HUD restores fair housing rule

The “affirmatively furthering fair housing rule” was drafted by the Obama administration in 2015. It was meant to encourage local governments and communities to meet obligations under the Fair Housing Act to provide affordable housing options and avoid housing discrimination.

Read the

Hot housing market on the verge of cooling off

Residential home prices grew by 14.8% in April, the highest annual growth rate in the nearly 30 years that Black Knight has been tracking this metric. Single-family properties actually had higher price appreciation, at 15.6% on an annual basis, while condominium prices rose by 10%.

Read the

Groups seek to keep mortgage origination, securitization rules aligned

The groups sent the letter to six federal regulators in response to the upcoming end of a periodic review done to determine whether the boundaries of the risk-retention exemption for securitized loans are adequate. Securitizers must retain at least 5% of the credit risk from loans pooled to create bonds unless all the mortgages involved meet certain standards. Risk retention was put in place in the wake of the Great Recession’s housing crash to incentivize securitizers to pool loans that would perform well even after the bonds were sold.

Read the

Brian Montgomery rejoins Radian's board

He became a director again on June 7 when Radian's board voted to expand the membership by one and named him to the seat.

Between 2012 and 2017, before a second go-round as Federal Housing Commissioner — where he oversaw Radian's government-run competitor — Montgomery served on the private mortgage insurer's board.

Read the

Home buying sentiment takes a tumble

After the segment of borrowers who thought it was a good time to buy dropped to a Fannie Mae Home Purchase Sentiment Index

Read the

Incenter units to help mortgage nonbanks offer student loans

Read the

MSR problem in Biden tax plan will likely be avoided

The proposal, which imposes a 15% alternative minimum tax on corporations with more than $2 billion in net income, could threaten a deferral that has been allowed on non-cash mortgage origination income from retained MSRs, the researchers said.

But they think the plan will likely be adjusted such that the deferral of taxes will be allowed to continue because it eliminates a logical timing issue whereby cash income from servicing would otherwise be taxed at origination, before it’s actually received.

Read the

Staff retention, volume fluctuation among top lender worries for 2021

An 88.2% share of 598 lending executives surveyed said

Read the

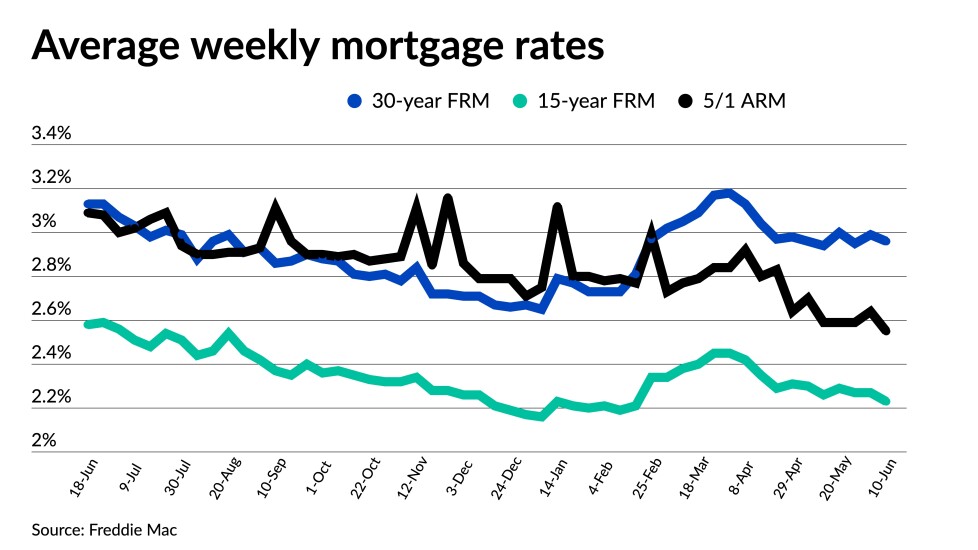

Mortgage rates fall for a second week

The 30-year average rate fell to 2.96% for the weekly period ending June 10, according to Freddie Mac’s weekly Primary Mortgage Markets Survey, down three basis points from 2.99%

Read the

Mortgage volumes fell during holiday week

The MBA’s weekly Market Composite Index, which measures mortgage volume based on the association’s survey of lenders, dropped a seasonally adjusted 3.1% week over week for the period ending June 4.

Read the

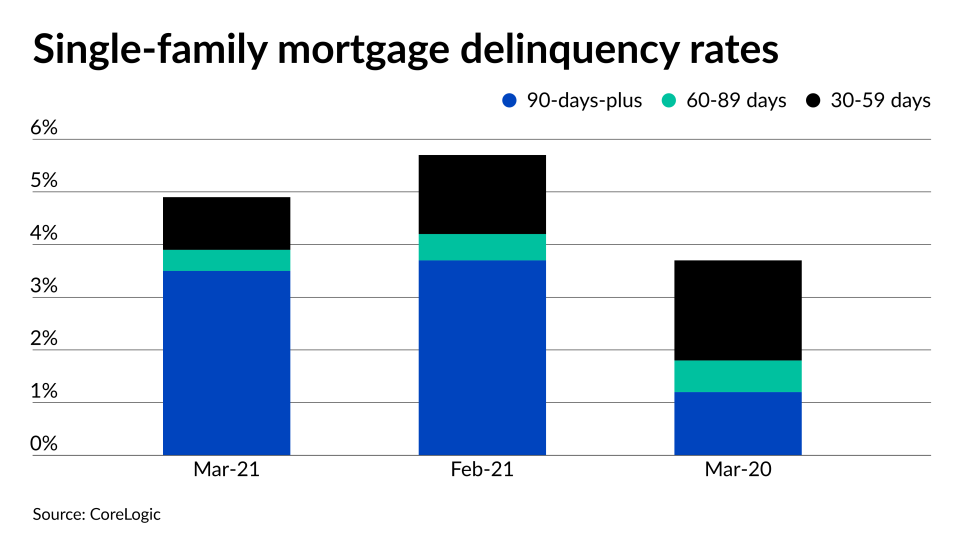

Mortgage delinquency levels reach pandemic low

The 4.9% overall delinquency rate was still 1.3 percentage points higher than March 2020's delinquency rate of 3.6%, but on a month-to-month basis, the delinquency rate fell 80 basis points from February's 5.7%. In

