-

Sales of single-family homes in the Albany, N.Y., area fell 17.4% in August from year-earlier levels, and real estate officials are blaming a 9% drop in inventories and steep prices for newly constructed homes for the decline.

October 11 -

Weaker-than-expected economic data led to a decline in mortgage rates this week, although consumer attitudes remain strong, and should continue to drive increased home purchase demand, according to Freddie Mac.

October 10 -

Houston-area home sales increased nearly 10% in September from a year ago as buyers closed on 7,035 single-family homes, the bulk of which sold for between $150,000 and $500,000.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

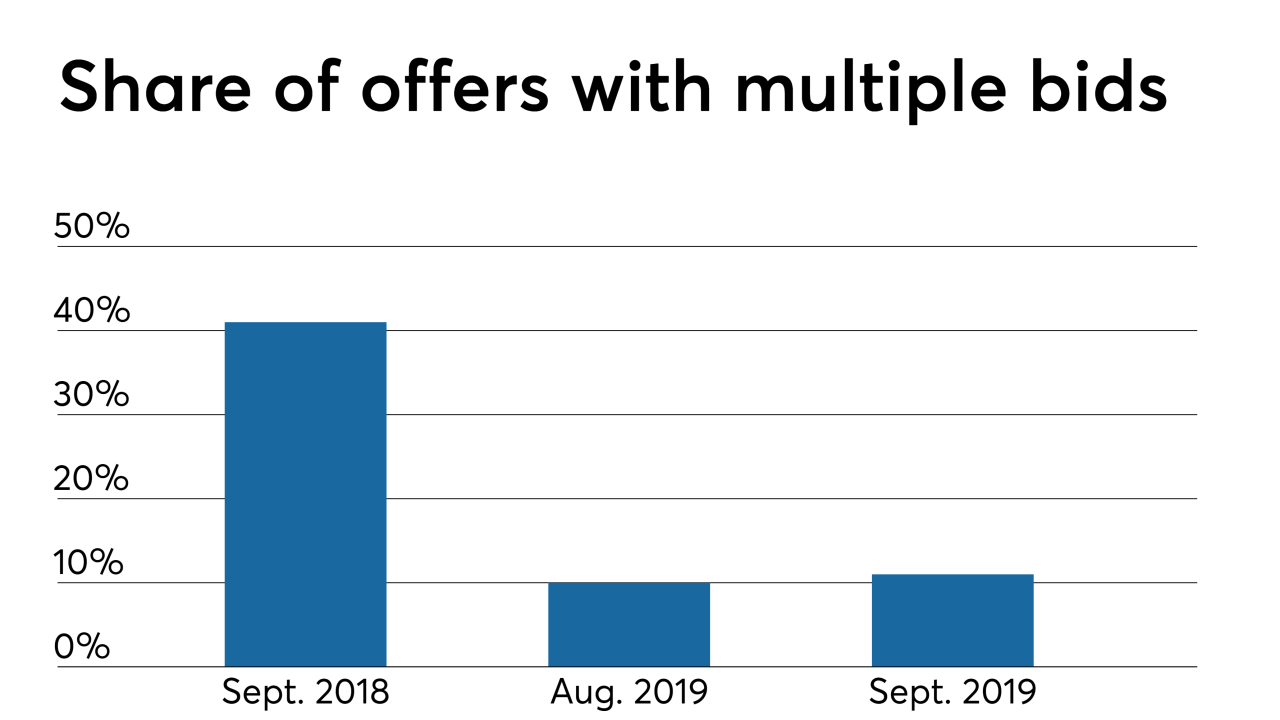

Home bidding activity tracked by Redfin in September was weaker than a year ago but up compared to August, suggesting purchase mortgage originations haven't been subjected to a seasonal slowdown yet.

October 8 -

Lower mortgage rates prompted Dallas-Fort Worth builders to ramp up home starts in the third quarter.

October 8 -

While home affordability reached a 32-month high in September, it could continue to increase in the fall months, according to Black Knight's Mortgage Monitor.

October 7 -

Bankers in St. Louis weren't surprised when mortgage data released this summer showed a drop in loans made between 2017 and 2018.

