-

Portland-area home sales rebounded in October after a slow September, but the housing market remains sluggish compared to a year ago.

November 20 -

The share of homes for sale with a price cut hit its highest level since 2010, but homebuyers are still reacting to rising prices and interest rates, according to Redfin.

November 19 -

Sales of single-family homes rebounded in October, a sign that higher mortgage rates may be compelling Houstonians to buy before rates go even higher, the Houston Association of Realtors said.

November 19 -

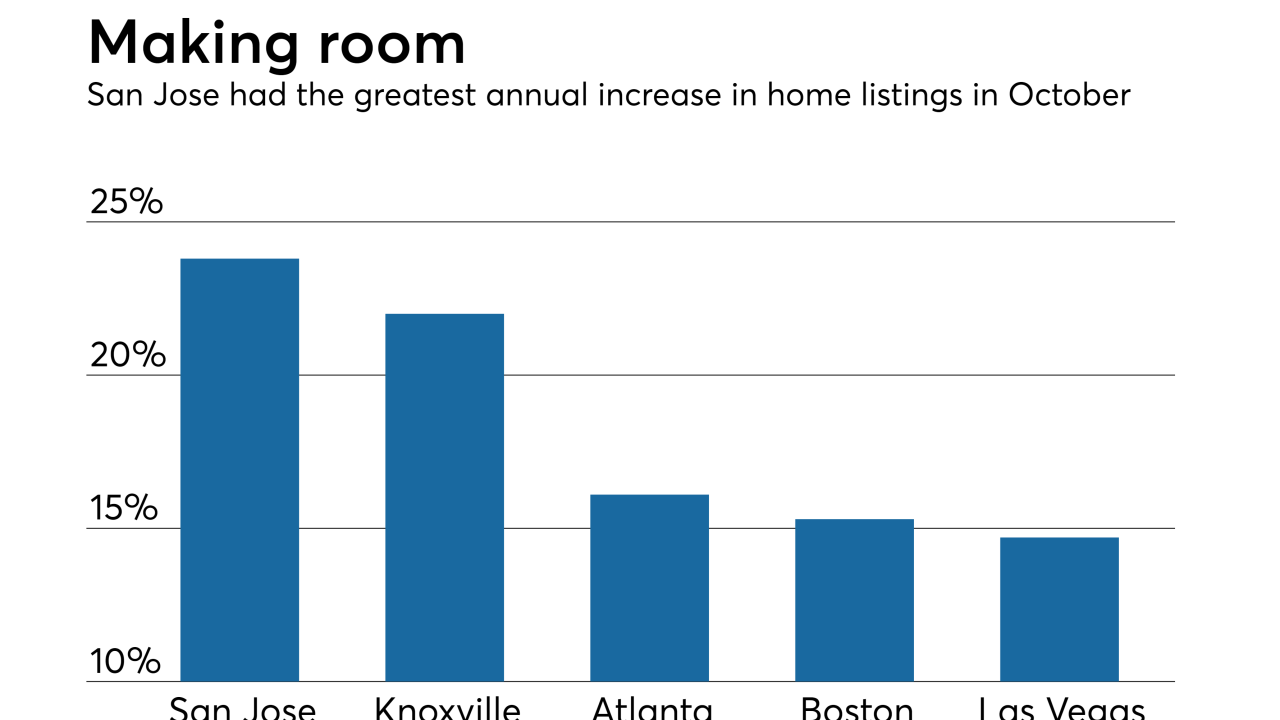

October's rise in the supply of homes for sale could signal the housing market is getting closer to equal footing for buyers and sellers, according to Remax.

November 19 -

Rising interest rates are holding back existing homeowners from listing their properties, driving the gap between existing and potential sales even as that disparity narrows, First American Financial said.

November 19 -

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Confidence among homebuilders plummeted by the most since 2014 as the highest borrowing costs in eight years restrain demand, adding to signs of a cooling housing market that will weigh on the Federal Reserve's debate over how far to raise interest rates.

November 19 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

Cleveland-area home sales perked up in October after their September slowdown, posting a modest gain even as interest rates edged higher.

November 15 -

As interest rates rise, mortgage originators need to teach millennial homebuyers about the product options outside of conventional loans, Ellie Mae said.

