CFPB extends forbearance request deadline for government loans

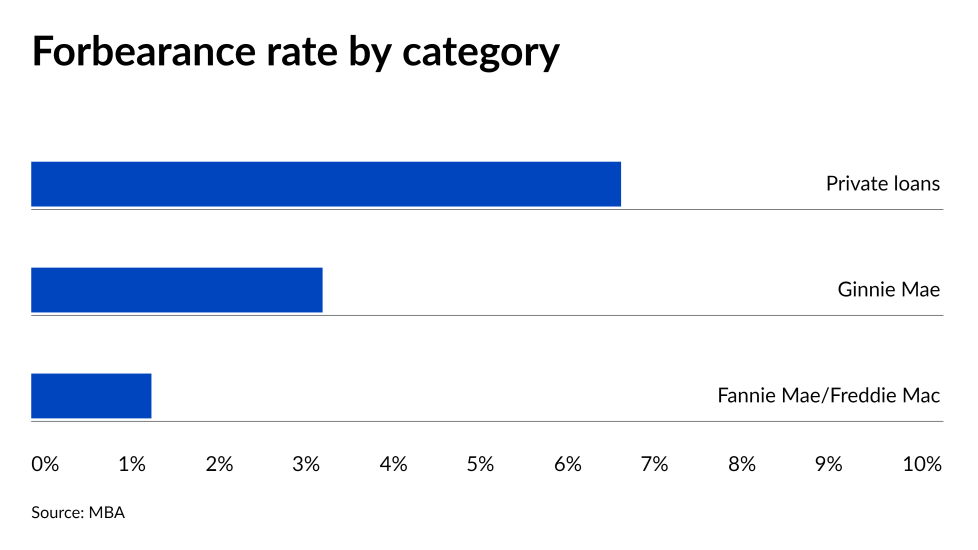

Previously set for Sept. 30, the deadline for initial forbearance requests for FHA, VA and U.S. Department of Agriculture loans won’t arrive until the pandemic ends.

“If you have a home loan backed by HUD/FHA, USDA, or VA, your mortgage servicer is authorized to approve initial COVID hardship forbearance requests until the...National Emergency is officially over,” the CFPB said.

Read the

Biden nominee to head Ginnie Mae moves closer to confirmation

Alanna McCargo, currently a senior advisor at the Department of Housing and Urban Development, told the Senate Banking Committee in a hearing to examine her nomination that while her role in slowing home price appreciation would be limited at Ginnie Mae, she would ensure that the agency would continue to be a reliable backstop to investors in mortgage-backed securities. That support in turn ensures that borrowers in government-backed programs are able to capture lower interest rates on home loans.

Read the

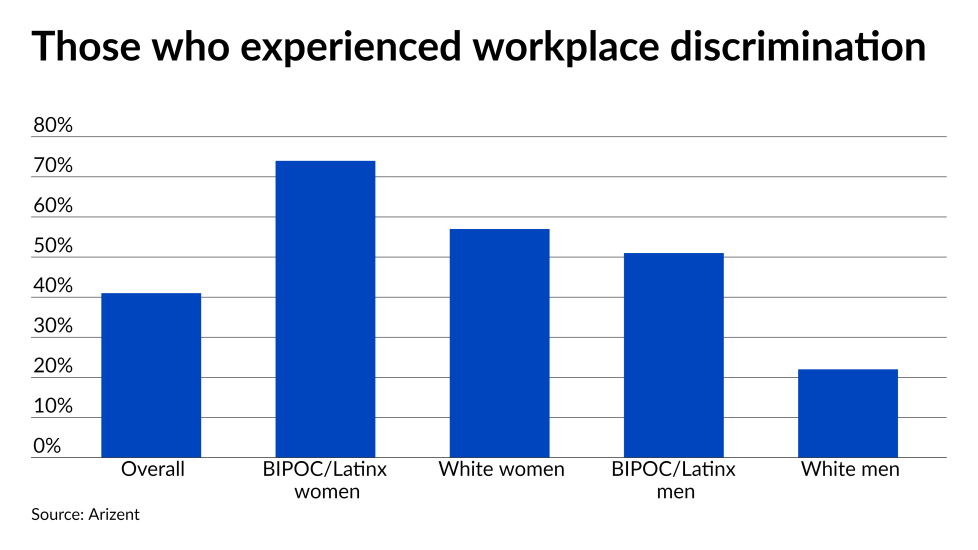

Discrimination continues to impact mortgage and housing professionals

That happened to Chandra Patterson, a realtor and regional vice president

Overall, 41% of employees throughout professional and financial services reported personally facing some form of workplace discrimination,

Read the

UniversalCIS, Credit Plus create largest trimerge report provider

Terms of the transaction, which is described as a merger of equals, were not disclosed.

