-

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

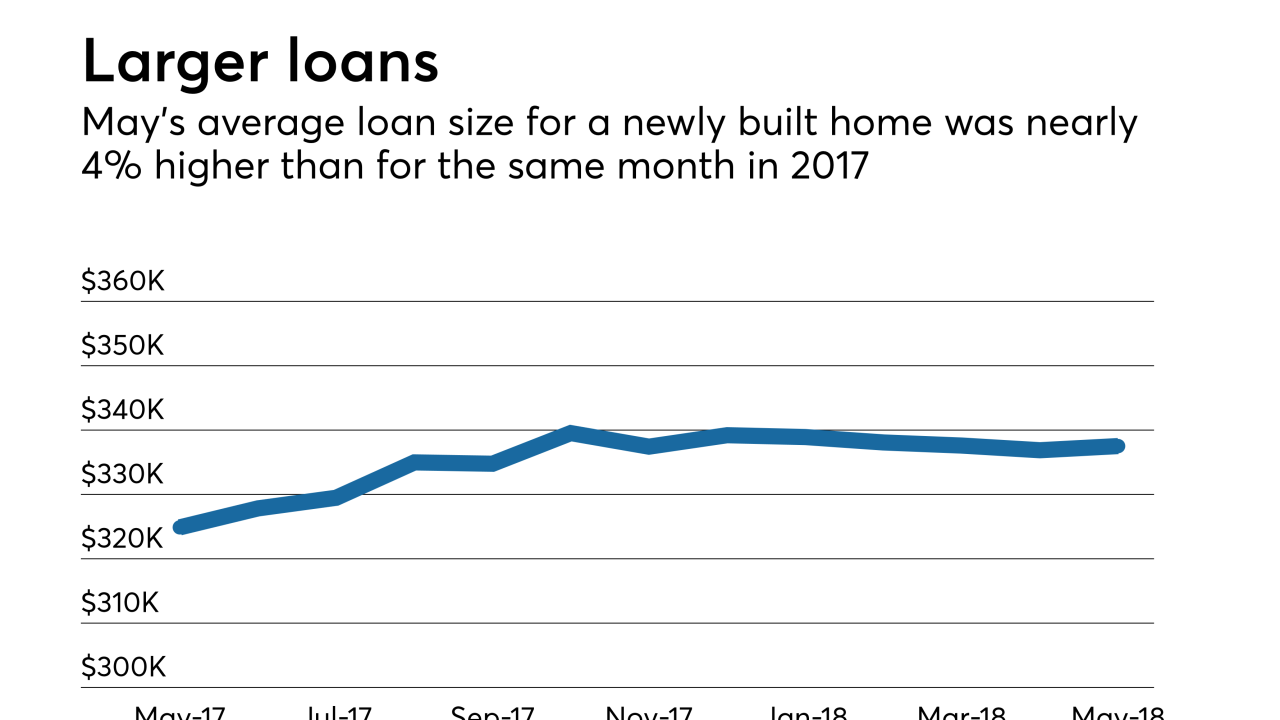

Mortgage applications for newly constructed homes declined in May as sales and supply are not keeping up with demand, the Mortgage Bankers Association said.

June 15 -

Mortgage applications fell 1.5% from the previous week, as rising interest rates ended a brief pickup in activity, the Mortgage Bankers Association reported.

June 13 -

Mortgage rates dipped for the second consecutive week although 10-year Treasury yields started to rise again, according to Freddie Mac.

June 7 -

After eight consecutive weeks of decreases, mortgage applications increased by 4.1% last week as key interest rates dropped sharply, according to the Mortgage Bankers Association.

June 6 -

Mortgage applications decreased 2.9%, falling for the eighth consecutive week even as interest rates came down from their recent highs, according to the Mortgage Bankers Association.

May 30 -

Union Bankshares has reached an agreement under which Federal Savings Bank will originate mortgages in its branches.

May 23 -

Mortgage applications decreased by 2.6%, falling for the seventh straight week as key interest rates jumped to seven-year highs, according to the Mortgage Bankers Association.

May 23 -

Mortgage applications decreased by 2.7% and fell for the sixth straight week as key interest rates fell slightly, according to the Mortgage Bankers Association.

May 16 -

Mortgage applications decreased by 0.4% and were down for the fifth straight week, as key interest rates also fell slightly, according to the Mortgage Bankers Association.

