-

The economic contraction will keep mortgage rates low for the foreseeable future.

May 14 -

Mortgage rates remained generally steady this past week, even with the continuing market volatility, and that is helping the purchase market, according to Freddie Mac.

May 14 -

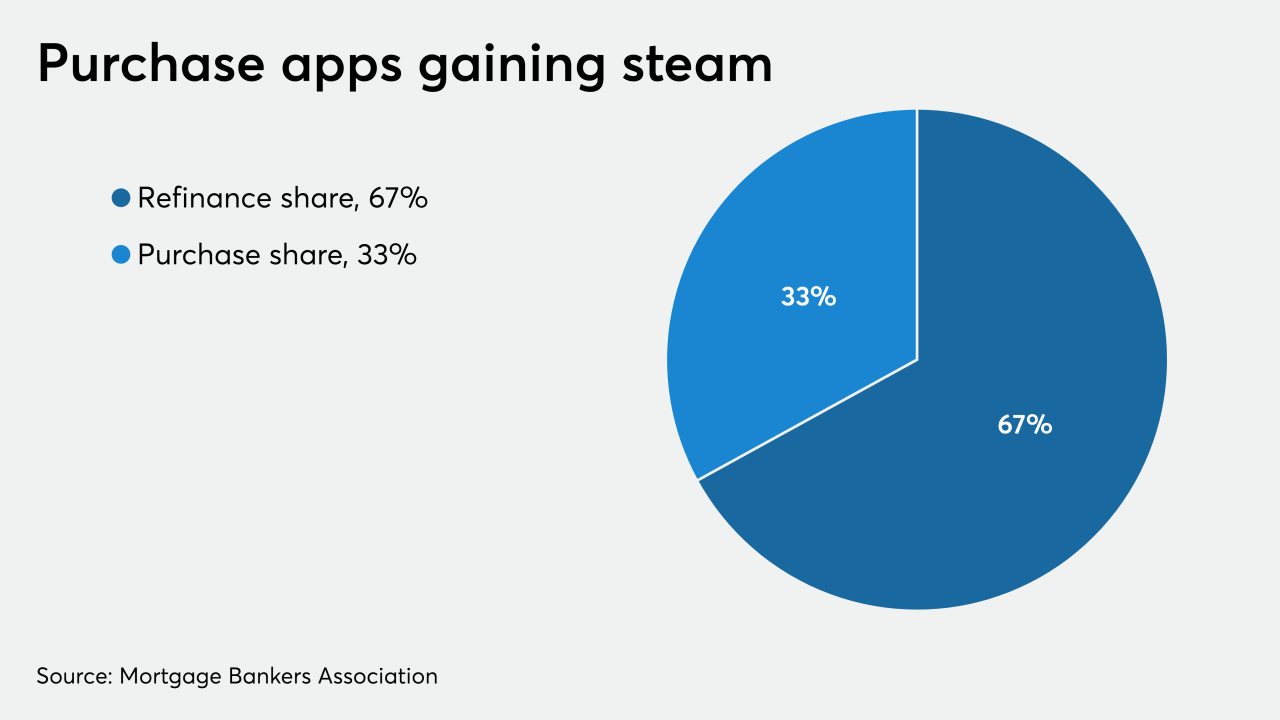

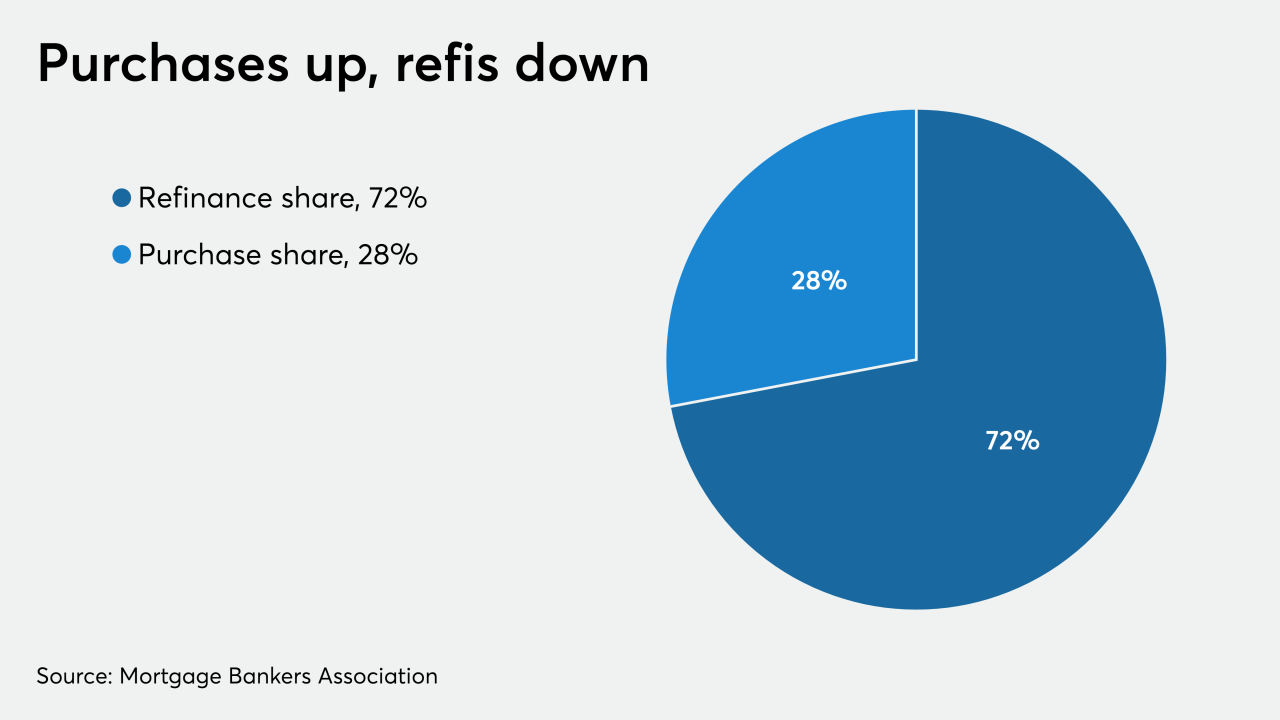

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8 -

Mortgage rates are at record lows, but borrowers hoping to take advantage are running into the toughest loan-approval standards in years.

May 8 -

Consumer sentiment for home buying fell to its lowest point since November 2011, according to Fannie Mae.

May 7 -

Mortgage rates ticked up slightly this week, but whether consumers are able to take advantage of them for purchases and refinancings depends on who looks at the data.

May 7 -

Houston home sales plunged more than 20% in April from year-ago figures as sellers took properties off the market and buyers stayed home through the coronavirus-induced shutdown.

May 7 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