UniversalCIS, based in Philadelphia, has grown in the past 14 months via a series of acquisitions. The first deal took place in August 2020, when CIS merged with Avantus. The following October, it

Read the

GSE securitization platform scuttles private-label market endeavor

Common Securitization Solutions has disbanded a group of independent board members originally brought in to look into the possibility, according to the Federal Housing Finance Agency. It also has named Matthew Feldman, the retired president and CEO of the Federal Home Loan Bank of Chicago, as chairman. Tony Renzi, a former mortgage servicing executive, will remain the CEO.

“In early 2020, FHFA explored expanding the role of CSS to serve a broader market. After a nearly two-year review, FHFA determined that CSS should instead focus on maintaining the resiliency of the enterprises’ mortgage-backed securities platform,” the agency said in a press release. “This decision allows CSS to stay focused on the safety and soundness of the housing finance market and reduce unnecessary expenses.”

Read the

Chopra expected to address fair housing, discrimination as CFPB head

Anti-redlining policies traditionally have been focused on mortgage lending. Analysts say housing will still be a priority, but the CFPB will likely also crack down on fair-lending violations for small-business loans governed by the Paycheck Protection Program.

Read the

CHLA calls for equal rules among depositories and IMBs

Under a January 2013 CFPB rule implementing the SAFE Act, mortgage loan officers at federally insured banks only have to be registered on the Nationwide Multi-State Licensing System. Their nonbank counterparts need to pass a licensing examination.

Read the

Altisource offers cryptocurrency payment option

Home buyers on Altisource marketplaces Equator.com or Hubzu.com who choose Premium Title — another Altisource-owned company — as their title and escrow provider will now be able to complete their transaction through ForumPay, which will convert the cryptocurrency at a fixed rate and wire funds directly to Premium Title or a closing attorney.

Read the

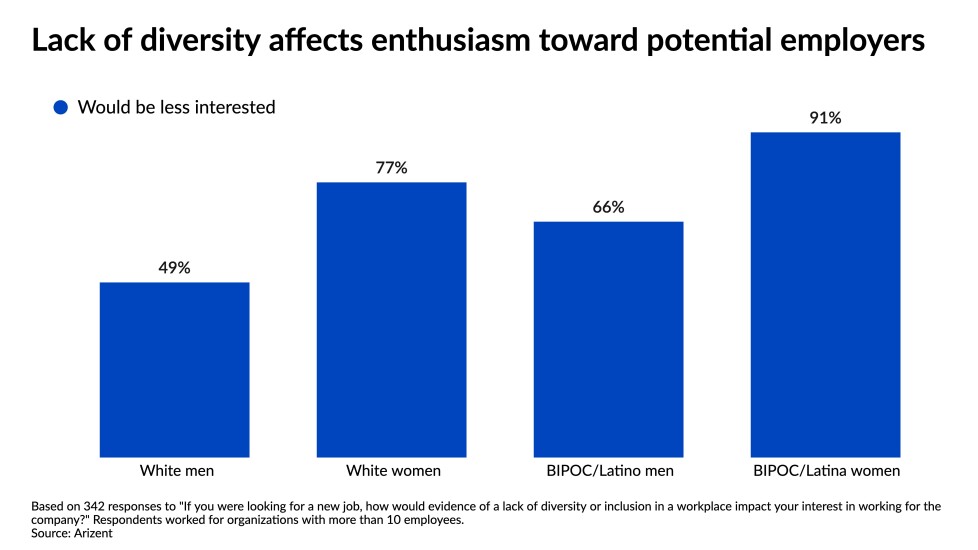

Work still needed for industry leadership to match client demographics

“The goal of inclusion is belonging,” Etienne said. “It's creating a workforce where everybody feels like they're part of the team. The data shows performance improves, turnover decreases, absenteeism decreases, all of these things drive retention. Retention drives, ultimately, development into leadership.”

even as companies of all sizes, including those within the mortgage sector, have placed increased emphasis on diversity and inclusion, results from

“There’s more want-to than there has been in the past, and I do think it's genuine, with some of the larger corporations trying to improve the experience for diverse employees and diversify the workforce,” said Jerome Nichols, president of commercial real estate financier and portfolio management company Standard Real Estate Investments.

