-

Mortgage application activity increased 30.2% from one week earlier as purchases were at their highest level in over a decade along with substantial growth in refinancings, according to the Mortgage Bankers Association.

January 15 -

More than half of Columbus homebuyers are millennials, according to a new study from the mortgage lead generation company LendingTree.

January 14 -

When it comes to purchasing a home vs. renting on the affordability continuum, the reasonably priced properties skew towards less populated areas, according to Attom Data Solutions

January 14 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

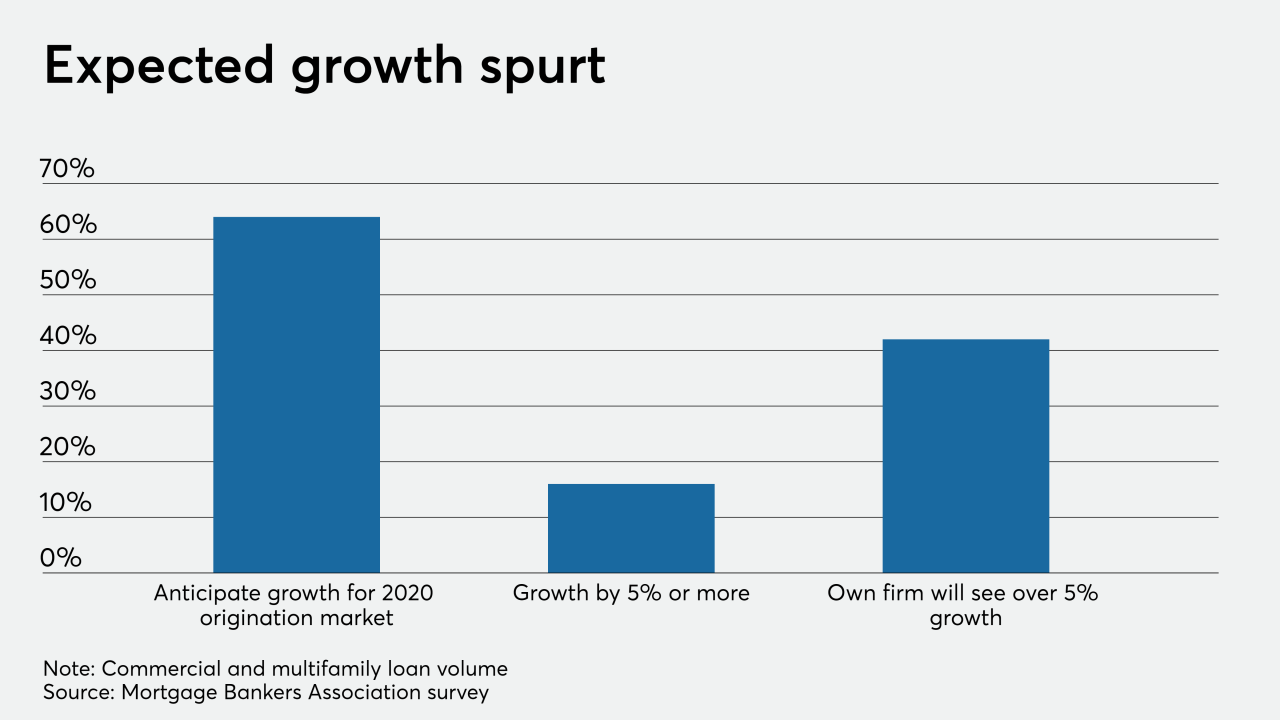

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

Home sellers in the suburbs north of New York City discounted their way to a strong fourth quarter, whittling pricing to levels that even luxury buyers found appealing

January 9 -

Mortgage rates fell to their lowest level since October as the financial markets reacted to rising tensions caused by the U.S. government's killing of an Iranian general, Freddie Mac said.

January 9 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

December home sales in the Houston area jumped 14% from the year before, capping a dramatic turnaround over the course of 2019.

January 9 -

Mortgage applications decreased 1.5% on a seasonally adjusted basis from two weeks earlier amid the annual end-of-year slowdown despite lower rates from global tensions, according to the Mortgage Bankers Association.

January 8 -

Consumer perception of the housing market ticked up slightly in December, as potential buyers remain bullish about making a home purchase in 2020, a Fannie Mae report said.

January 7 -

Instability among foreign relations typically drags down long-term interest rates and the latest crisis with Iran could be a catalyst for a drop in 2020, according to NerdWallet.

January 3 -

Yields on the 10-year Treasury slipped in Jan. 3's morning hours as investors moved money into safer instruments following the U.S. attack that killed an Iranian general.

January 3 -

November's foreclosure starts hit their lowest level since Black Knight started tracking this data in 2000, while the foreclosure rate reached a 14-year low.

January 2 -

If the first weekly Freddie Mac report of the year is any indication, there could be far less volatility for fixed mortgage rates in 2020 than there was in 2019.

January 2 -

Home prices in 20 U.S. cities rose at the best pace in five months in October, posting a second straight acceleration as real estate markets showed fresh strength at the start of the fourth quarter.

December 31 -

The drop in home buying power heightened the risk of misrepresentations on purchase mortgage loan applications during November, as consumers are more willing to fudge information in an uncertain market, First American Financial said.

December 30 -

Contract signings to purchase previously owned homes increased in November for the third time in four months, consistent with steady progress in the residential real estate market.

December 30 -

November was another disappointing month for home sales in Champaign County, Ill., with figures down 6.9% from the same month last year.

December 30 -

Mortgage rates ended the week little changed from the previous seven-day period and near historic lows for the year, according to Freddie Mac.

December 26