-

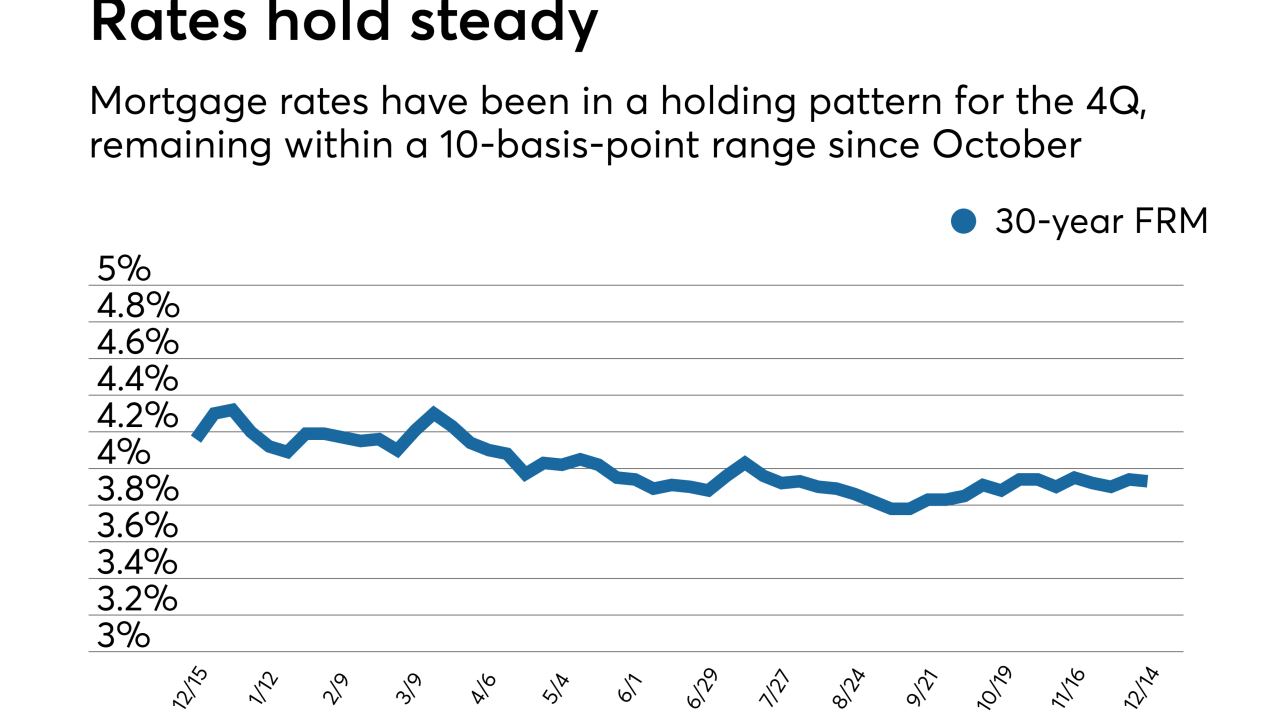

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Consumer house-buying power, measuring how much one can purchase based on changes in income and interest rates, fell 2.1% year-over-year, but increased by 1.3% from the month prior, according to First American Financial Corp.

November 28 -

Federal Reserve officials meeting earlier this month saw an interest-rate increase in the near term even as divisions persisted over the policy path forward amid tepid inflation.

