-

Prices paid for vacant land in Philadelphia have plummeted to their lowest levels in three years after peaking in 2017, an indication that the city's development boom led by townhouse, condo and apartment projects is losing steam.

October 11 -

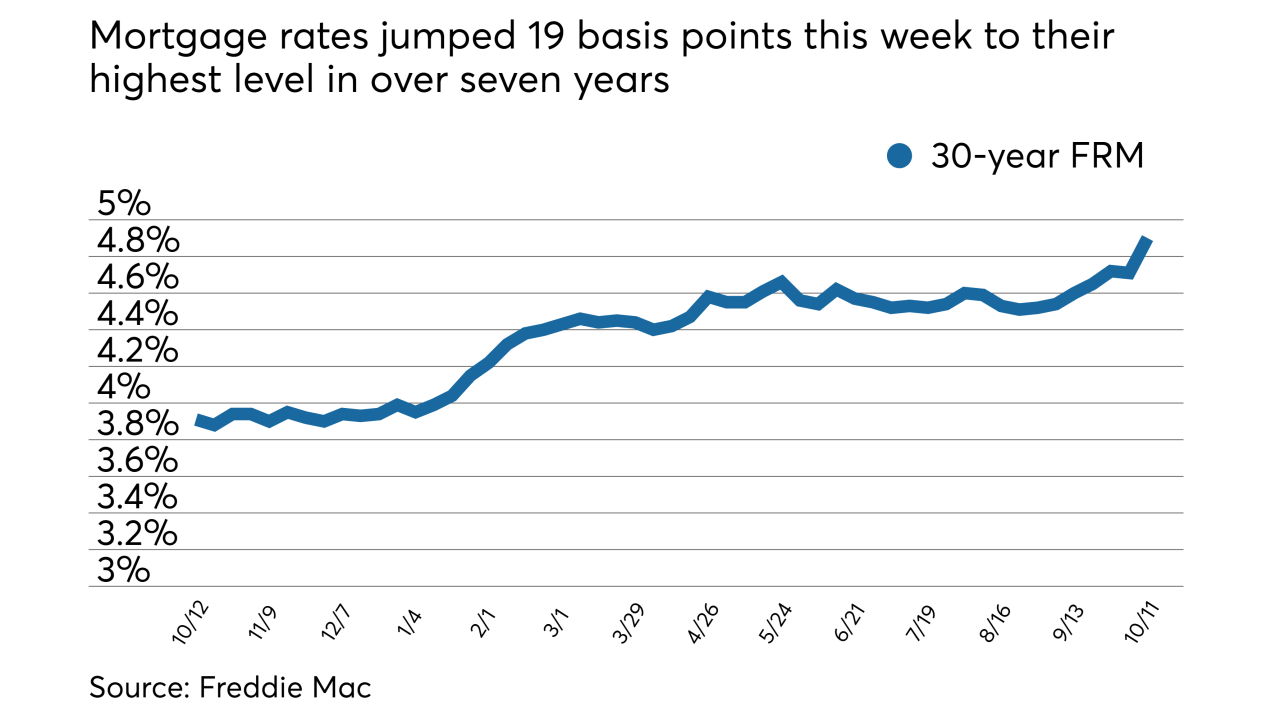

Mortgage rates, after a brief respite last week, rose to their highest level in over seven years, according to Freddie Mac.

