-

After more than three years of a strong seller's market, Staten Island's residential real estate is now favoring homebuyers, Realtors say.

December 7 -

House flipping fell for the third consecutive quarter, following a pattern seen the last time mortgage rates spiked, according to Attom Data Solutions.

December 6 -

Mortgage rates dropped this past week as investors pulled money from the stock market over global trade worries and instead purchased bonds, according to Freddie Mac.

December 6 -

Southern California's housing market weathered the slowest October in seven years, prompting a debate over where the market is headed.

December 6 -

The Colorado Springs single-family housing market is still going strong — just not quite as strong as last year.

December 6 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

Mortgage applications rose for the second straight week as key interest rates fell back toward 5%, according to the Mortgage Bankers Association.

December 5 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

The lack of housing affordability, caused by rising home prices and mortgage rates, remains a roadblock to homeownership.

December 4 -

Bay Area home sales ground down in October, with seasonal slowing and further indications that buyers are taking a wait-and-see approach before plunging into a record-setting market.

December 3 -

Housing prices in the Missoula, Mont., area have risen tremendously since January and are on pace to see the largest annual spike in well over a decade.

November 30 -

Volatility in the stock market caused the growth in the top 5% of average home sale prices to slow more than the rest of the market, according to Redfin.

November 29 -

Contract signings to purchase previously owned homes unexpectedly fell by the most since January, reaching the lowest level since mid-2014 amid mounting evidence that the housing market is struggling.

November 29 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

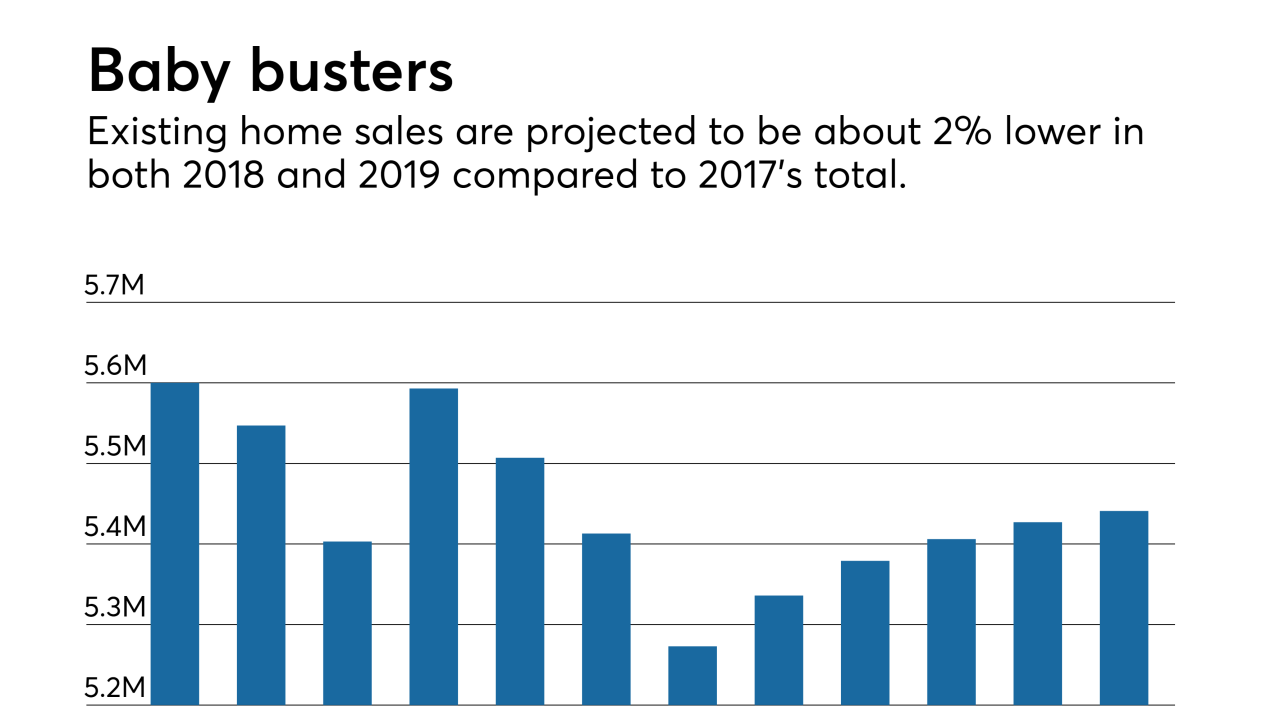

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

A forecast from Realtor.com predicts metro Denver home sales could slow significantly next year, but that the decline in activity won't derail home price gains as existing homeowners buy up higher-value properties.