November 22 -

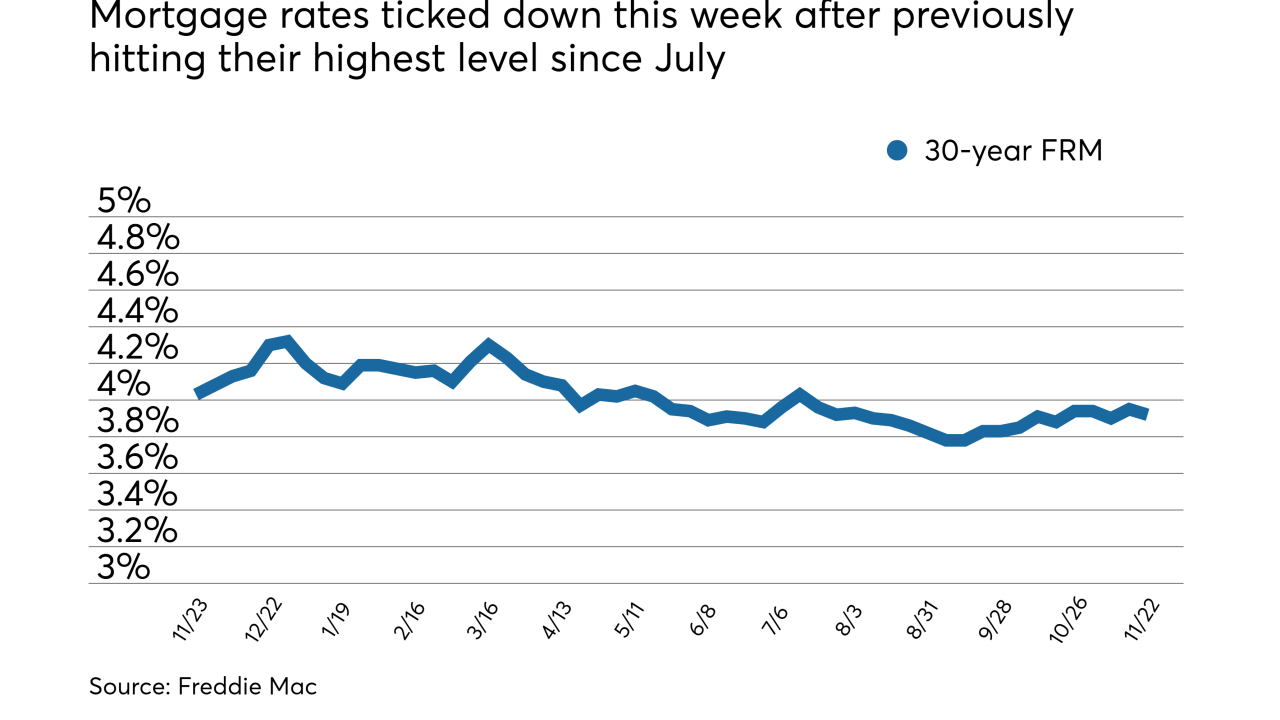

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9 -

Home prices are up strongly both year-over-year and month-over-month, and nearly half of the nation's largest 50 markets are overvalued, according to CoreLogic.

