-

Connecticut's housing market saw modest gains in September, with the number of sales of single-family homes and condominiums increasing as well the median sale price for both types of properties.

November 1 -

A mortgage company's dispute with Connecticut over what tasks a licensed loan officer needs to handle points to a potential compliance concern for direct and digital lenders seeking to maximize efficiencies.

September 24 -

The spring home buying market — traditionally the strongest of the year — didn't do much to boost overall home sale prices in greater Hartford this year.

August 19 -

1st Alliance has ceased lending activities following the loss of bonding in Connecticut, plus financial concerns it links to a state regulatory dispute, but it may later seek to recapitalize.

August 16 -

Connecticut single-family home sales fell in June, the 11th consecutive monthly decline, as the median sale price also dropped.

August 1 -

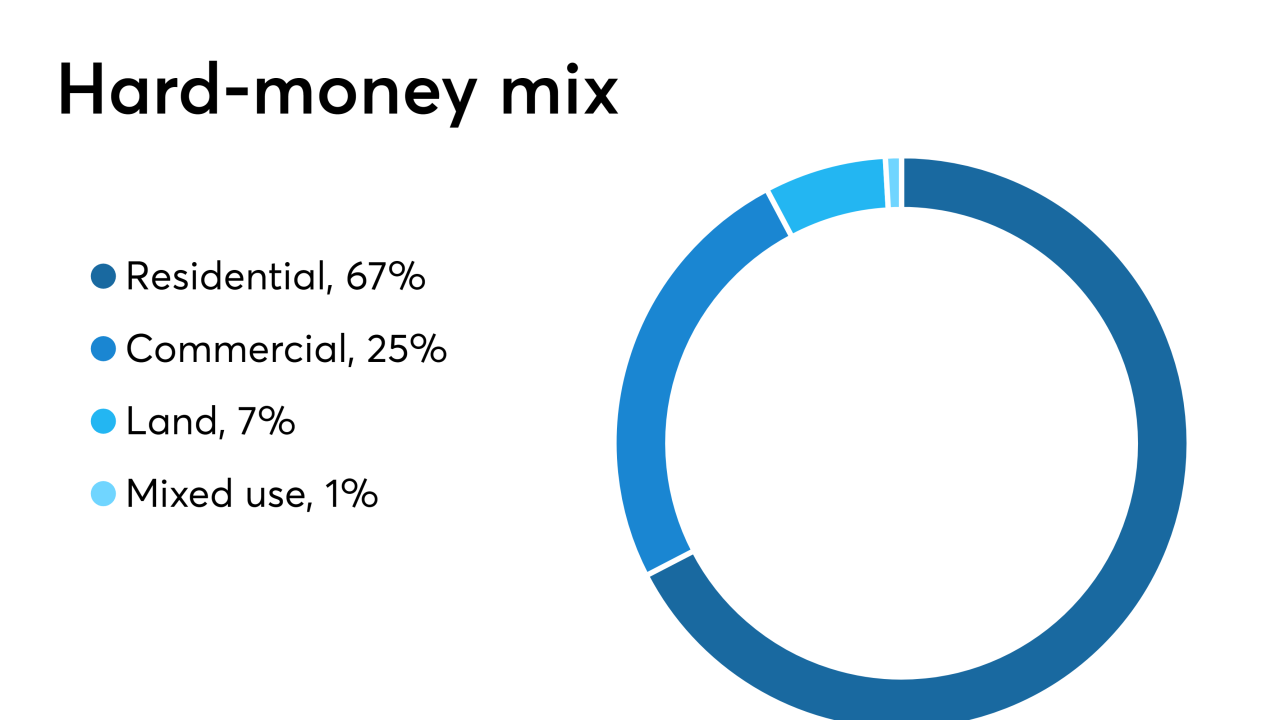

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The spring home buying market got off to a disappointing start in April, as sales sputtered and the state marked the ninth consecutive month of year-over-year sale declines.

June 3 -

Home sales across Connecticut in March provided a weak lead-in to the state's spring home buying season with sales and prices both registering year-over-year declines.

April 25 -

Northeast mortgage originators relied heavily on referral relationships with attorneys and financial planners and less so with homebuilders last year, the Top Producers 2019 survey found.

April 17 -

Sheldon Oak Central, a Connecticut affordable housing developer, is at risk of losing half a million dollars in federal subsidies if it can't come up with cash to rehab one of its aging properties.

April 15 -

Single-family home sales fell sharply in Connecticut during February, according to the latest data from The Warren Group, real estate information firm.

March 28 -

Connecticut's real estate market was hit hard in January, with single-family home sales hitting their lowest level for the month in a decade, according to the Warren Group.

March 1 -

Home sale prices in Connecticut got a welcome bump up in 2018, but overall prices are still far below the peak prior to the last recession a decade ago.

January 24 -

1st Alliance Lending CEO John DiIorio explains why the mortgage lender turned down a consent order with the Connecticut Department of Banking and the high cost of fighting what he sees as an overreach of regulators' enforcement power.

January 17 1st Alliance Lending

1st Alliance Lending -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

Connecticut's real estate market was in flux for much of 2018, especially when compared to the other New England states, according to a new report.

January 11 -

October was a difficult month for Connecticut's housing industry as two key indicators, sales of existing single-family homes and new housing permits issued, declined.

November 29 -

Wells Fargo & Co. raised its required down payment for homebuyers in Connecticut's Fairfield County to 25% from the standard 20% after it categorized the area as distressed.

November 15 -

Home sale prices across Connecticut rose in September, compared with a year ago, reaching their highest level for the month since 2008.

November 2 -

Housing recoveries usually look like this: sales pick up momentum, price increases follow and there is a good flow of new properties coming on the market to keep up buyer interest.

October 25