The Federal Reserve's emergency rescue of the U.S. mortgage market should have set off celebration among lenders trying to keep up with demand from borrowers. Instead, executives at Quicken Loans got a hefty margin call.

May 4 -

As the coronavirus takes a major toll on housing inventory and credit availability, pent-up buyer demand could lead to market recovery, according to Redfin.

May 1 -

Homebuilders in the Twin Cities ramped up production last month, despite a barrage of challenges including growing economic uncertainties and a mandate to practice social distancing rules on job sites.

May 1 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

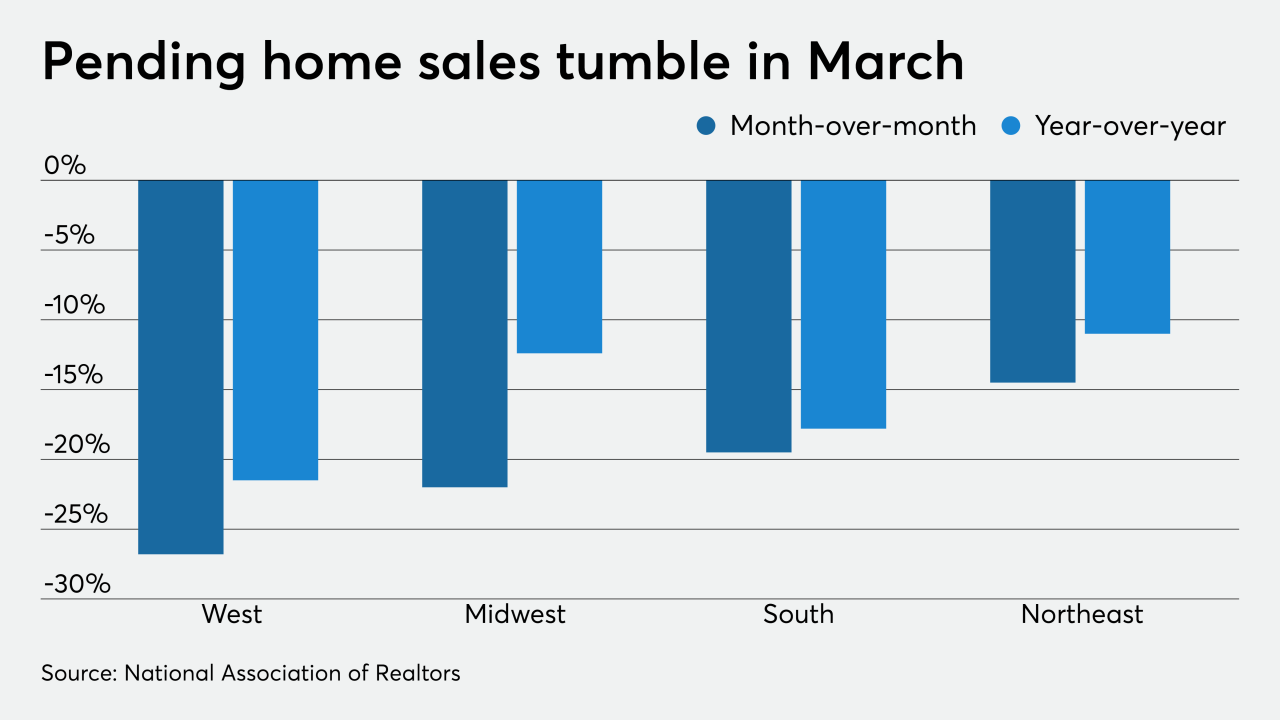

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

Contracts to buy existing homes plunged in March by the most since 2010 as the coronavirus forced people to stay home and the economy spiraled down.

April 29 -

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

Pre-pandemic, home-buying power was high, but few are likely to buy a home today given a host of uncertainties regarding coronavirus, First American said.

April 27 -

In the days before COVID-19 entered American consciousness, home prices in San Diego climbed near record territory.

April 23