-

The 2018 spring home buying season could be even more competitive than last year's, marked by fewer listings, quicker sales, and a higher percentage of homes selling above the asking price in January.

February 15 -

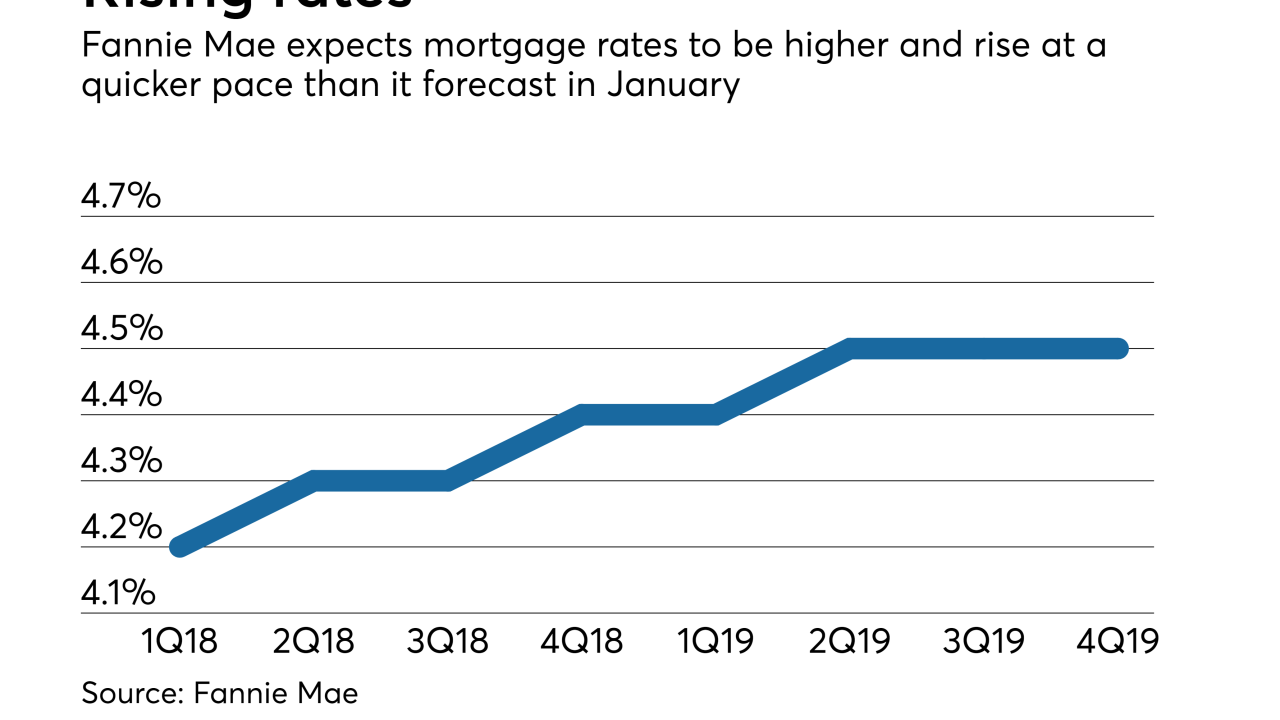

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

Homebuyers are most likely to slow their purchases or stay on course if mortgage rates rise above a certain benchmark, but some could act more quickly or drop out.