November 29 -

Here's a look at 12 cities with slower home price appreciation and more favorable mortgage rate and wage conditions, offering purchasing power advantages to consumers.

November 28 -

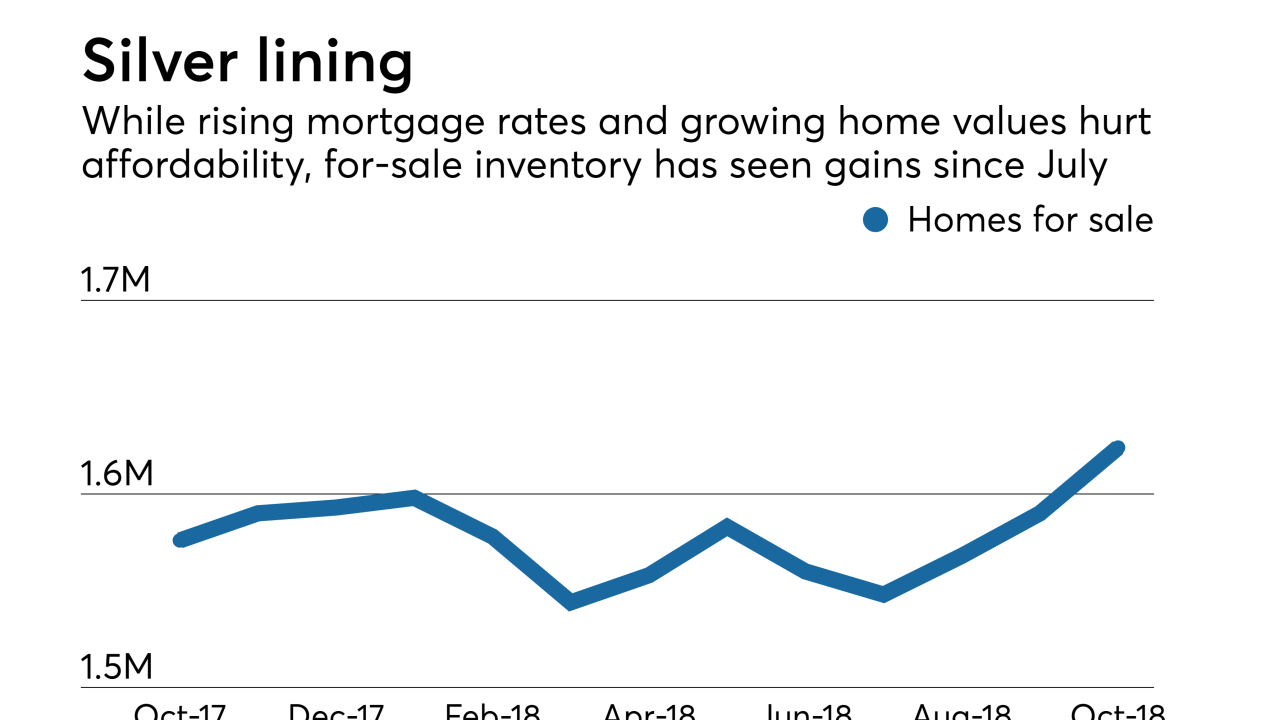

Affordability will take a hit and rent prices are expected to go higher next year behind rising mortgage rates, but they'll bring positive developments, according to Zillow.

November 28 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

Home-price gains in 20 U.S. cities grew in September at the slowest pace in almost two years, adding to signs that buyer interest is waning amid higher mortgage rates and elevated property values.

November 27