October 11 -

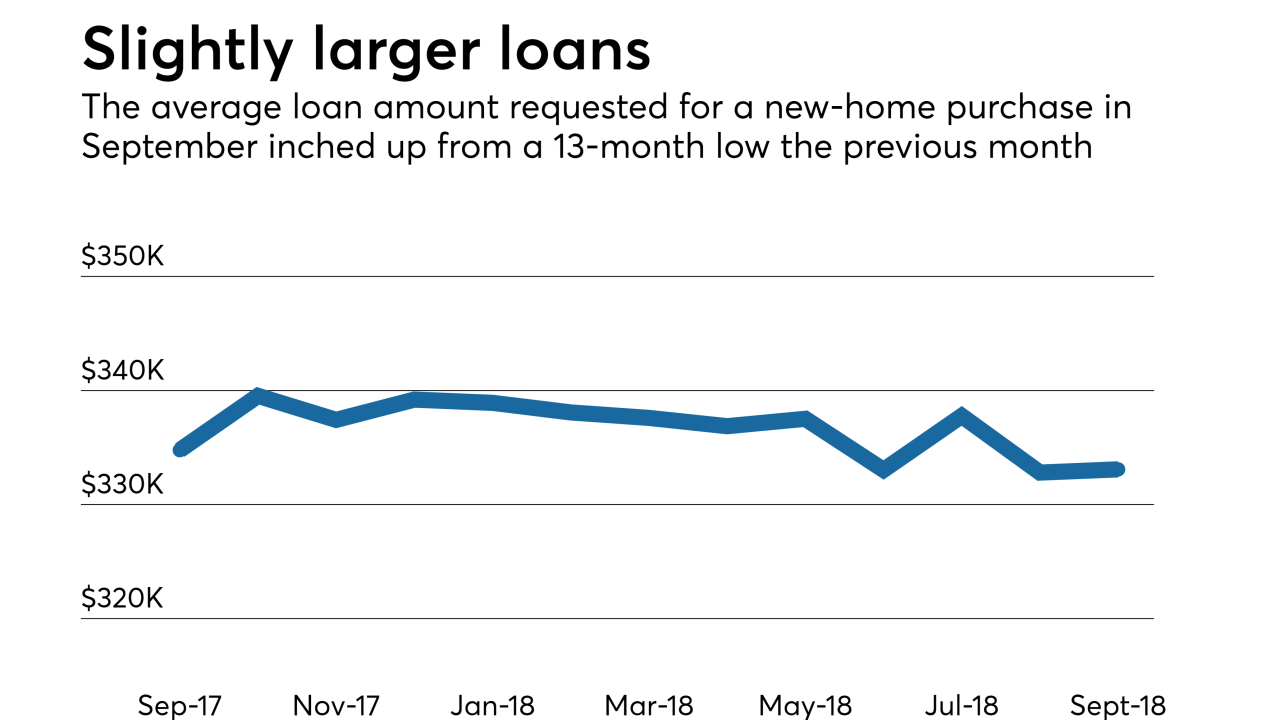

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

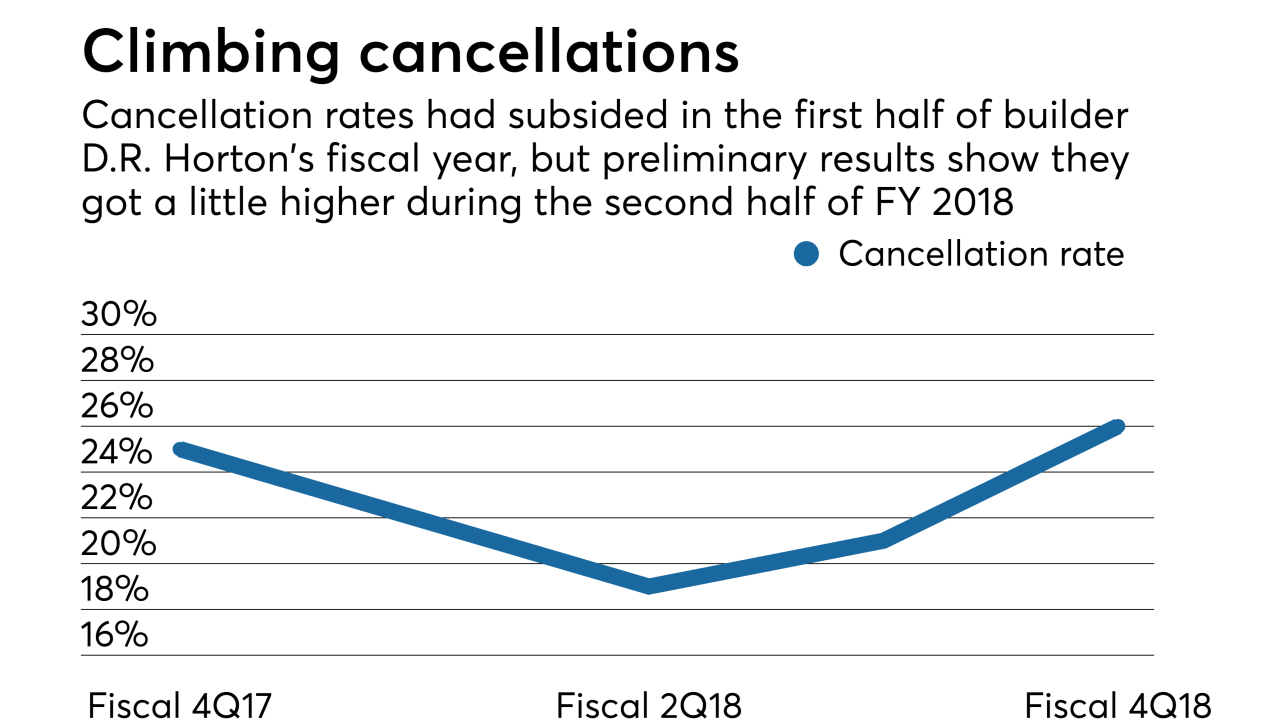

D.R. Horton is selling more homes, but its cancellation rates also are higher in the company's primary fiscal year results, a sign that rising mortgage rates may be affecting the market.

October 9 -

Rising interest rates, both current and the prospect for future increases, took a toll on consumers' outlook on the housing market during September, according to Fannie Mae.

October 9 -

Here's a look at the 12 cities with the biggest gap between the current wages needed to buy a home and the historical average, a sign a housing bubble might be brewing.

October 4 -

Mortgage rates dropped slightly for the first time after five weeks of increases, but this is only a temporary lull as the economy remains strong, Freddie Mac said.

October 4 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

It's been a rough year for Manhattan's home sellers, and they're not about to catch a break any time soon.

October 2