November 8 -

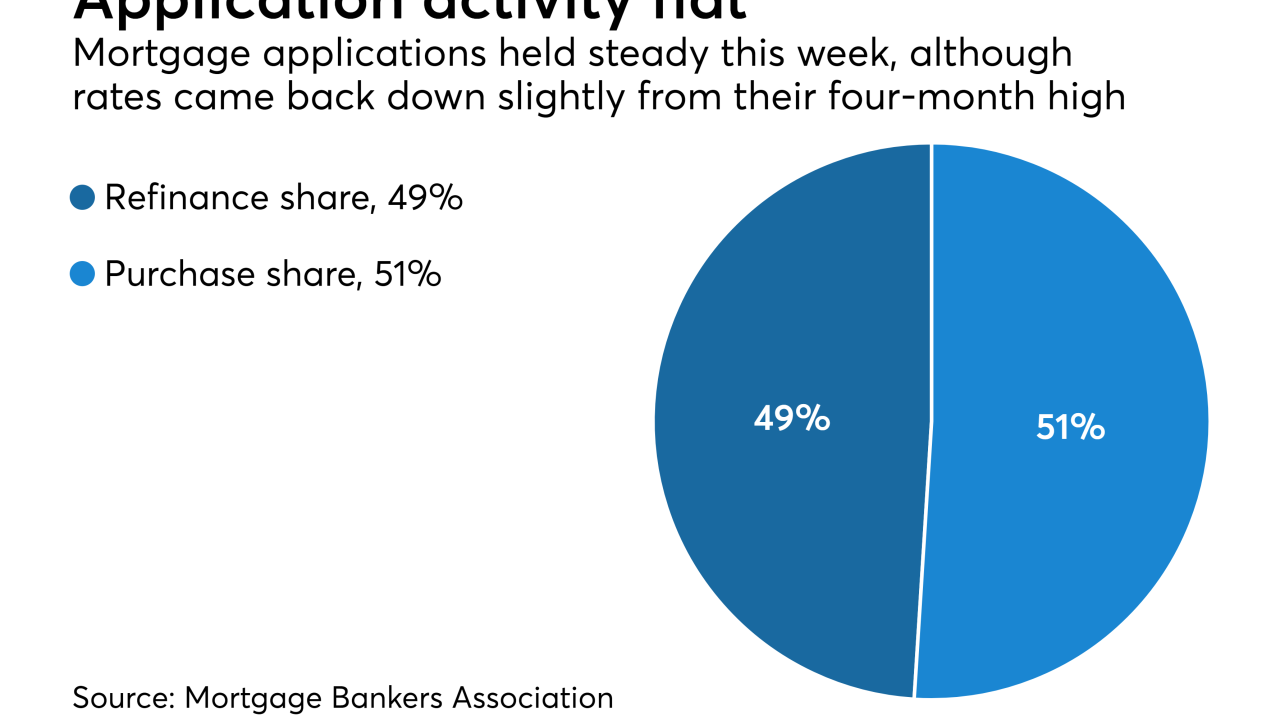

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8 -

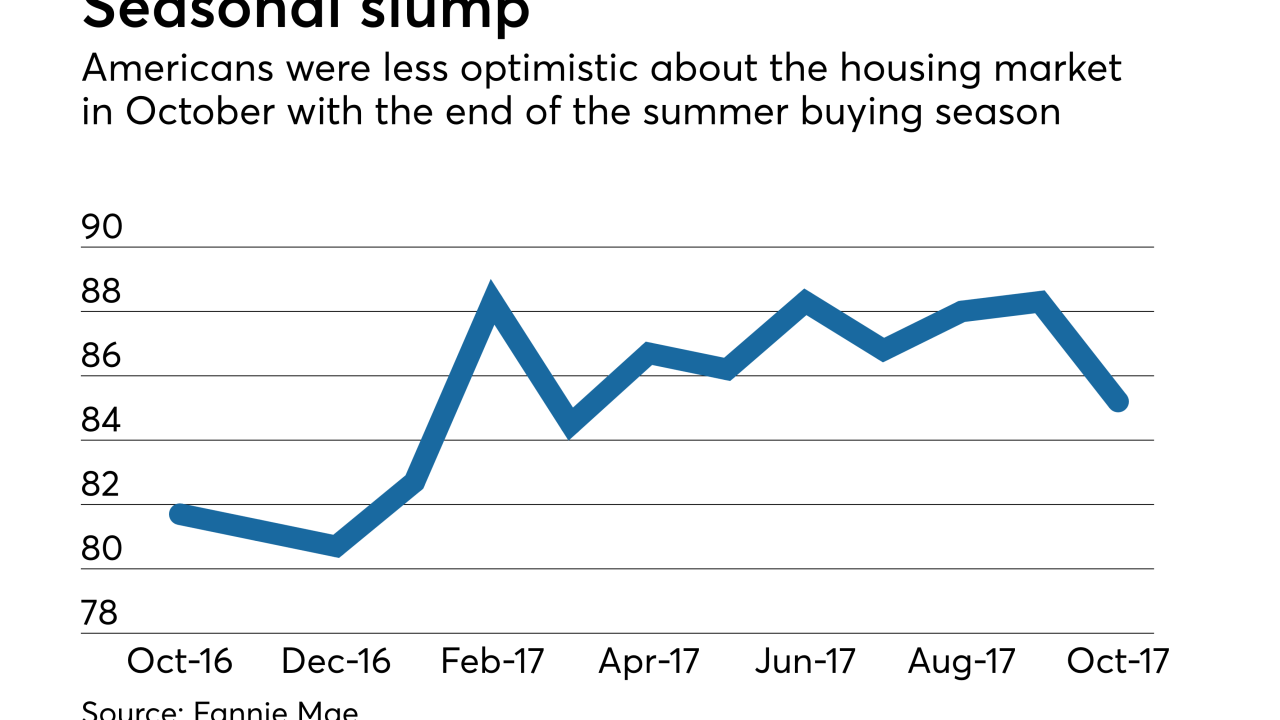

With the end of the summer home buying season, consumers were less optimistic that it was a good time to purchase or sell a home in October.

