Wildfires burned 8.8 million acres of land in 2018 alone — the sixth-highest total on record since the mid-1900s. In addition, the annual average of acres burned between 1970 and 1999 has more than doubled between the turn of the century and the present day. These trends are in direct correlation with

While all states face some risk of wildfire, that risk is highest for the 13 most westerly states, which are the most often affected. California led in total acreage burned last year with over 1.8 million, followed by Nevada's 1 million and Oregon's 897,262.

From Texas to California, these are the 15 most-at-risk metro areas with the highest wildfire reconstruction costs.

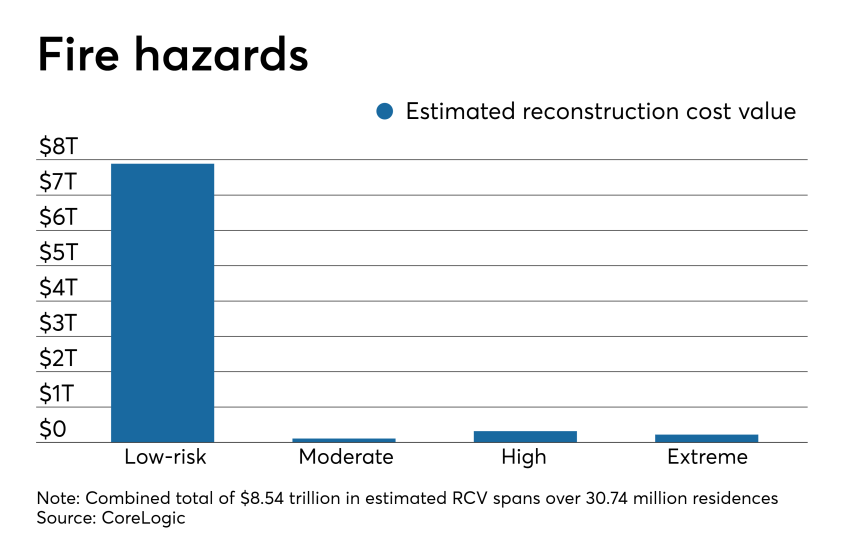

CoreLogic evaluated the combined number of single-family and multifamily residences at risk of wildfire damage by state, reconstruction cost, and associated losses from recent wildfires. It then ranked metro areas based on the combined values of high and extreme-risk residences.

No. 15 Houston, Texas

Total high- and extreme-risk residences: 36,004

No. 14 Salinas, Calif.

Total high- and extreme-risk residences: 11,314

No. 13 Redding, Calif.

Total high- and extreme-risk residences: 21,057

No. 12 Santa Fe, N.M.

Total high- and extreme-risk residences: 23,546

No. 11 San Antonio, Texas

Total high- and extreme-risk residences: 30,696

No. 10 Colorado Springs, Colo.

Total high- and extreme-risk residences: 31,323

No. 9 Oxnard, Calif.

Total high- and extreme-risk residences: 19,555

No. 8 Truckee, Calif.

Total high- and extreme-risk residences: 31,987

No. 7 Denver Colo.

Total high- and extreme-risk residences: 49,734

No. 6 San Francisco, Calif.

Total high- and extreme-risk residences: 32,174

No. 5 Austin, Texas

Total high- and extreme-risk residences: 536,984

No. 4 Sacramento, Calif.

Total high- and extreme-risk residences: 68,056

No. 3 San Diego, Calif.

Total high- and extreme-risk residences: 75,096

No. 2 Riverside, Calif.

Total high- and extreme-risk residences: 108,787

No. 1 Los Angeles, Calif.

Total high- and extreme-risk residences: 121,589