February 12 -

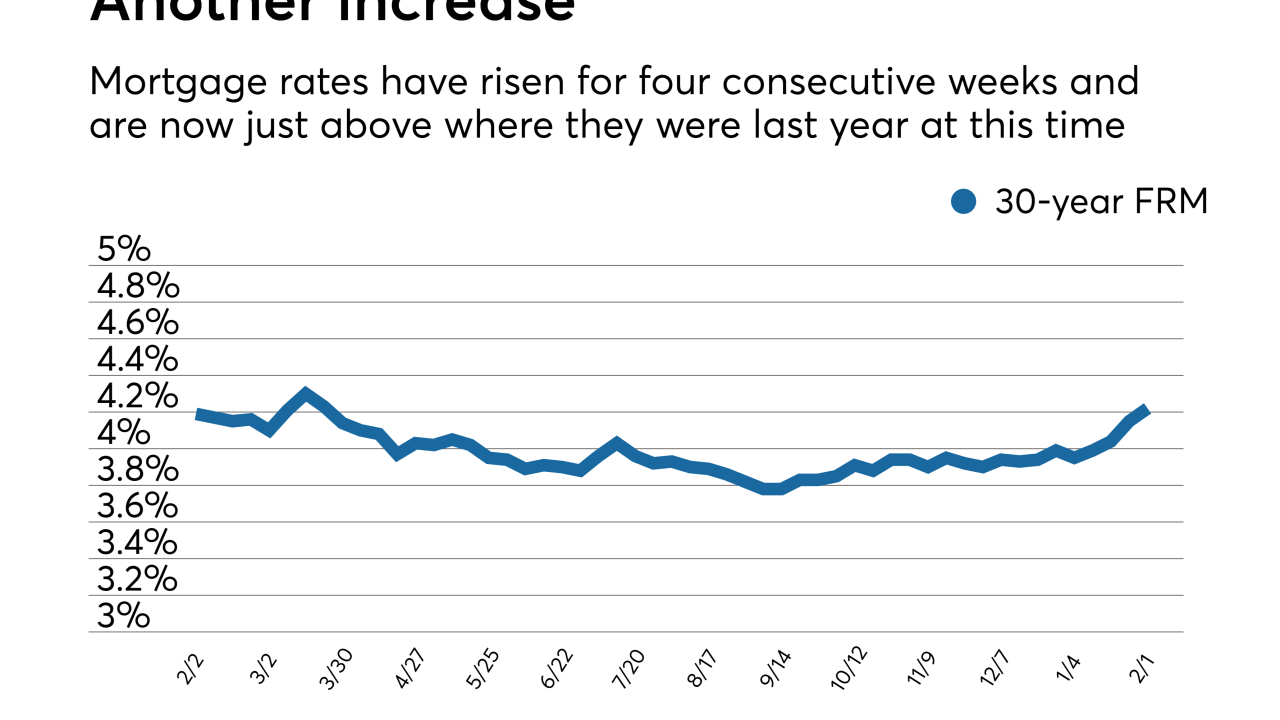

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Shares of homebuilders are now in their 10th straight day of decline, the longest losing streak for the sector since 2002, when it lasted 11 days.

February 5 -

The pace of Colorado Springs-area homebuilding soared in January, picking up where a strong 2017 left off.

