FHFA contemplates eliminating GSE-loan price adjustments

Acting FHFA Director Sandra Thompson said Thursday that the agency is weighing changes to the loan-level price adjustments enacted in 2008 to help the government-sponsored enterprises manage risk.

Mortgage lenders, Realtors and housing experts have urged the FHFA for years to eliminate the fees that raise the cost of a home loan for many borrowers.

Read the

Senate names Rohit Chopra CFPB chief

Chopra was approved Thursday by the Senate in a 50-48 vote along party lines. He has been serving as a member of the Federal Trade Commission.

He was announced as the administration's choice to lead the CFPB nine months ago, before President Biden took office. Chopra succeeds Kathy Kraninger, who was appointed in the Trump administration after having served as a senior official at the Office of Management and Budget. She led the CFPB for two years before

Read the

Incenter takes bids on over $6 billion in Ginnie Mae MSRs

More than 19% of the loans involved, which average around four years of seasoning, have been removed from securitized pools because they are delinquent or in forbearance. Delinquency rates, including forbearance, break down into the following buckets: 90-plus days, 14.57%; 30-59 days, 3.81%; and 60-89 days, 1.07%

Some investors have shown interest in investing in the secondary market for mortgages in forbearance with the aim of potentially profiting if the borrower gets back on track with payments and the loan

Read the

Audit finds FHFA comes short in sharing GSE counterparty issues

The FHFA, which regulates the two government-sponsored enterprises, has agreed to rework and improve its procedures related to sharing information about performance issues like servicing lapses, in line with the report by its inspector general.

The recent audit on how the FHFA’s Division of Enterprise Regulation shared information about the performance of counterparties such as lenders, servicers and mortgage insurers found that the division did not follow or provide training in its information sharing procedures.

Read the

Forbearances drop below 3% for first time since March 2020

At 2.96%, the overall payment suspension rate was down from 3%

Read the

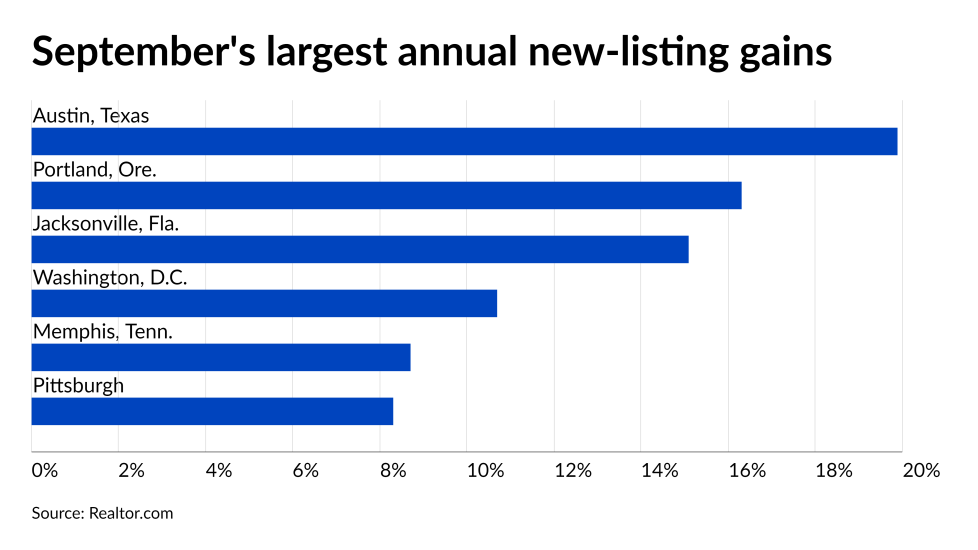

Available housing inventory hits 2021 peak

The month had a total of 646,854 active listings, down 22.2% from Sept. 2020 but an improvement from August’s 641,000 and that month’s 25.8% year-over-year decrease, according to Realtor.com. However, new listings fell annually for the first time in five months, dropping 3.9%. That dichotomy represents a possible turning point for home buyers going forward, said the company’s Chief Economist Danielle Hale.

Read the

Democratic senators put forward 20-year mortgages

However, industry participants question whether this is the best way to help minorities and low-income families

The Low-Income First-Time Homebuyers Act, LIFT for short, sponsors are all Democrats: Sens. Mark Warner and Tim Kaine of Virginia; Raphael Warnock and Jon Ossoff of Georgia; and Chris Van Hollen of Maryland.