Read the

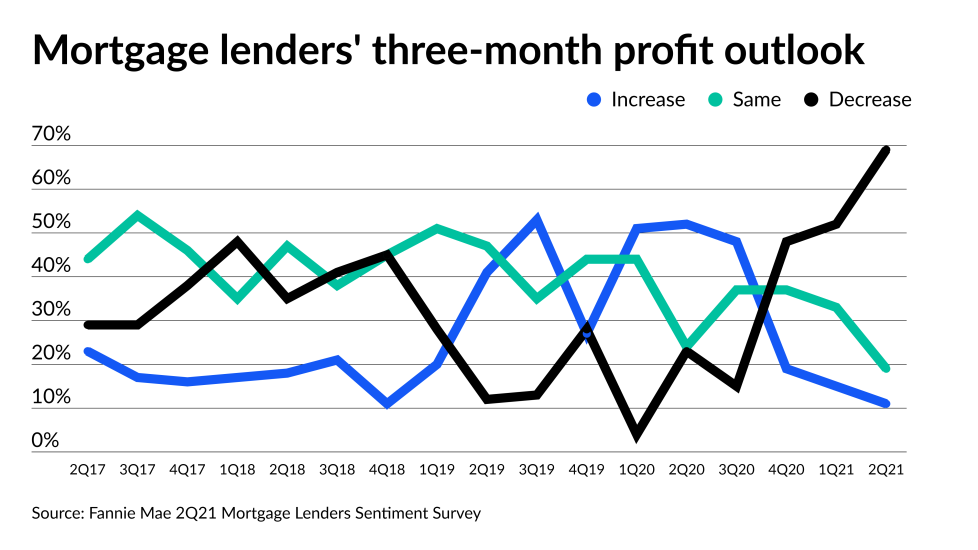

Mortgage lenders remain negative on profits, citing competition

Over two-thirds of the respondents, 69% said their profits will decrease over the next three months, while just 11% expected them to increase, for a negative net differential of 58%. Net share measures the difference between the percentage that believes profits will be higher and those that said they will be lower. That makes three consecutive quarters in which lenders were pessimistic about their profitability.

Read the

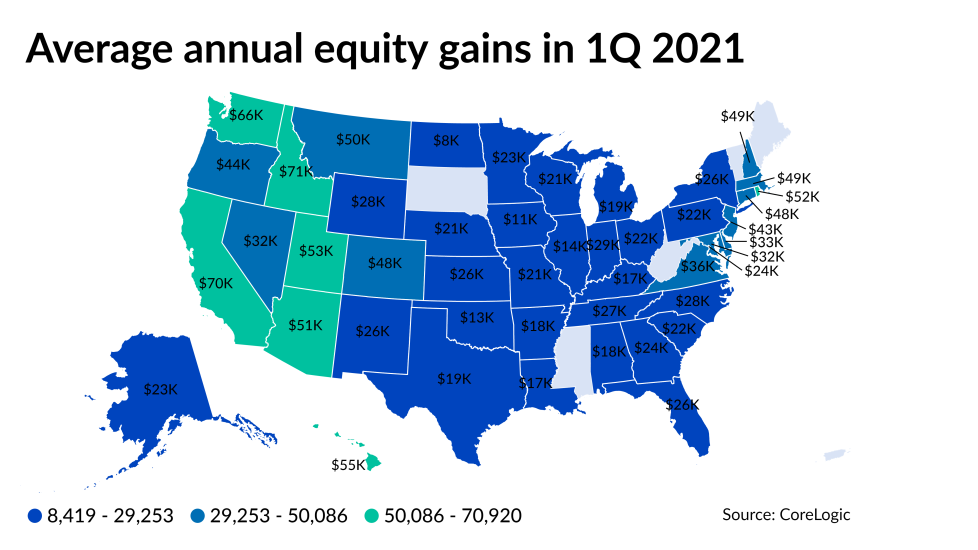

Borrowers gain decade-high levels of home equity in first quarter

On an annual basis, homeowners with mortgages collectively compiled over $1.92 trillion in equity in the first quarter of 2021, good for an average gain of $33,403 per borrower, according to CoreLogic. These compared to $1.58 trillion and $26,512 the prior quarter and $665 billion and $12,188 a year ago.

The growth also dropped the negative equity share by 24% annually to the lowest rate since at least 2009. The share of underwater borrowers fell to 2.6% with an aggregate unpaid principal balance of $273 billion from 2.9% and $281.1 billion in the fourth quarter of 2020 and 3.4% and $286.3 billion year-over-year.

Read the

Why GSEs may be pacing multifamily buying

“There’s a return to pre-pandemic credit parameters,” said Debby Jenkins, executive vice president of Freddie Mac’s multifamily division. “Debt service reserves, and things of that nature, are being rolled back.”

Read the

FHFA veteran reflects on 20 turbulent years in housing finance

Alfred Pollard, who has been at the forefront of housing finance issues for 20 years, retired in April as the FHFA's general counsel. He had held the the job since 2008, when the agency was established, and was previously the top lawyer at its predecessor agency, the Office of Federal Housing Enterprise Oversight.

Read the