February 5 -

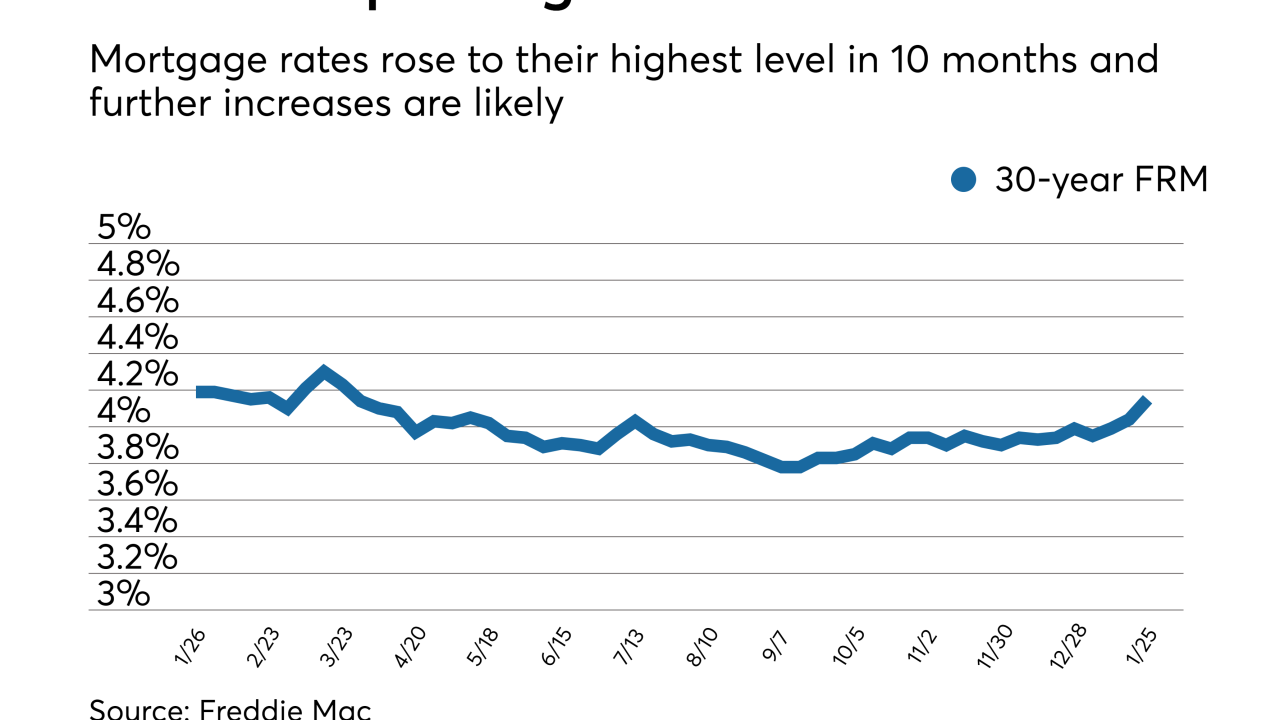

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1 -

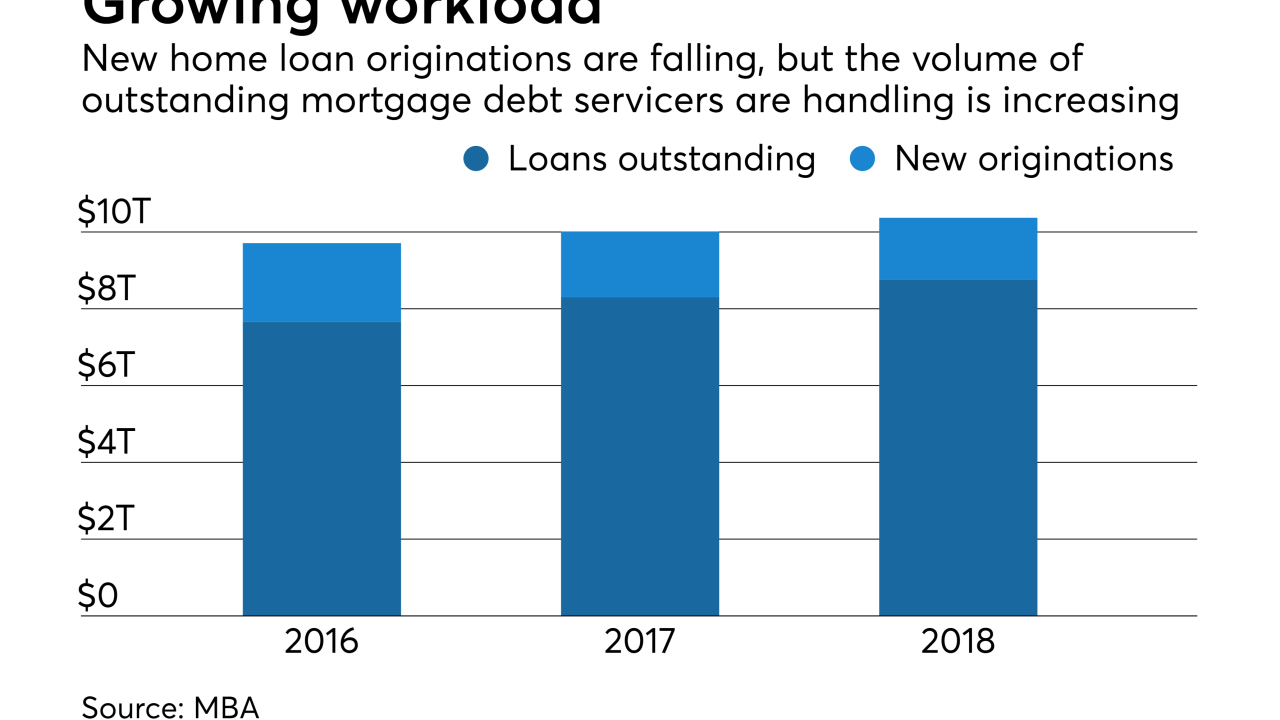

Rising mortgage rates have taken a toll on refinance lending and extended the lifecycle of existing loans. With new purchase originations also making portfolios larger, servicers must take steps to avoid capacity constraints.

January 31 -

Warehouse lines of credit are getting more expensive as short-term interest rates rise, and lenders have limited options for reducing their costs.