Read the

Regions buys California commercial real estate lender

The $156 billion-asset bank will acquire the lending and servicing business of Sabal Capital Partners in a deal expected to close in the fourth quarter. Financial terms of the transaction were not disclosed.

Read the

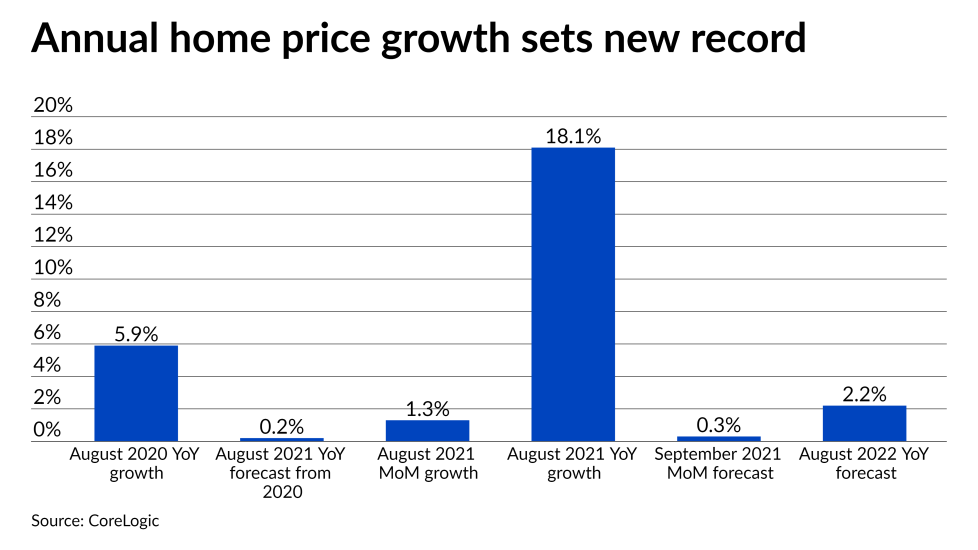

Home price growth breaks 45-year record

Annual appreciation surged by 18.1% in August, setting a new record since tracking began in 1976. It more than tripled the

Read the

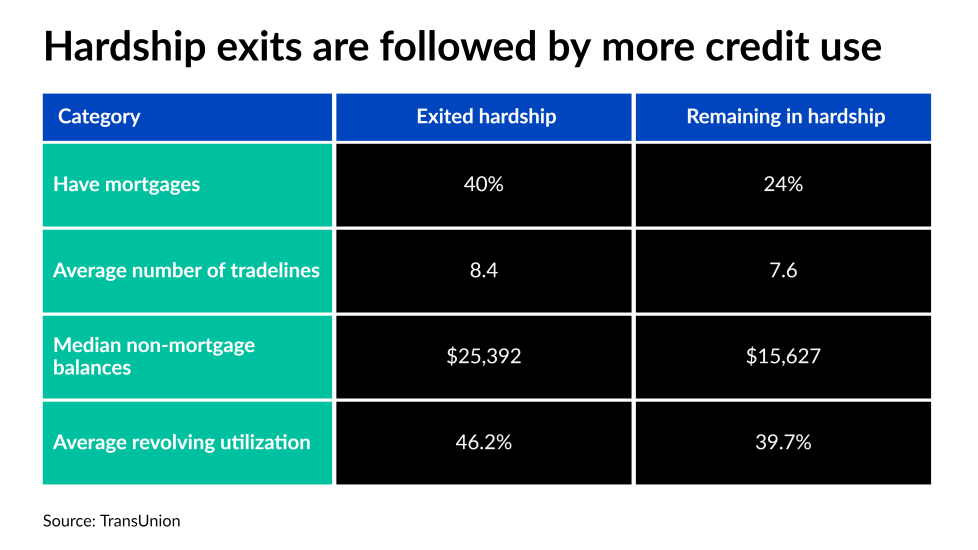

Credit scores increased among consumers with COVID hardships

In a study of VantageScore 4.0 changes for consumer credit lines other than student loans, TransUnion found that 58% of those with an indicator of

Read the

Snapdocs and Freddie Mac join forces to drive eMortgages

The software aims to address some of the key issues that have hindered the adoption of eMortgages and eNotes, such as the unique technical components required to store and manage the note, the variability in counterparties' digital closing acceptance policies and the complexity of implementing and managing the process changes required.

