-

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

Overall housing confidence rose in September, with renters becoming particularly optimistic, according to Fannie Mae.

October 10 -

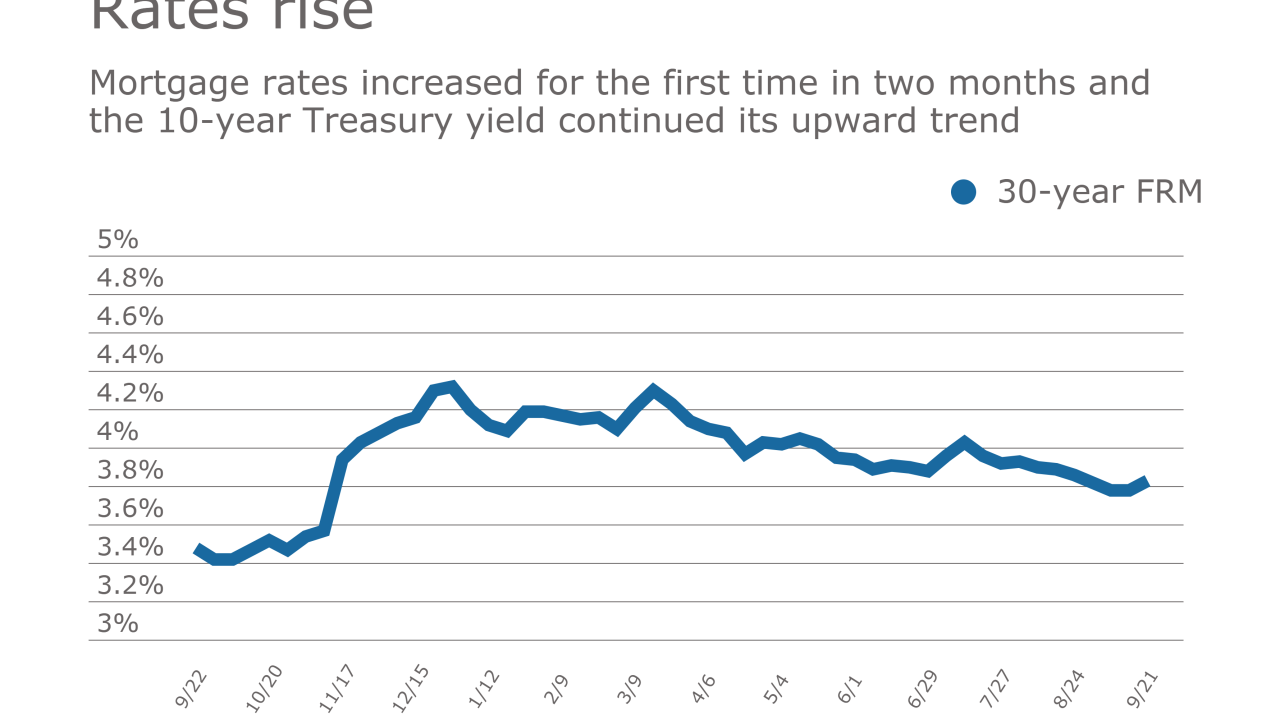

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

October 5 -

In housing markets dominated by young borrowers, millennials took an even bigger share of overall mortgage activity in August.

