-

Mortgage rates posted a slight increase this week following the Federal Open Markets Committee's decision to boost short-term rates by 25 basis points, according to Freddie Mac.

March 22 -

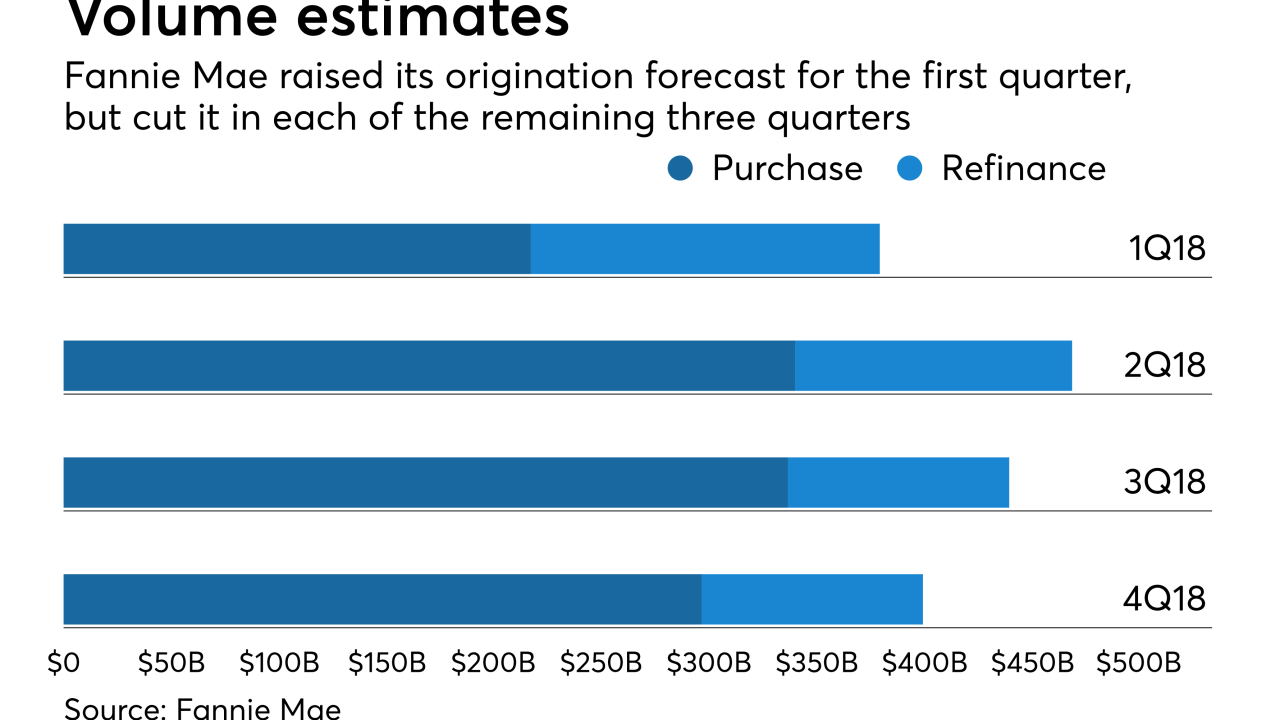

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Only a small percentage of borrowers are deterred by the higher rates seen this year, even with the additional cost making it tough for first-time buyers to find affordable properties.

March 16 -

Residential mortgage originations fell 19% year-over-year in the fourth quarter of 2017, due primarily to a large drop in refinance volume, according to Attom Data Solutions.

March 16 -

Houston-area homebuyers face a tightening supply of homes just as the busy Spring home-buying season is about to hit.

March 16 -

After increasing for nine consecutive weeks, mortgage rates dropped for the first time in 2018, according to Freddie Mac's Primary Mortgage Market Survey.

March 15 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

There's too much momentum and too little debt for rising interest rates to derail the U.S. economic expansion or drive up the cost of home ownership.

March 14 -

Thanks to low mortgage rates, homes in most metros are actually more affordable today than they were in 1990.

March 12 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12