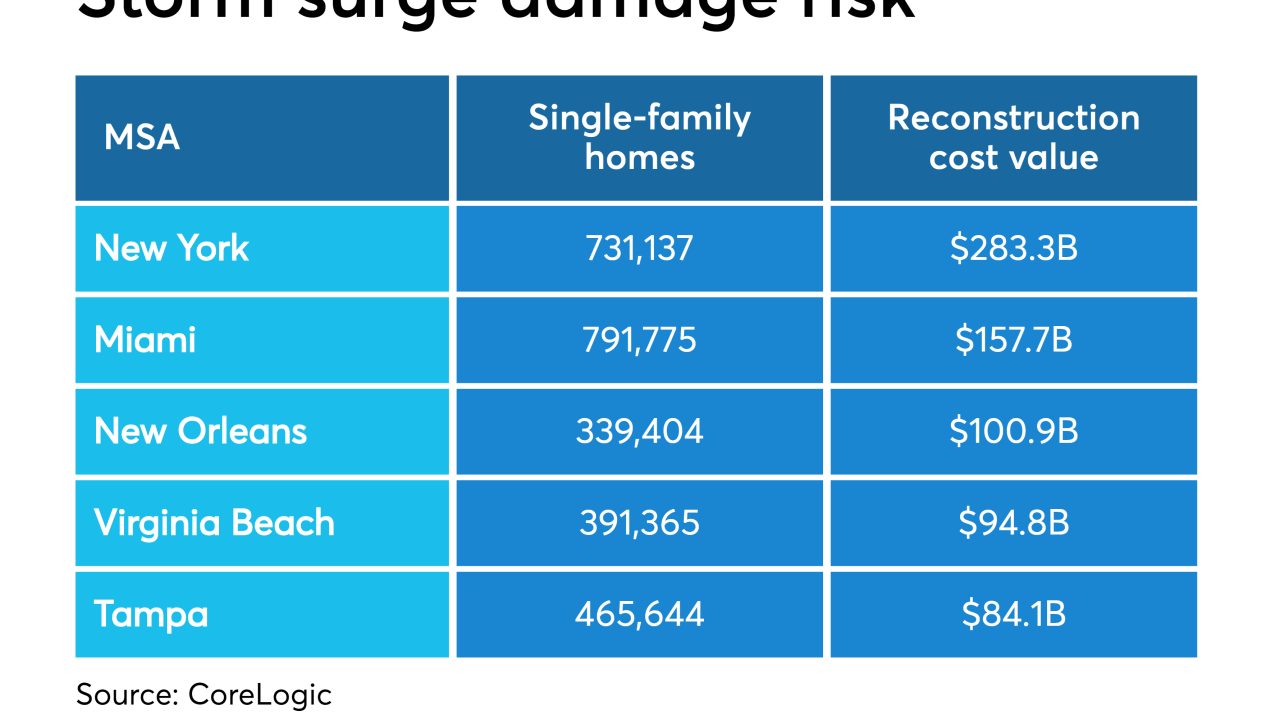

In the worst-case scenario, $1.8 trillion in reconstruction costs could result from coastal storms in 2019, even as hurricane experts predict a near-normal year for this season, according to CoreLogic.

June 3 -

Congress extended the National Flood Insurance Program through June 14, preventing the federal initiative from expiring on Saturday.

May 30 -

Hurricane Michael killed seven people and caused more than $6 billion in damage in Florida in October, a toll compounded by warmer, higher seas and wetter air, the signs of climate change scientists have long warned about.

May 13 -

The House Financial Services Committee debated legislation Wednesday to reform and reauthorize the National Flood Insurance Program, but no clear solution emerged.

March 13 -

Real estate experts think homebuilders should prevent natural disasters with better strategies, but this could drive up already rising prices and hurt buyer affordability, according to Zillow.

March 12 -

Private flood insurance rules that go into effect this summer have a safe harbor for some policies, but determining whether others are compliant could be a time-consuming, imprecise and costly exercise.

February 27 Buckley Sandler LLP

Buckley Sandler LLP -

The House Financial Services Committee will hold eight hearings next month, looking at Wells Fargo's recent consumer protection scandals, a reauthorization of the flood insurance program and more.

February 25 -

The agency has required restitution in just one of six settlements under its new director, raising questions about whether the pattern will continue.

February 20 -

Depository mortgage lenders are optimistic the final version of a regulation designed to open up the flood insurance market will make it easier for them to comply with a rule requiring them to accept private carrier policies.

February 11 -

Modular houses typically referred to as tiny homes could be a quick, relatively cheap living option for residents recovering from Hurricane Michael.

February 1 -

The Houston City Council has approved up to $400 million in contracts with six firms to build new housing and repair single-family homes damaged by Hurricane Harvey.

January 31 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

The government shutdown could affect mortgage origination credit quality as lenders miss some red flags normally found using data that is not currently available, according to Moody's.

January 10 -

New York Gov. Andrew Cuomo has signed into law a bill that provides a property tax break for Syracuse property owners who buy flood insurance.

January 3