October 4 -

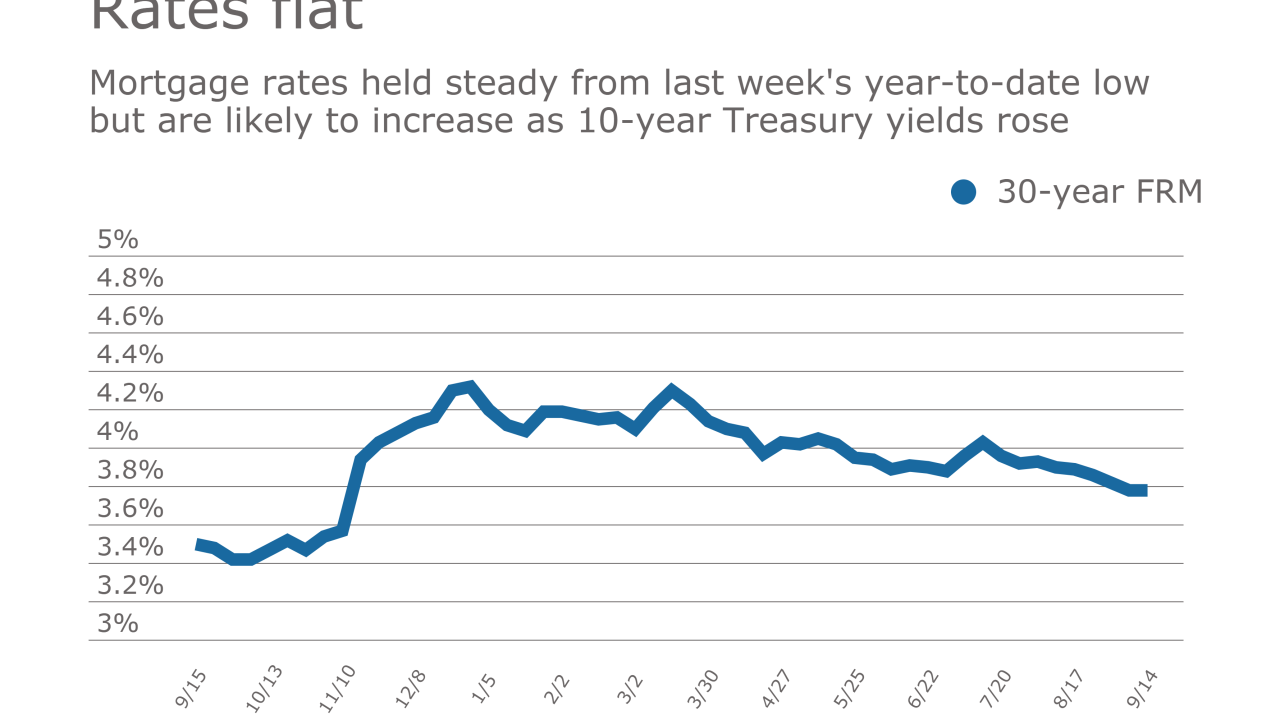

Mortgage rates remained unchanged from last week even through the 10-year Treasury yield first moved lower then spiked up during the period, according to Freddie Mac.

September 28 -

Mortgage application activity decreased 0.5% from one week earlier as a decline in refinance volume was only partially offset by an increase in purchases.

September 27 -

The percentage of newly originated loans that are used to refinance an existing mortgage could shrink dramatically in 2018 as rates rise and burnout continues.

September 22 -

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

Mortgage application activity decreased from one week earlier due to normal seasonal trends, according to the Mortgage Bankers Association.

September 20 -

Along with the temperature, the housing market in the Twin Cities is beginning to cool.t

September 19 -

Sentiment among America’s homebuilders fell more than forecast in September as companies grew concerned about the cost of construction materials and labor shortages in the wake of Hurricanes Harvey and Irma.

September 18 -

Mortgage rates remained unchanged from last week's year-to-date low but going forward they are likely to increase as 10-year Treasury yields rose.

September 14 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

As mortgage rates dropped to new lows for the year, loan application volume increased from one week earlier, according to the Mortgage Bankers Association.

September 13 -

From debunking down payment myths to making sense of interest rates, here's a look at five essential lessons lenders can teach to millennials preparing for homeownership.

September 12 -

Consumer confidence in the housing market is growing overall, but the gap between those that say it's a good time to buy versus selling a home is widening, according to Fannie Mae.

September 11 -

Mortgage rates dropped to a year-to-date low for the third consecutive week as the 10-year Treasury yield also declined, according to Freddie Mac.

September 7 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

Mortgage rates fell to a new low for the year this week, but are 38 basis points higher than they were one year ago, according to Freddie Mac.

August 31 -

Wells Fargo forced borrowers to pay millions of dollars in fees to extend interest rate locks that expired due to the bank's delays in processing mortgage applications, a lawsuit claims.

August 29