Mr. Cooper sells reverse servicing to Mortgage Assets Management

The divestiture of the Champion-branded business to Mortgage Assets Management reduces the unpaid principal balance of Mr. Cooper's servicing portfolio by $16 billion. It also decreases Mr. Cooper’s balance sheet by $5 billion in federally insured Home Equity Conversion Mortgages and other assets. (HECMs are the dominant form of reverse mortgage.)

Read the

New modular homes aim to cut construction time 80%

The line of factory-made homes are designed for “plug-and-play” construction, in which each room gets connected at the building site. This cuts builder waste since it allows for bulk materials to be ordered for the pods’ exact dimensions. Manufactured homes overall typically sell at a lower price point than traditional single-family homes due to their reduced construction costs — currently a major issue restricting home builder activity. Even though lumber futures came

The manufactured homes take under two months to build — a sharp contrast to the average of about seven months for a single-family property, according to the U.S. Census Bureau.

Read the

Regulators expected to advance Biden agenda despite 'acting' tag

Three financial services regulators are now led by an "acting" appointee. After Biden ousted FHFA Director Mark Calabria, senior agency official Sandra Thompson was quickly named as the interim director. She joined Dave Uejio, acting director of the Consumer Financial Protection Bureau and acting Comptroller of the Currency Michael Hsu.

Without permanent heads in place, long-term policy goals such as reforming the Community Reinvestment Act and charting a future for Fannie and Freddie could be slowed, some observers said. But analysts say that the acting leaders are likely taking their cues from officials within the White House and the Treasury Department, giving the administration greater power to set policy.

Read the

Sun Capital purchases LoanLogics

Terms of the deal were not disclosed. LoanLogics, headquartered in Jacksonville, Fla., had a post-money valuation of between $50 million and $100 million following a 2016 investment according to Crunchbase.

"The support and resources Sun Capital is capable of providing to companies like ours will enable us to continue to ensure quality performance for our clients, enhance our operations and serve the rapidly modernizing mortgage technology market," LoanLogics CEO Bill Neville said in a press release.

Read the

Blend values IPO at $414M, completes Title365 buy

The mortgage technology provider is looking to sell 20 million shares of its Class A stock and also has a 3 million share underwriters' option. Less than 10% of the total Class A stock will be outstanding after the IPO of approximately 208.7 million shares. The prospectus estimates the IPO will deliver net proceeds of $309.5 million at $17 per share. That amount rises to $357 million if the underwriters' option is exercised.

Blend, which is used by major banks, is set to launch its offering in a market that has recently proved challenging for nondepository lender IPOs. Every mortgage company that has launched one recently has cut both the number and dollar amount of shares.

Read the

Fannie, Freddie forbearances hit lowest level since March 2020

Home loans in forbearance plans represent 3.87% of all outstanding mortgages, about 1.9 million homeowners. That reflects a decline from

Read the

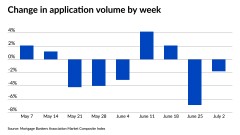

Mortgage applications decline for a second week

The Market Composite Index, which tracks total mortgage volume based on a survey of MBA members, dropped a seasonally adjusted 1.8% from the prior pre-holiday week ending July 2. On an unadjusted basis, the decrease came in at 2%. Compared to the same week in 2020, the index was 19.2% lower, seasonally adjusted.

Read the

Mortgage rates hit lowest point in months

The 30-year fixed rate mortgage averaged 2.9% for the weekly period ending July 8, down eight basis points from 2.98% the previous week, according to the results of Freddie Mac’s Primary Mortgage Market Survey. One year ago, the 30-year average came in at 3.03%. While

“All told, mortgage rates now sit near their lowest level since February, fully reversing the sharp upward movements from earlier in the year,” said Zillow economist Matthew Speakman in a statement. “While longer-term changes in rates are likely to be to the upside, the shift in the market’s outlook suggests that rates have little reason to move sharply higher anytime soon.”

Read the

Home prices expected to grow 7% through Q2 2022

"Buyer demand is strong in nearly every market in the country," Veros CEO Darius Bozorgi said in a press release. "We are squarely in a seller's market and buyers have no choice but to put forward the best offer they can, frequently making offers above asking price, to secure the home they want to own."

Furthermore,

"Despite that, [Federal Open Market Committee members] have not slowed the pace of bond buying," Fox added. "They have their foot on the accelerator full speed ahead and are only thinking about

Read the

FHA delinquencies pose most risk to these metros

Those metro areas, ranked in part by the number of delinquent loans, are Atlanta (42,268), Houston (40,147), Chicago (28,792), Dallas (22,302), Washington, D.C. (20,285), Baltimore (17,851), Riverside, Calif. (17,622), San Antonio (14,491), Fort Worth (12,866) and Philadelphia (12,490).

Read the

Private equity firms to buy Lereta

Financial terms for the acquisition of the company, which is currently held by funds owned by Tarsadia Investments as well as Lereta management, were not disclosed. Management will retain a minority stake in the company and its current leadership and structure will remain intact.

Lereta, previously known as Lenders’ Real Estate Taxes, is reportedly seeing growth in part because many loans have

Read the

Home buying, selling sentiments hit extremes in June

The share of borrowers who thought it was a good time to buy a home dropped to a new Fannie Mae Home Purchase Sentiment Index all-time low of 32%

Despite the largely unfavorable conditions,

Read the

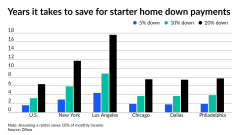

Starter home prices are growing 7 times faster than renter income

Housing affordability

This disparity in growth rates added a year to the amount of time a typical consumer would need to save for a 20% down payment compared to 2016. To keep stride with Zillow’s projected 14.9%

Read the

7 candidates to lead Fannie and Freddie's regulator

It remains to be seen how quickly Biden will nominate a permanent FHFA director. After all, he has yet to send Congress a name for another key financial regulatory position: the head of the Office of the Comptroller of the Currency. But given how quickly the administration moved to fire Calabria after a key Supreme Court decision and how important housing is to the economic recovery, a nomination could come soon.

After the Supreme Court ruled June 23 that the president

Read the