November 14 -

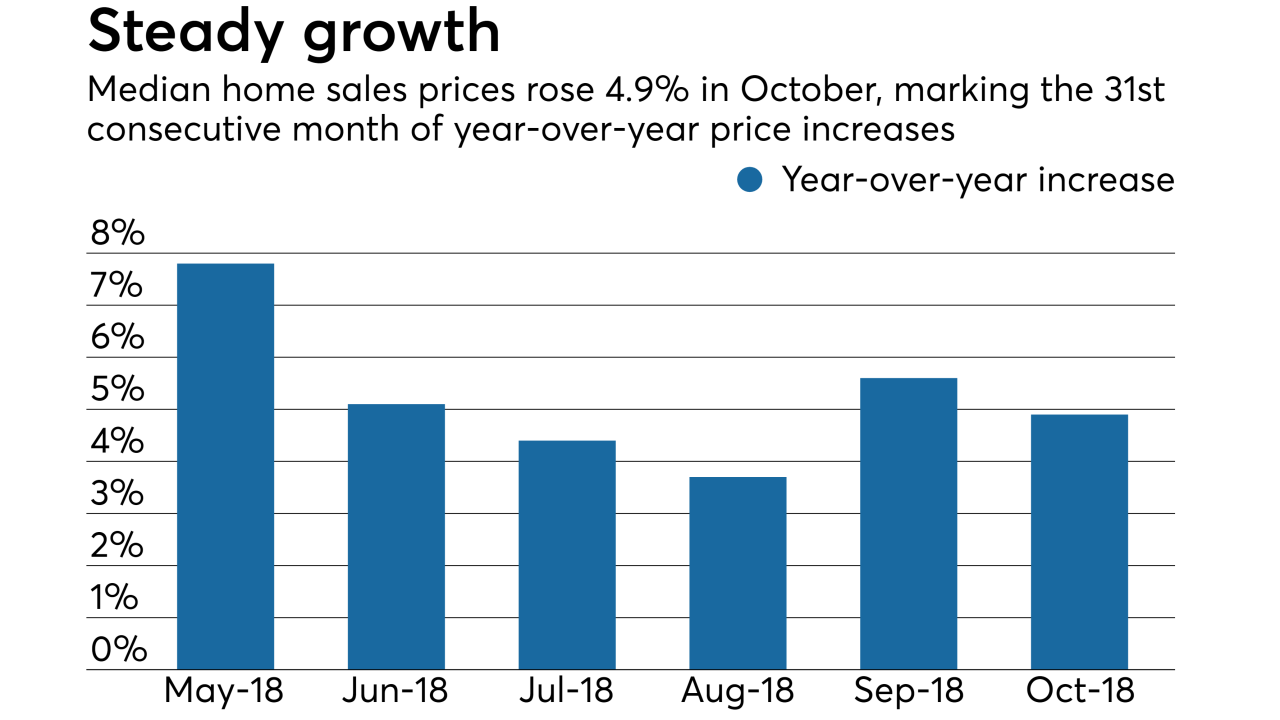

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

Beazer Homes USA is working to encourage competition among its approved lenders in order to help control upward pressure on home prices and lending rates that could slow sales.

November 13 -

After more than doubling local home starts in the last decade, don't expect Dallas-Fort Worth builders to increase construction by much in 2019.

November 13 -

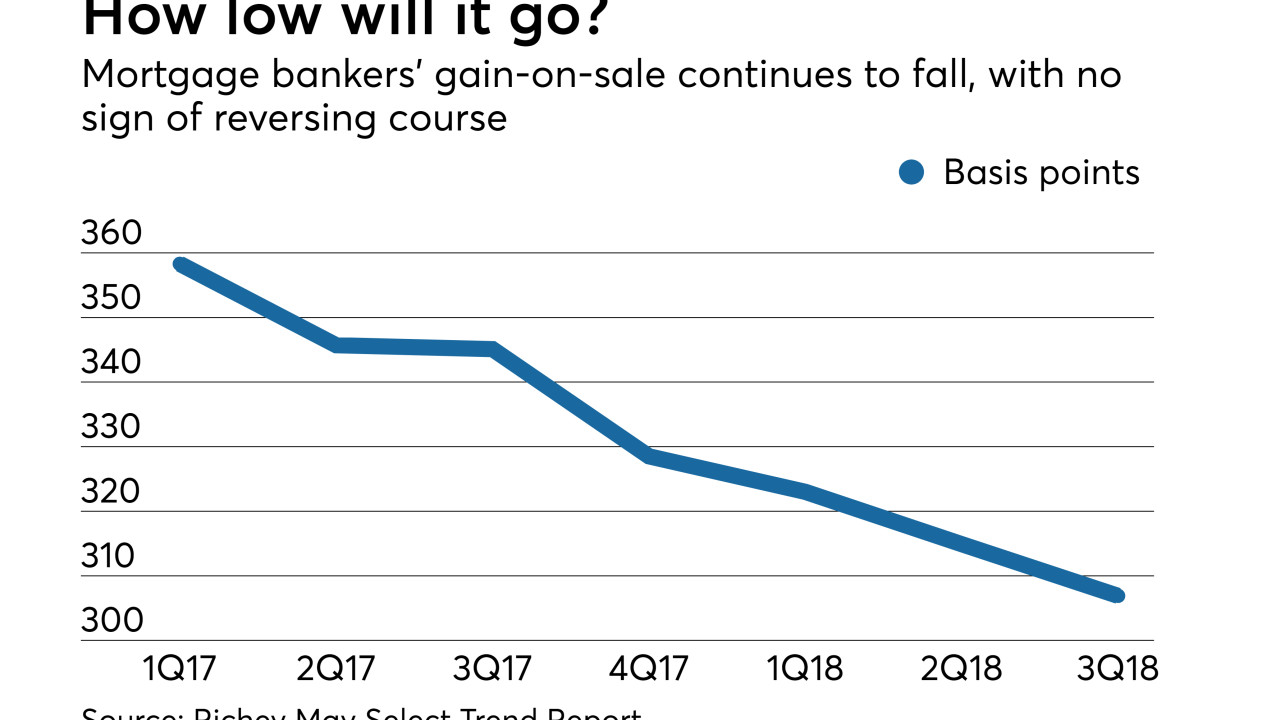

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9 -

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9 -

The number of homes sitting unsold in King County has doubled in the past year as buyers continue to retreat from the once-hot market — pushing prices in the city of Seattle down even further.

November 9 -

D.R. Horton Inc. fell the most in more than three years after executives at the builder said the market for homes is getting "choppy" and that the pace of order growth may slow next quarter.

November 8