-

There is an opportunity for home sales to break out of the doldrums if price appreciation slows, mortgage rates remain flat and supply increases, Freddie Mac said.

July 23 -

Mortgage rates took a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

July 19 -

As purchase mortgages continue to dominate overall industry volume, lenders aren't letting the extra work required to close these loans affect their productivity.

July 18 -

Mortgage banking revenue stemming from a year-to-year increase in rates weighed down noninterest income at U.S. Bancorp, but increased interest income from higher rates helped improve earnings overall.

July 18 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

New-home groundbreaking and permits fell in June to the slowest pace in nine months, as higher mortgage rates and elevated costs for labor and materials pinch the housing market.

July 18 -

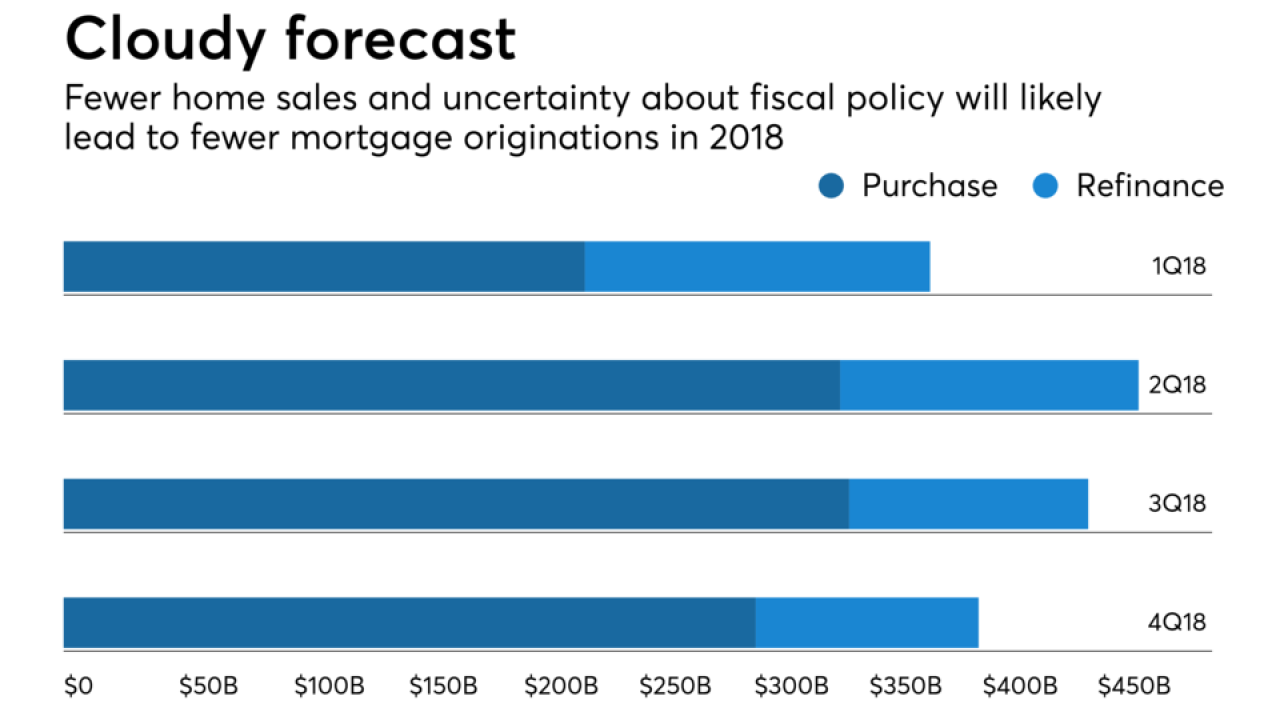

Fewer sales of existing homes and uncertainty around future fiscal policies will result in fewer mortgage originations than previously expected, according to Fannie Mae.

July 17 -

Confidence among homebuilders held steady in July, matching the lowest level of the year, as solid job gains support demand while elevated material costs pressure developers.

July 17 -

Mortgage rates broke from their recent respite, increasing for only the second time in the past seven weeks, according to Freddie Mac.

July 12 -

Greater consumer access to credit could help mortgage bankers replenish originations eroded by higher rates, but they are reluctant to depart from the status quo to provide it.

July 11