November 7 -

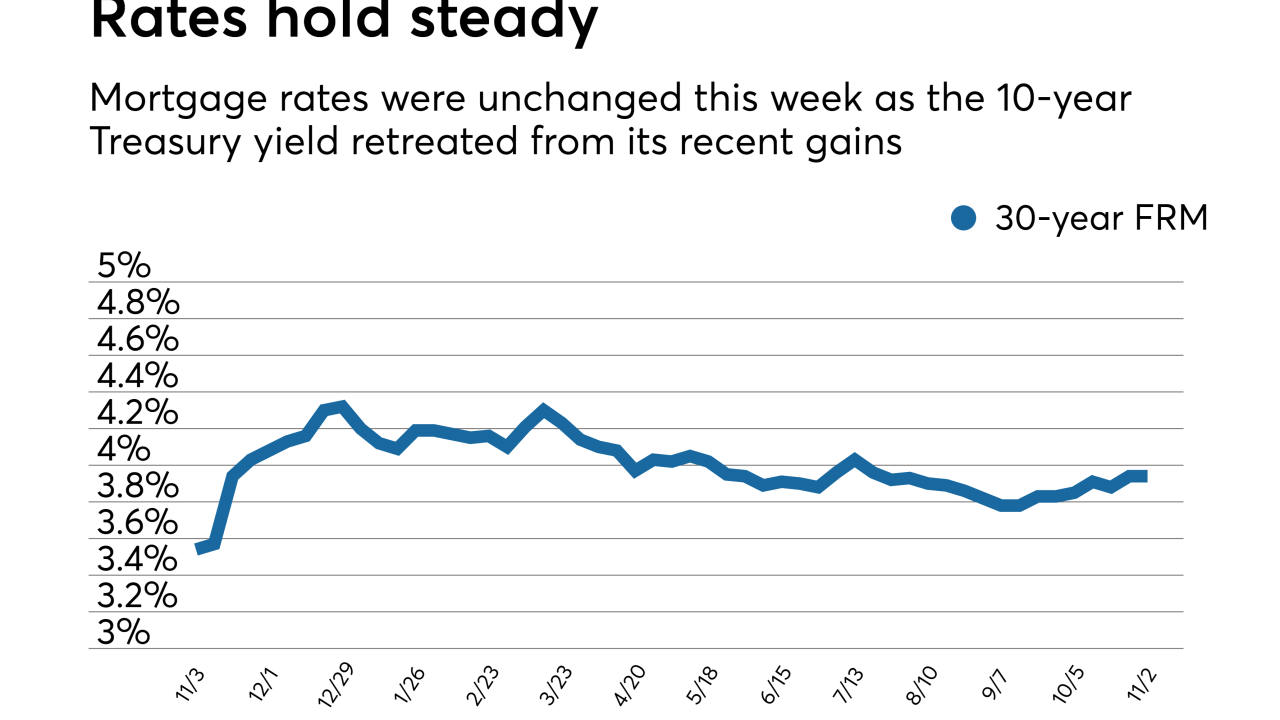

Mortgage rates were unchanged or up slightly this week even as the 10-year Treasury yield retreated from its recent gains, according to Freddie Mac.

November 2 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Mortgage rates ticked down for the first time in two weeks as the 10-year Treasury yield fell to its lowest point in October, according to Freddie Mac.

October 19 -

The percentage of refinance loans rose in September as interest rates dipped to a 2017 low, according to Ellie Mae.

October 18 -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12