October 7 -

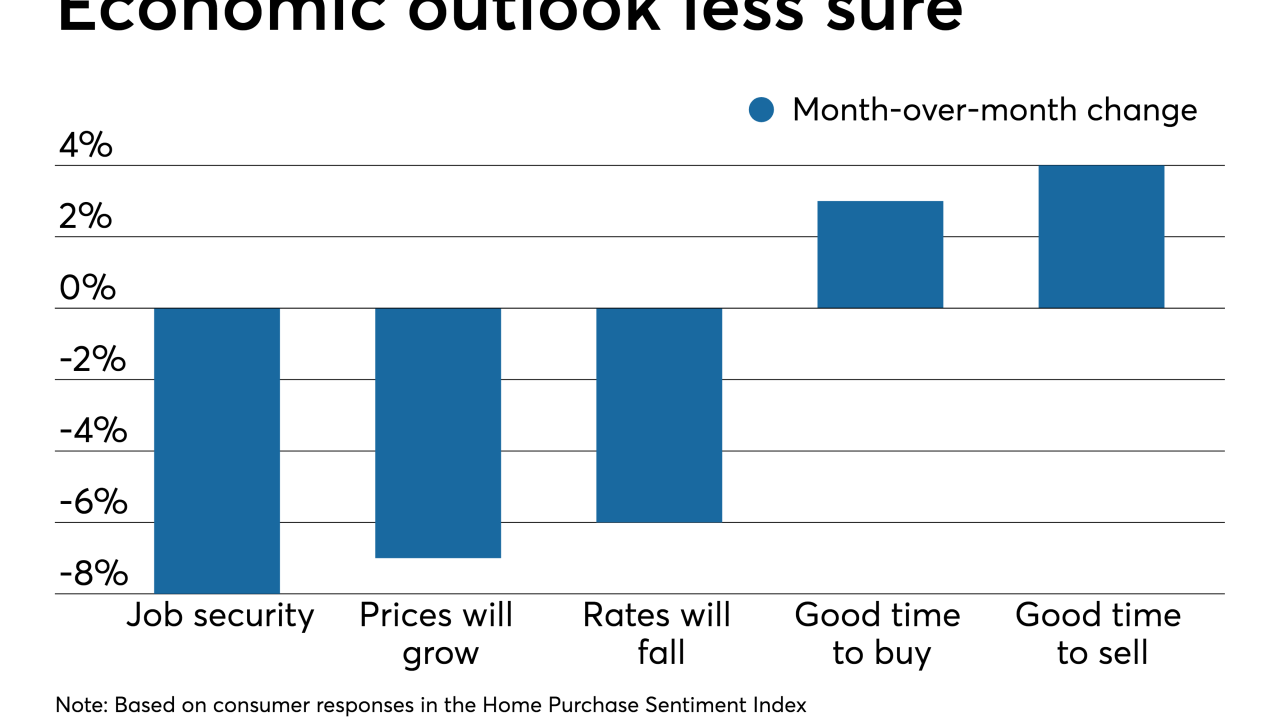

Consumer confidence in the housing market remains relatively strong, but economic uncertainty is testing its resiliency, according to Fannie Mae.

October 7 -

Employment estimates for nonbank mortgage companies rose to a 2019 high as lower rates spurred consumer demand in August, but higher rates in September could mean future numbers will be weaker.

October 4 -

Real estate economists' outlook for single-family housing starts through 2021 weakened compared with six months ago even though they are relatively bullish on the economy, an Urban Land Institute survey found.

October 3 -

Economic issues were the biggest influence on average mortgage rates in the past week, although two trackers moved in different directions.

October 3 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Millennials — now more than ever — dictate the direction the housing market is moving in, and with the deceleration of starter home prices, more should become homeowners soon, according to CoreLogic.

October 1 -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

The switch to a buyer's home purchase market, as well as fewer natural disasters helped drive the five-month-long decline in mortgage application fraud risk, First American said.

September 27 -

Neither boom nor bust, the Palm Beach County, Fla., housing market ended the summer selling season with a steady but unspectacular performance.

September 27 -

Economic uncertainty and high housing prices will put a damper on home sales next year, but low mortgage rates will offset that, pushing house prices to all-time highs in 2020, the California Association of Realtors forecast.

September 27 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27 -

Rising home prices are likely to constrain affordability for some time to come, with only the current low mortgage interest rate environment softening the blow, Attom Data Solutions said.

September 26