-

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5 -

Mortgage rates maintained their recent slide and have now declined in five of the past six weeks, according to Freddie Mac.

July 5 -

Housing demand is high, but few homeowners are interested in selling and the resulting inventory shortage continues to drive home prices higher.

July 3 -

Purchasing power took a plunge in some of the nation's hottest housing markets, as a competitive spring purchasing season continues to drive home prices higher.

July 3 -

Dallas-area home prices are up 7.8% from a year ago in the latest national comparison by CoreLogic.

July 3 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

From lowering expectations about their ideal home to moving faster to close a deal, here's a look at five ways house hunters say they would react to average mortgage rates reaching 5%.

June 29 -

Mortgage rates declined over the past week as worried investors increased their purchases of 10-year Treasuries, according to Freddie Mac.

June 28 -

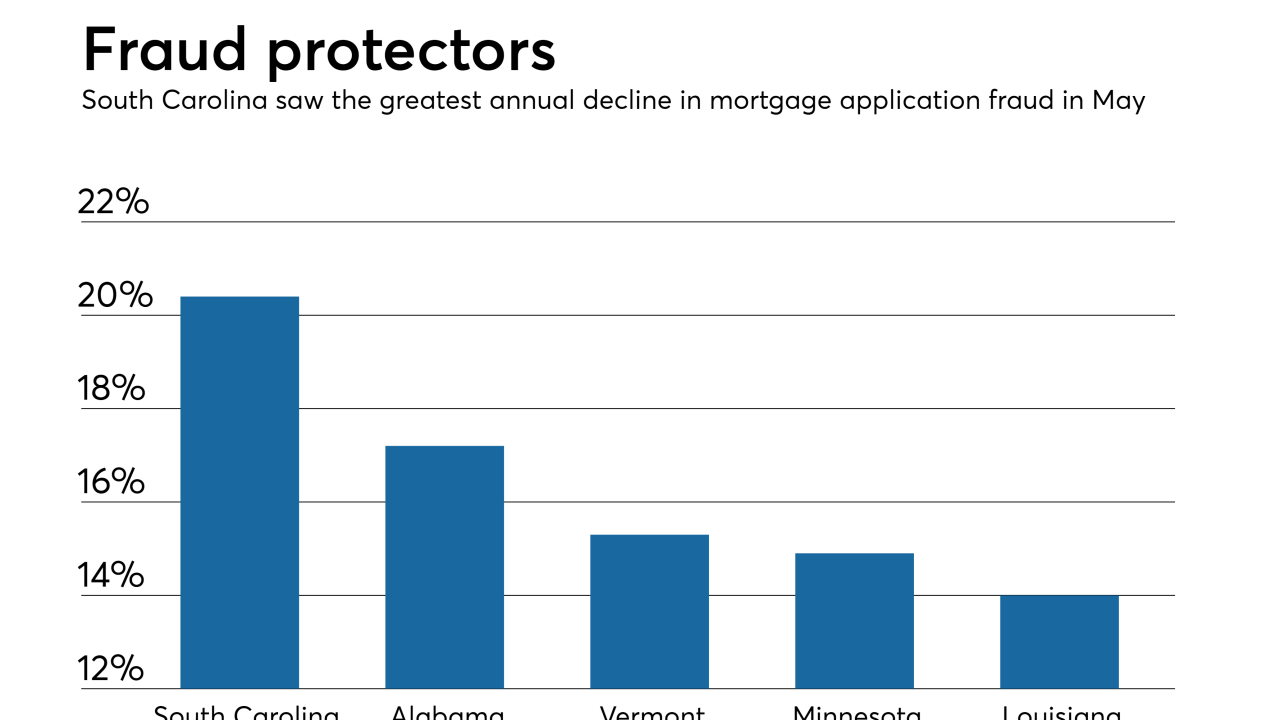

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

An index of contract signings to purchase previously owned homes unexpectedly declined for a second month in May, reflecting a persistent shortage of available homes.

June 27 -

Mortgage applications fell by nearly 5% last week as concerns over foreign trade and tariffs outweighed other positive economic news, according to the Mortgage Bankers Association.

June 27 -

Home sales dipped in Ohio and across the nation last month, as prices climbed, mortgage rates inched up and would-be buyers were stymied by a persistent shortage of available properties.

June 26 -

Purchases of new homes advanced in May to a six-month high as sales in the South increased to the fastest pace since 2007, according to government data.

June 25 -

Since the bottom of the housing market in 2012, home prices have increased 75% but wages have only increased 13%.

June 25 -

With affordability down to its lowest level in nearly 10 years, average wages aren't enough to afford a home in 75% of local housing markets, according to Attom Data Solutions.

June 21 -

Mortgage rates slid over the past week and have now declined in three of the past four weeks, according to Freddie Mac.

June 21 -

Sales of previously owned homes unexpectedly fell in May for a second month as a lack of inventory and elevated asking prices weighed on demand, National Association of Realtors data showed.

June 20 -

Mortgage application activity increased 5.1%, rising for the second time in the past three weeks, according to the Mortgage Bankers Association.

June 20 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

Despite the long, stratospheric rise of home prices in the U.S., the inflation-adjusted monthly payment on the median single-family home in 2017 was less than in 1987, when home prices were lower but interest rates were higher.

June 19