-

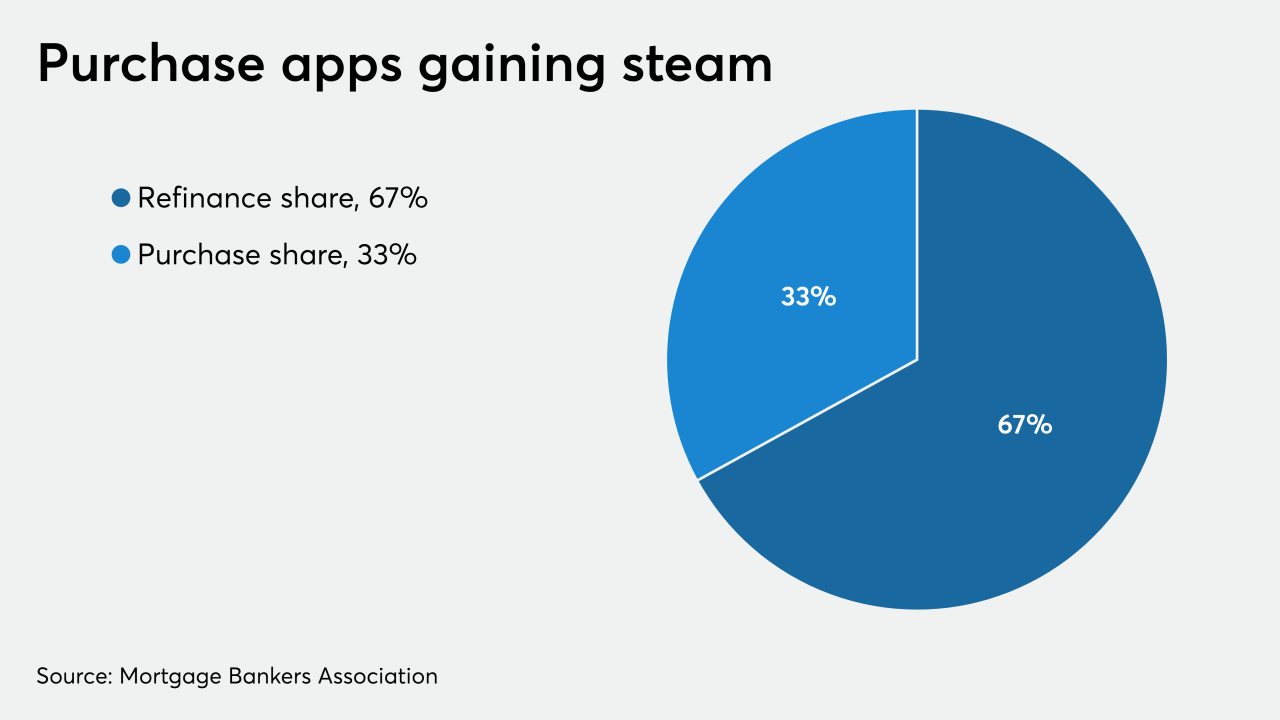

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

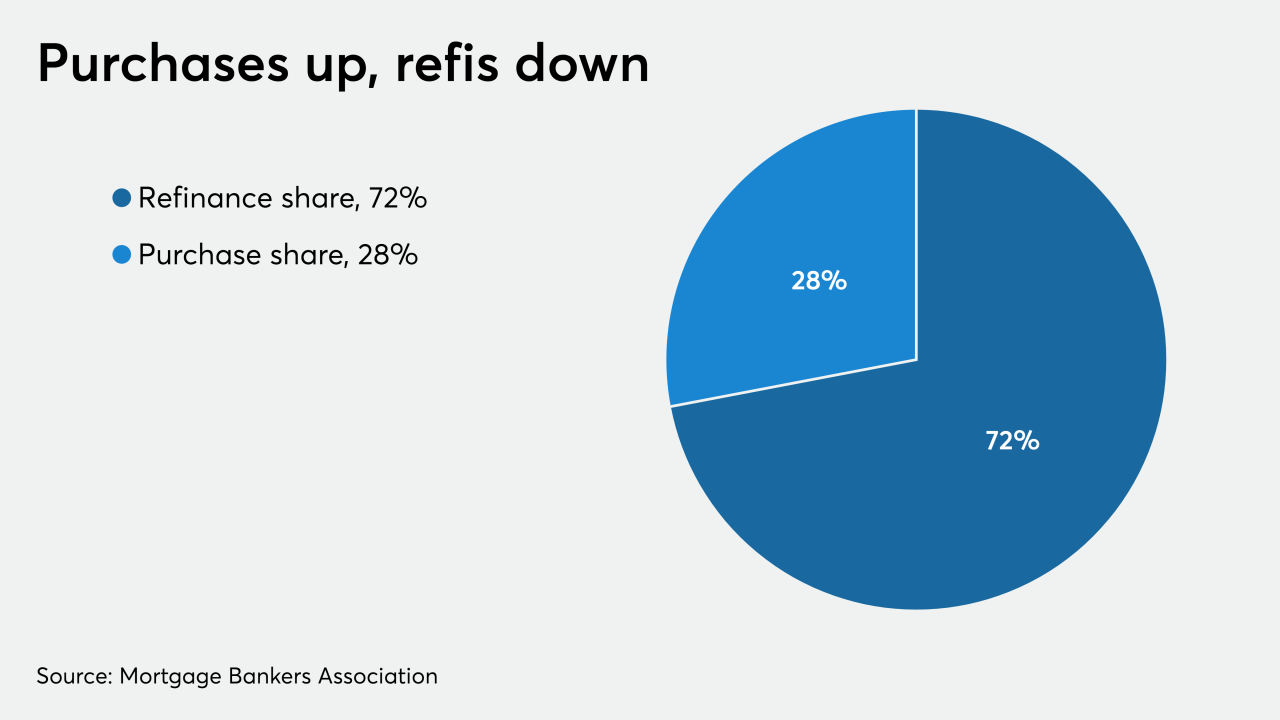

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

-

-

Sales of new homes slid in March by the most since 2013 as the coronavirus started to wreak havoc on the country’s economy.

April 23 -

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16 -

The move is part of an effort by CFPB Director Kathy Kraninger to help smaller lenders by significantly raising loan thresholds for collecting and reporting mortgage data.

