-

Mortgage rates dropped to their lowest point in six weeks as bond investors were concerned about inflation and the U.S. economy, according to Freddie Mac.

August 10 -

Mortgage application volume increased 3% from one week earlier as slightly lower interest rates resulted in more refinance activity, according to the Mortgage Bankers Association.

August 9 -

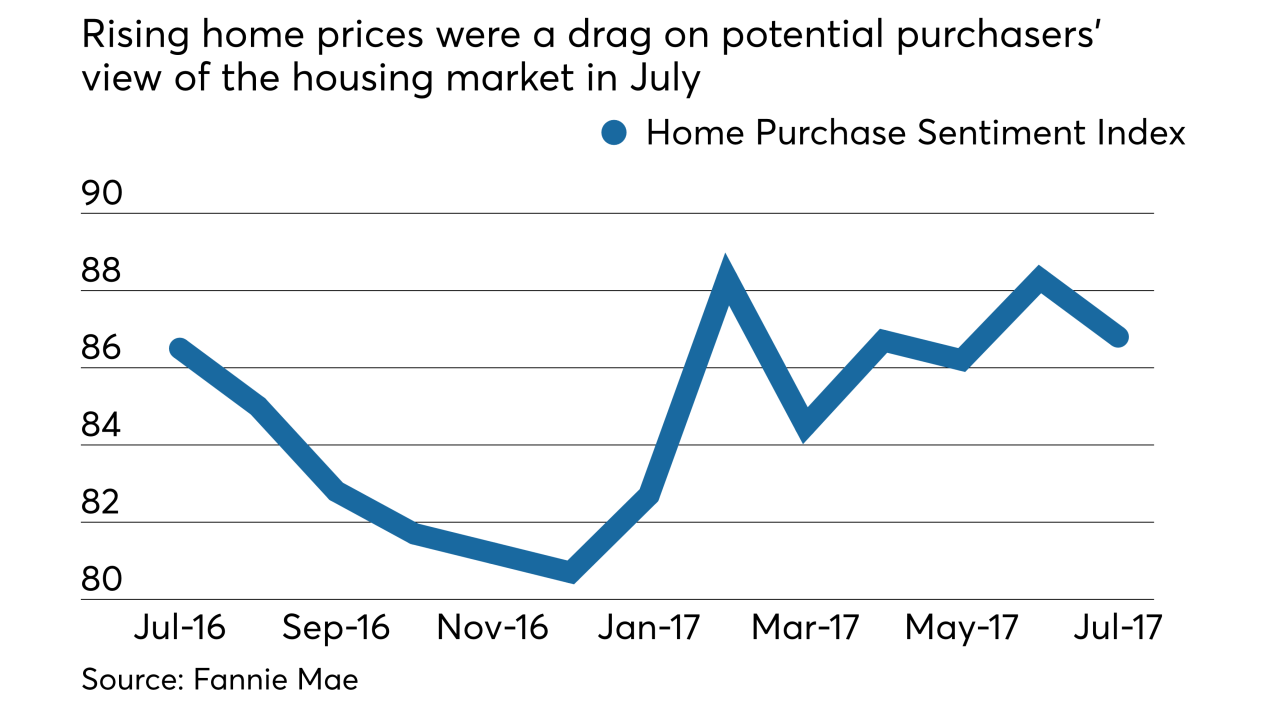

The percentage of people who said July was a bad time to buy a home increased to a survey high because of rising prices, according to Fannie Mae.