May 9 -

Rising interest rates contributed to a 2.5% decrease in mortgage application activity, which fell for the fourth straight week.

May 2 -

As key interest rates grew, the refinance share of mortgage applications hit a low not seen since September 2008, according to the Mortgage Bankers Association.

April 25 -

Better weather allowed consumers to go shopping for homes and drive the increase in mortgage application volume compared with one week earlier, according to the Mortgage Bankers Association.

April 18 -

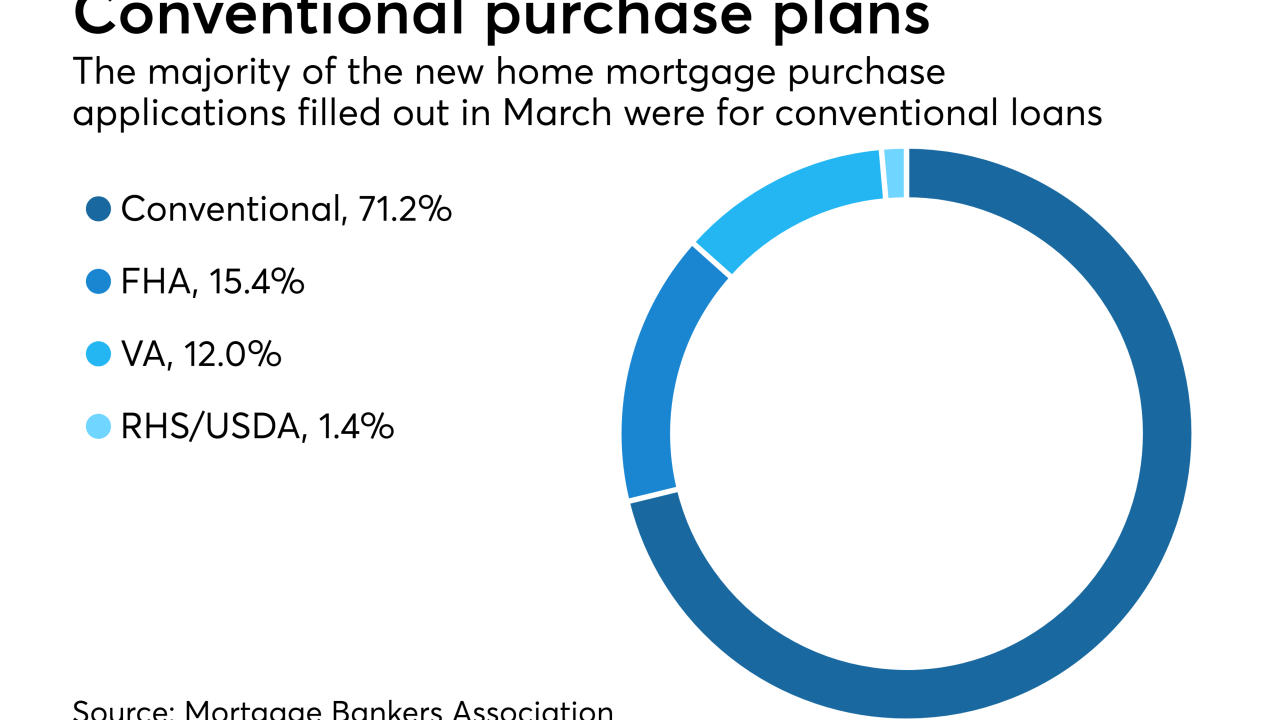

March mortgage applications for new home purchases were stronger than in February but lenders didn't produce as many of them as they did a year ago.

April 13 -

The bank says its partnership with Lender Price will help streamline and simplify its home loan process.

April 12 -

Mortgage applications decreased 1.9% from one week earlier as purchase activity was down again, according to the Mortgage Bankers Association.

April 11 -

Mortgage application activity decreased 3.3% from one week earlier as purchase and refinance volume fell prior to the start of the home buying season, according to the Mortgage Bankers Association.

April 4 -

Banks that scored high in customer-satisfaction ratings did so for their front-line service, not their tech capabilities, a study finds.

March 30 -

Lenda, launched in 2014, currently makes mortgages start to finish in two weeks. But it's aiming to make it a process that can be finished on a borrower's lunch break.

March 28 -

Mortgage applications increased 4.8% from one week earlier and rose for the fourth time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

March 28