With the quickstart program, Snapdocs provides the technology necessary to generate, store, manage, and transfer eMortgages that is agnostic to point-of-sale, loan origination or doc prep systems. It also involves creating streamlined implementation processes between counterparties with the aim of reducing complexity and facilitating eMortgage approvals.

Read the

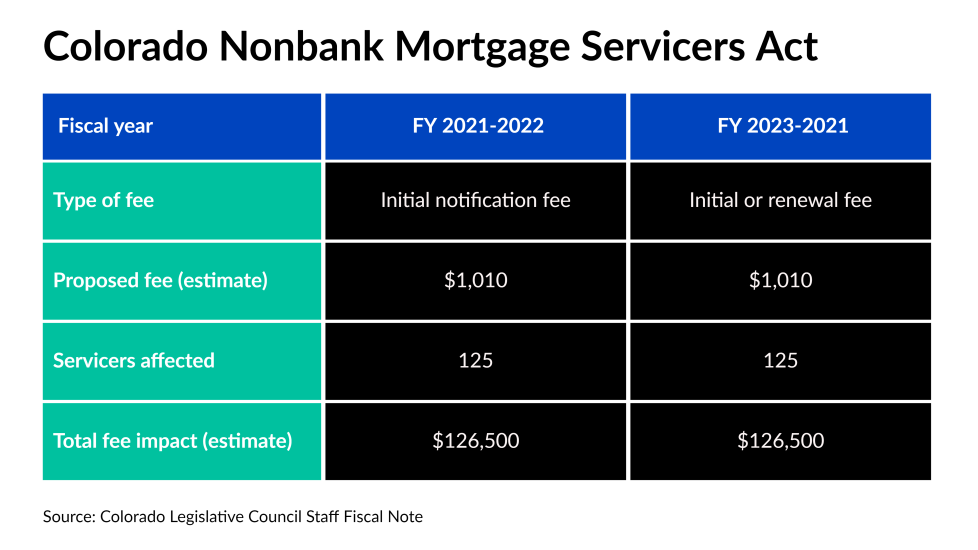

Colorado adds fee for nonbank servicers

“The Act, among other things...requires mortgage servicers to pay the administrator an initial notification fee within 30 days after commencing servicing activities in Colorado,” Weiner, Brodsky & Kider noted in

Read the

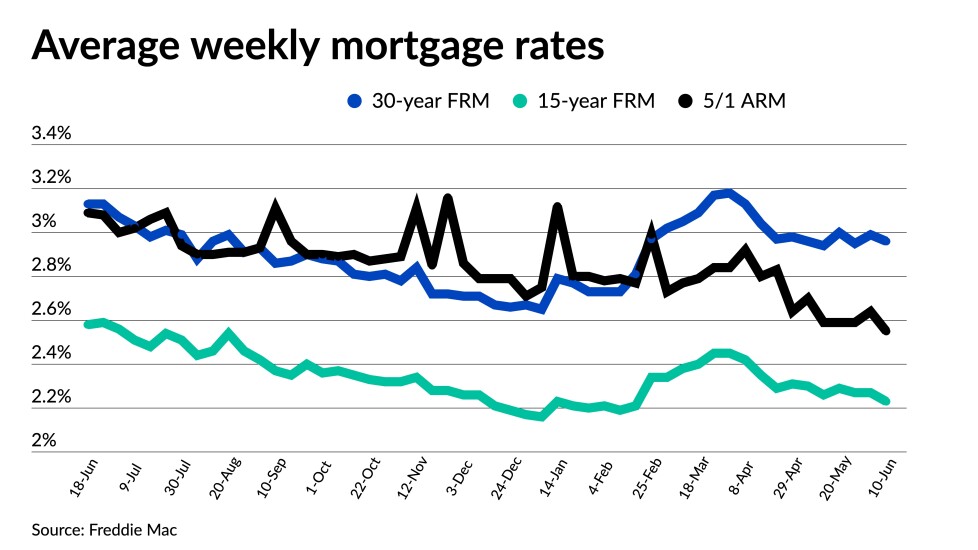

Mortgage rates fall back below 3%

The 30-year fixed-rate mortgage averaged 2.99% for the seven days ending Oct. 7, according to the Freddie Mac Primary Mortgage Market Survey. A week ago, the average shot up to 3.01% after spending the majority of the summer close to 2.9%. The latest rate still came in above the figure from this time a year ago when the 30-year average sat at 2.87%.

“Mortgage rates continue to hover at around 3% again this week due to rising economic and financial market uncertainties,” said Sam Khater, Freddie Mac’s chief economist, in a press statement.

Read the