April 16 -

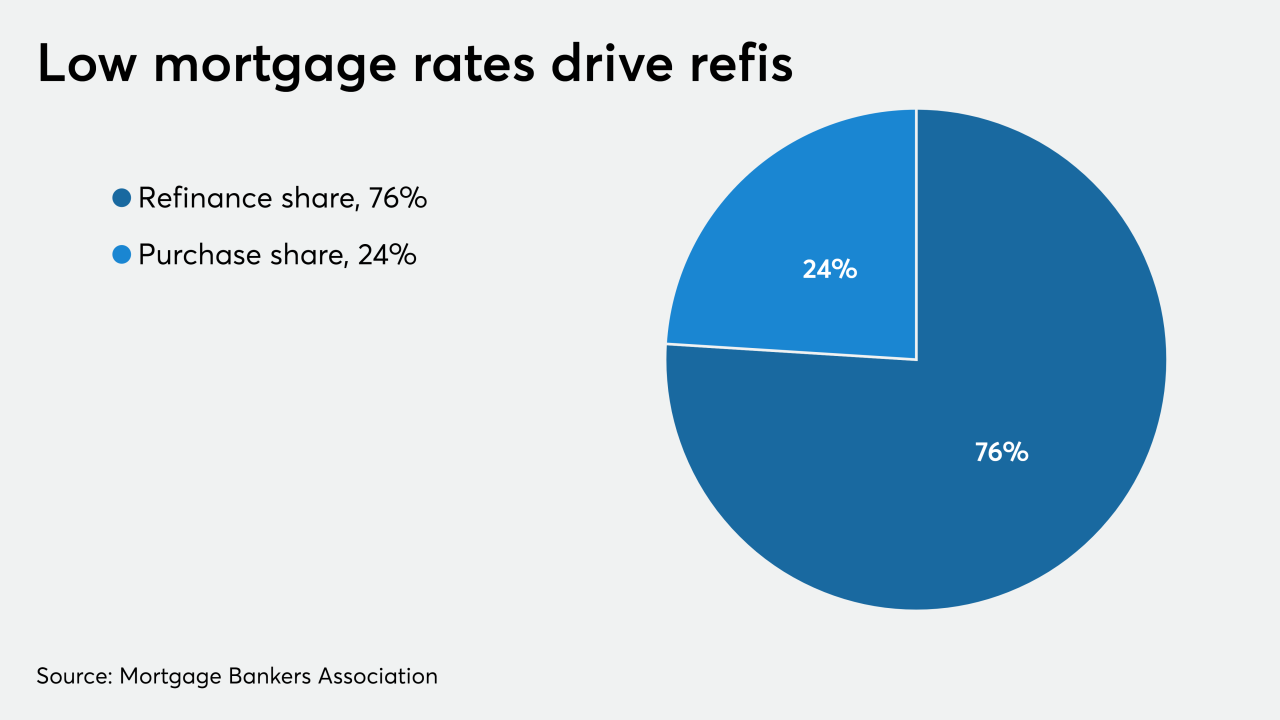

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

Homebuilders in the Twin Cities kept the construction spigot open during March amid growing concerns about the COVID-19 pandemic.

April 10 -

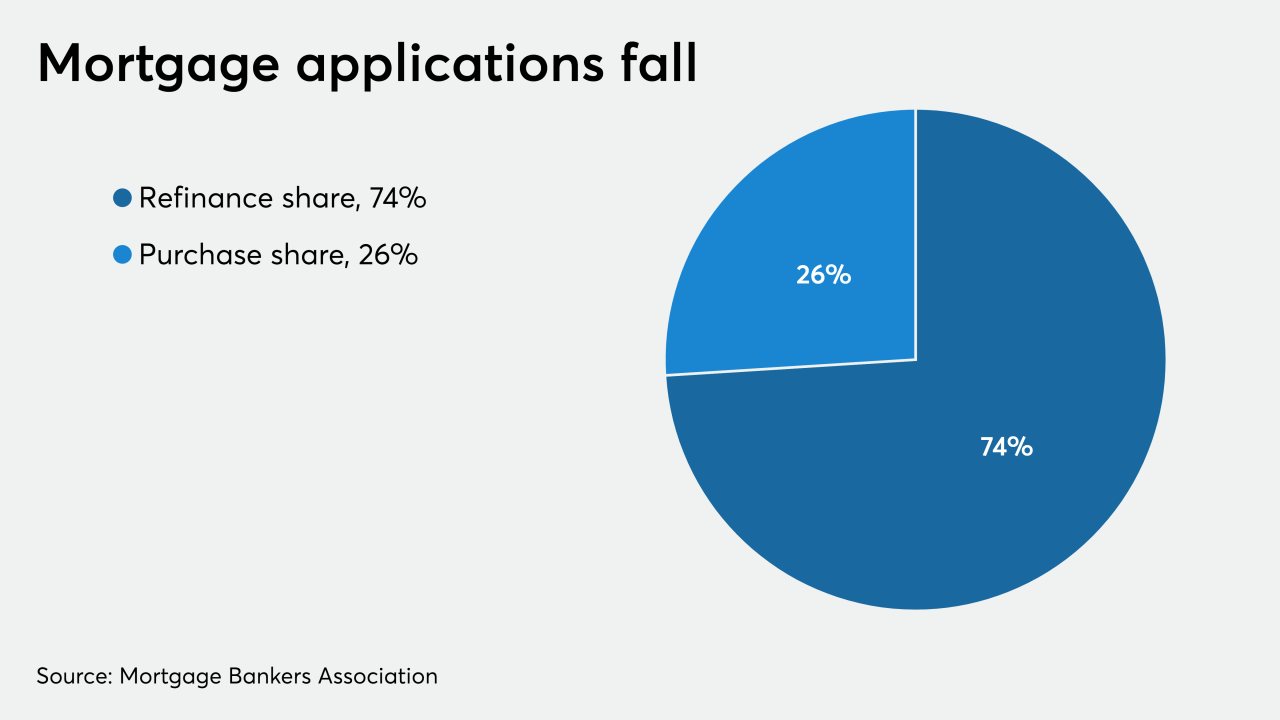

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

Mortgage application volume decreased 8.4% compared with one week earlier as lenders managed activity by raising rates even as 10-year Treasury yields fell below 1%, according to the Mortgage Bankers Association.

March 18 -

Mortgage applications to purchase new homes took a small step back in February from record levels during the previous month, but further positive momentum could be blunted by the coronavirus.

March 17