August 7 -

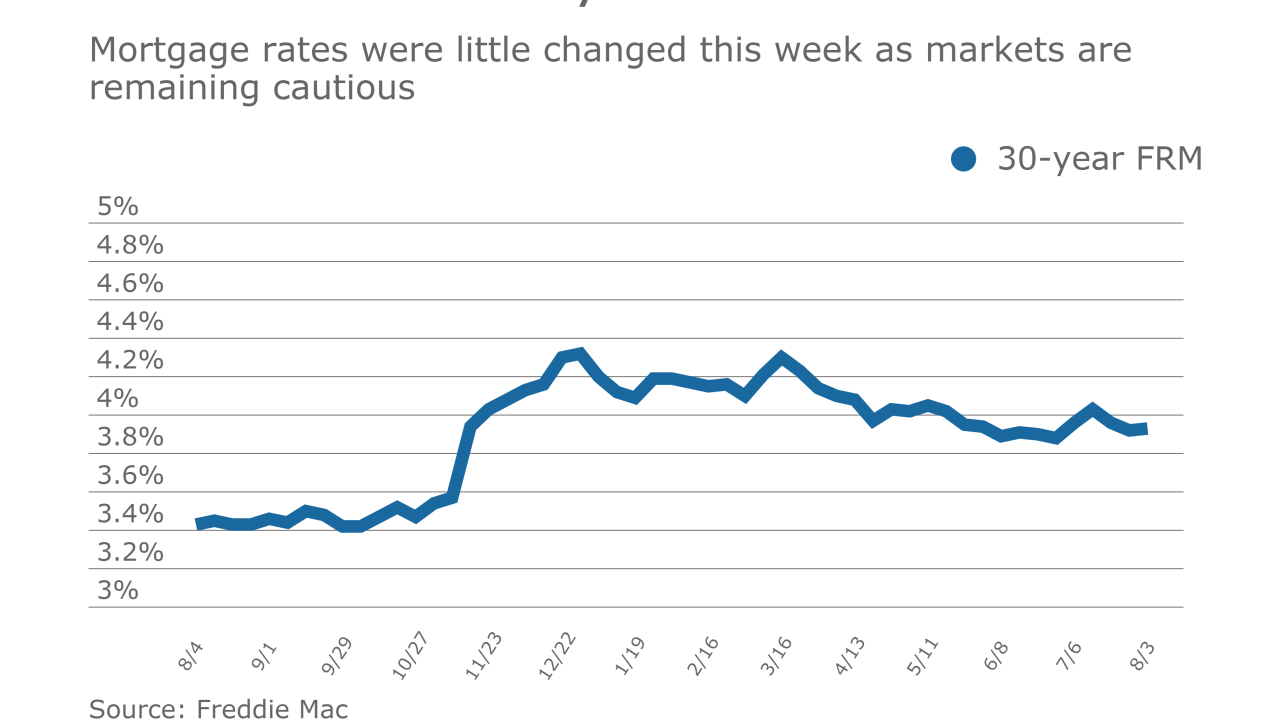

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Mortgage application activity decreased 2.8% from one week earlier as interest rates were flat or moved slightly higher, according to the Mortgage Bankers Association.

August 2 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27 -

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

Loan application volume increased 0.4% from one week earlier, according to the Mortgage Bankers Association, as rates fell to their lowest level in three weeks.

July 26 -

The housing market is stabilizing near 10-year highs, according to government data Wednesday that showed sales of new homes were slightly less than forecast.

July 26 -

Mortgage rates moved back below 4%, pushed by last week's weak economic data report, according to Freddie Mac.

July 20 -

Mortgage loan application volume increased 6.3% last week as interest rates remained flat after a sharp gain during the previous 14-day period, according to the Mortgage Bankers Association.

July 19 -

Mortgage rates rose across the board for the second consecutive week, with the 30-year fixed-rate loan moving over 4%, according to Freddie Mac.

July 13 -

Rising mortgage rates hurt both refinance and purchase application activity as volume decreased 7.4% from one week earlier, according to the Mortgage Bankers Association.

July 12 -

Broker John Pasalis knew Canada’s hottest housing market was cooling but an email from desperate sellers showed him just how bad it was.

July 11 -

As expected, mortgage rates had their largest week-over-week increase since March as yields on the 10-year Treasury moved sharply higher, according to Freddie Mac.

July 6 -

Mortgage rates this week reached their lowest level so far in 2017, but are highly likely to increase over the next few days, according to Freddie Mac.

June 29 -

Homebuyers went on a shopping spree in Miami-Dade in May — and snapped up enough houses to set a new record.

June 22 -

Mortgage rates remained at their 2017 lows as ongoing economic uncertainty is affecting loan pricing, according to Freddie Mac.

June 22 -

The purchase mortgage share increased 15 percentage points in the first five months of 2017 to 68% of all closed loans in May, according to Ellie Mae.

June 21