Consumer

The Real House Price Index — a metric that adjusts residential property prices for income and interest rate fluctuations — fell 7.3% annually and 0.3% month-over-month. Drops in real house prices equate to better affordability for potential buyers.

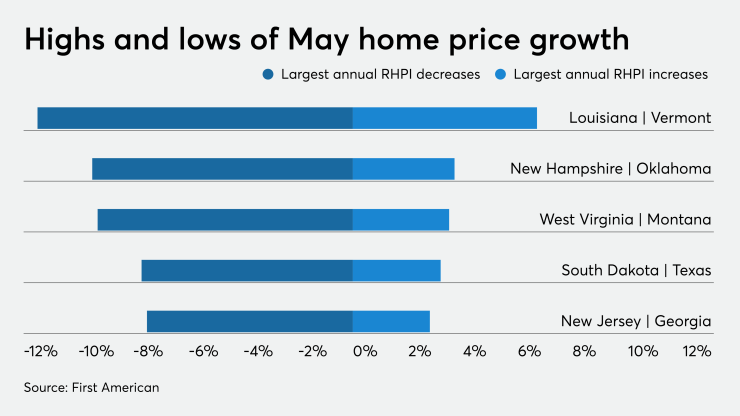

RHPI fell the furthest in Louisiana, down 11.5% annually, followed by drops of 9.5% in New Hampshire and 9.3% in West Virginia.

Vermont's 6.7% increase in RHPI year-over-year was highest in the nation in May, with rises of 3.7% in Oklahoma and 3.5% in Texas trailing.

Broken down by metro area, the biggest decline came in Las Vegas at 24.5%, followed by decreases of 14.1% in Providence, R.I., and 7.5% in Boston. New York's 14.8% was the largest increase in RHPI, with San Diego's 10.1% and Pittsburgh's 8.8% coming next.

"As the coronavirus pandemic continues to wreak havoc on global and domestic economies, housing has thus far proven resilient, managing a V-shaped recovery from the low point reached in April," Mark Fleming, chief economist at First American, said in a press release.

"Mortgage rates were falling before the pandemic, and just last week

While purchasing power outpaced price growth,

"The supply and demand imbalance that existed entering the pandemic has persisted, and even worsened, meaning house price growth will likely remain strong this summer," Fleming said.

"Under an optimistic scenario with continued labor market improvement and consistently low rates, continued strong demand against a limited supply of homes for sale pushes house price appreciation to accelerate in July and remain strong in August," Fleming added.

"If the labor market limps along, the demand will not be quite as strong, but the momentum of house price appreciation remains," he said. "Even under a pessimistic outlook for the labor market, the housing market would benefit from a house-buying power boost as mortgage rates are likely to be pressured lower."