January 29 -

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24 -

Sales of previously owned homes fell in December for the first time in four months, as the market struggles with record-low supply and rising prices.

January 24 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

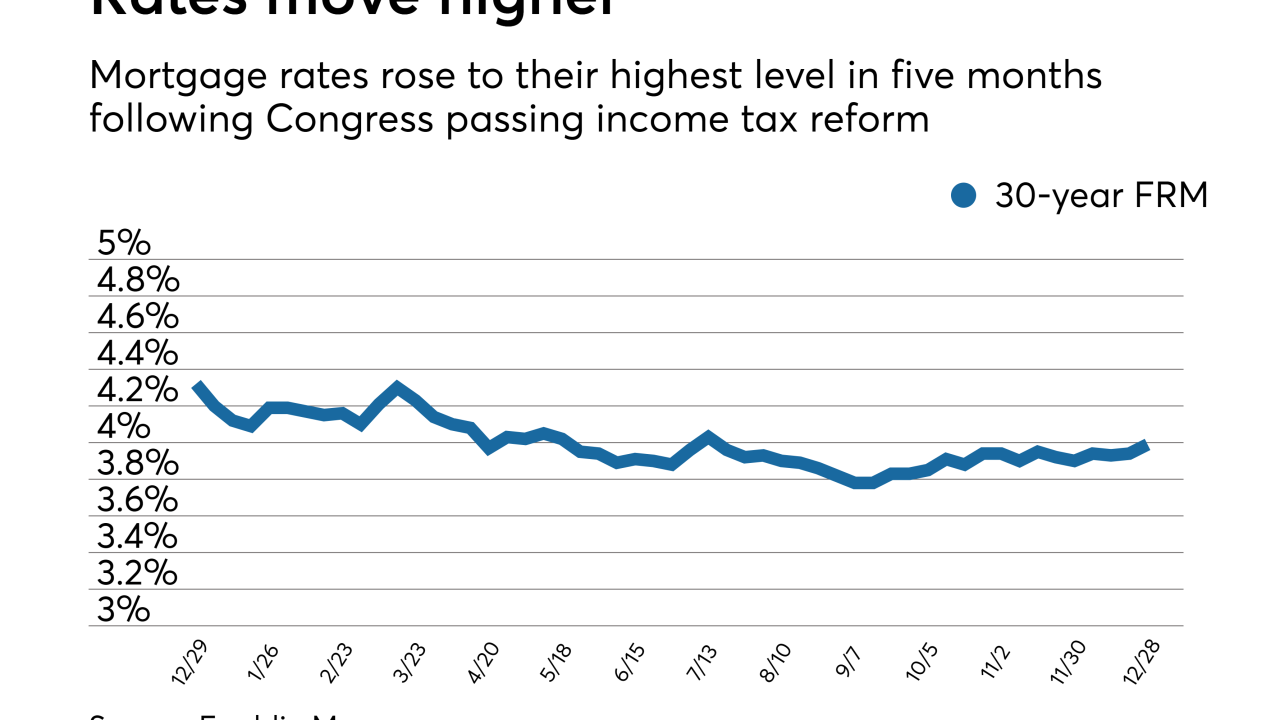

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

The tax reform bill Congress sent to President Trump's desk this week is likely to prompt at least a short-term spike in mortgage rates.

December 21