-

Average mortgage rates fell by their largest amount in more than 10 years last week as bond yields fell in reaction to the March 20 Federal Open Market Committee meeting.

March 28 -

If mortgage rates fall below 4%, it could more than double the dollar volume of agency mortgages exposed to refinancing incentive, analysts at Keefe, Bruyette & Woods found.

March 25 -

The Federal Reserve decision to shift into Treasuries could pull rates down and increase the prepayment speeds on mortgage-backed securities.

March 22 -

The 30-year mortgage rate dipped lower than it was 12 months ago for the third week running, according to Freddie Mac's latest report.

March 21 -

The Federal Reserve will roll its maturing holdings of mortgage-backed securities into Treasuries starting after September, capping it at $20 billion per month.

March 20 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20 -

Mortgage rates declined across the board this week, which should make home buying more attractive although there are continuing concerns about inventory, according to Freddie Mac.

March 14 -

The increase in average mortgage rates this week should not affect the spring home purchase market because other factors remain strong, according to Freddie Mac.

March 7 -

Freddie Mac again increased its origination forecast for the next two years, as the rate drops of the past few months are expected to boost refinance volume.

March 1 -

With few headlines to drive up or down movement in the bond markets, mortgage rates held steady after declining for three consecutive weeks, according to Freddie Mac.

February 28 -

As expected economic growth remains at 2.2% — down from 2018's 3.1% — 2019 should only be accompanied by a solitary rate hike from the Federal Reserve, according to Fannie Mae.

February 21 -

Mortgage rates declined for the third straight week, adding to a brighter outlook for the spring home buying season, according to Freddie Mac.

February 21 -

Mortgages rates fell to their lowest levels since early 2018, but positive news involving trade and no new shutdown could send them rising again, according to Freddie Mac.

February 14 -

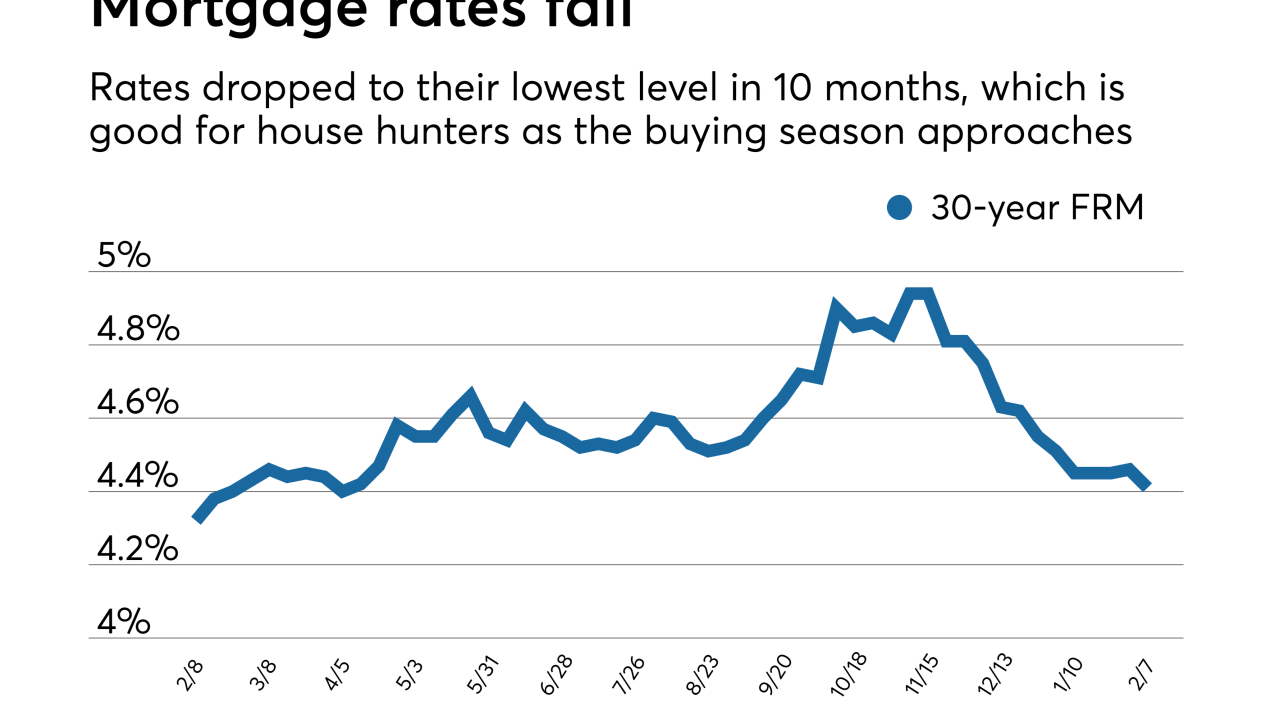

Mortgage rates fell to their lowest level in 10 months, bringing good news for house hunters as spring's home buying season approaches, according to Freddie Mac.

February 7 -

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

Average mortgage rates continued the downward spiral that started before Thanksgiving and in the past week that finally boosted mortgage application activity, according to Freddie Mac.

January 10