Read the

Cenlar appoints Sara Avery chief risk officer

Avery, who has been named CRO at Cenlar, developed and built out the enterprise risk management function for Common Securitization Solutions’ technology platform. The Common Securitization Platform plays a key role in the U.S. housing finance market because it’s used to manage the issuance of Fannie Mae and Freddie Mac’s bonds, including the

Read the

Extreme weather impacts home buying decisions

A 78% share of buyers and 84% of sellers said that

factored into how they chose the location of their next home, according to a Realtor.com survey of over 3,000 consumers conducted in July. Overall, 47% of homeowners are more concerned about natural disasters now than they were five years ago, 44% said their attitudes haven’t changed over that period and 9% are less concerned.

Among recent home buyers, 72% of millennials expressed concern, followed by 66% of Generation X, 58% of Generation Z, 55% of baby boomers and 44% of the silent generation. (The survey’s results were weighted for age and other factors in order to align them with their actual demographic proportions in the population, Realtor.com noted.)

Read the

Private-label securities issuance forecast to reach $96 billion

An estimated $29 billion for the third quarter, added to around $43 billion during the first half, puts annual issuance in a position to easily top its previous post-crisis high, which was set in 2019 at roughly $60 billion. While the current forecast of $96 billion for 2021 still represents a sliver of the overall mortgage market and remains a far cry from the days when the volume topped $1 trillion prior to the crash, it would represent the biggest jump in annual issuance seen in several years.

Read the

Mortgage rates rise above 3% for first time since June

The 30-year fixed-rate mortgage hit its highest point in three months, averaging 3.01% for the weekly period ending Sept. 30, according to the Freddie Mac Primary Mortgage Market Survey. The average jumped from

Read the

Pending home sales climb to seven-month high in August

The National Association of Realtors’ index of pending home sales increased 8.1% from a month earlier to 119.5, the first advance in three months, according to data released Wednesday. The median estimate in a Bloomberg survey of economists called for a 1.4% advance.

The figures suggest housing activity is firming after retreating from the record-high levels seen last year. Historically low borrowing rates, slower price appreciation and more available properties could rejuvenate demand that has softened this year.

Read the

First-time home buyers struggle to meet down payments

As of June, the typical borrower needed 7.9 years to accumulate 20% down, compared to 7.1 years in January 2020, according to Tomo. This assumes a savings rate of 10% of income per month, which is high for most consumers.

Among the top 50 metro areas, the

Read the

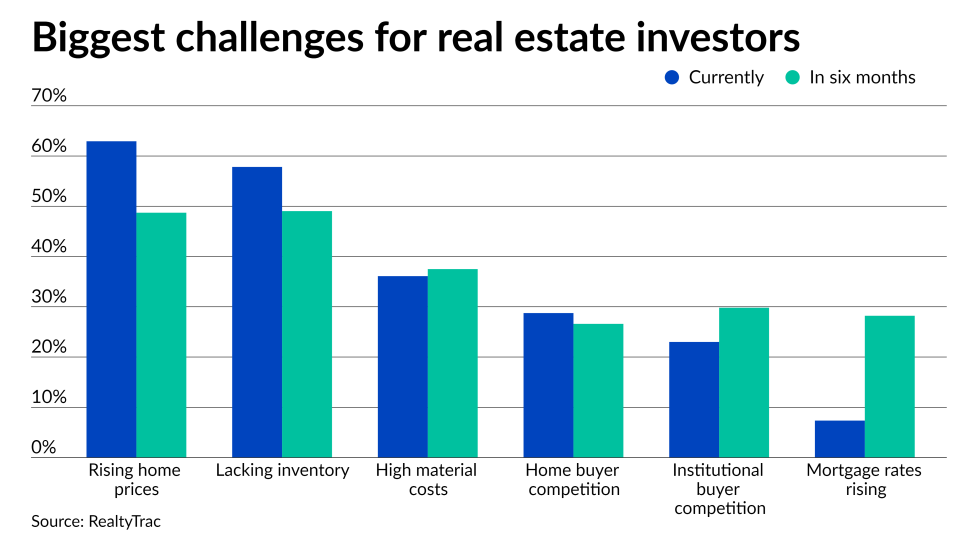

Individual investors grow pessimistic toward housing market

A 48.1% share of residential real estate investors found the environment worse than a year ago, according to a survey conducted by Attom Data Solutions affiliate RealtyTrac. Low inventory and

Read the

Cavco completes purchase of manufactured-home builder

The largest independent builder of manufactured and

Read the