-

Rising mortgage interest rates not only will continue to constrain banks' once-robust revenue from this business, they will also affect existing borrower credit quality, a report from Moody's said.

October 19 -

Conforming mortgage interest rates dropped slightly over the past seven days after weeks of steady increases, according to Freddie Mac.

October 18 -

While mortgage volume is expected to shrink next year, it should increase during the following two years and beyond as millennials start buying homes, the Mortgage Bankers Association forecasts.

October 16 -

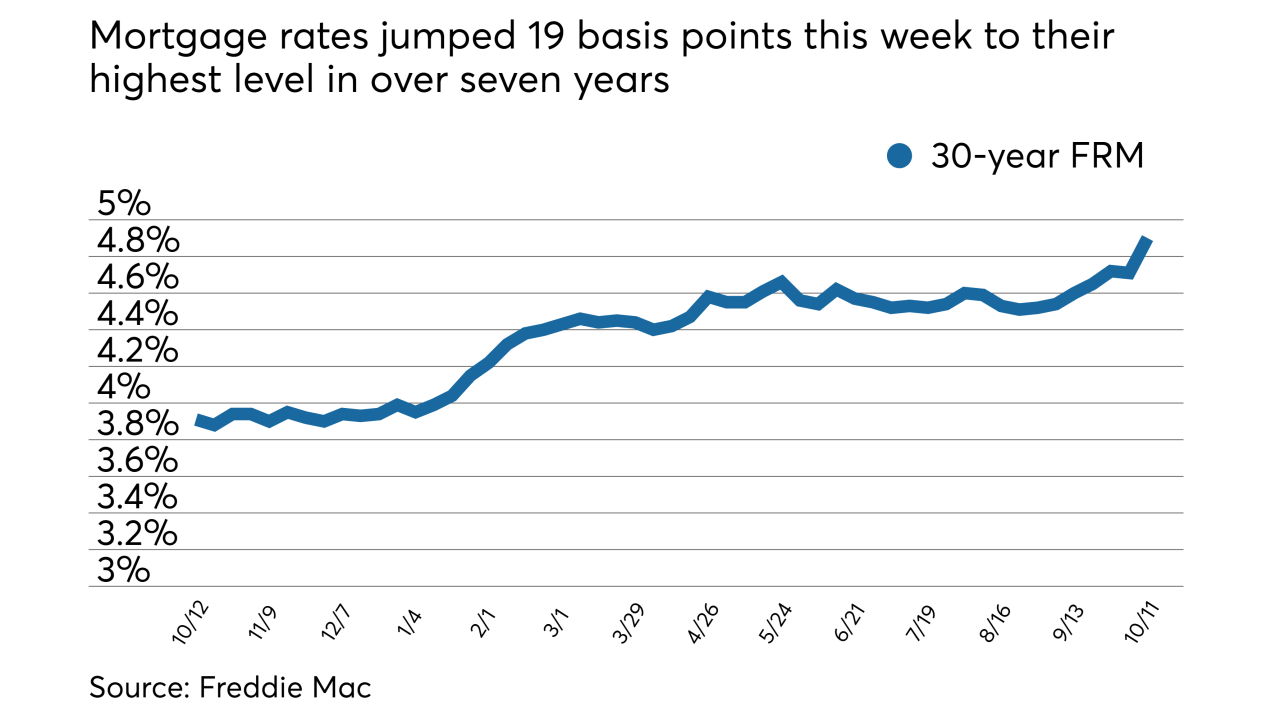

Mortgage rates, after a brief respite last week, rose to their highest level in over seven years, according to Freddie Mac.

October 11 -

Rising interest rates, both current and the prospect for future increases, took a toll on consumers' outlook on the housing market during September, according to Fannie Mae.

October 9 -

Mortgage rates dropped slightly for the first time after five weeks of increases, but this is only a temporary lull as the economy remains strong, Freddie Mac said.

October 4 -

The strong U.S. economy pushed mortgage rates in the past week to their highest level in over seven years, and further hikes are on the way, according to Freddie Mac.

September 27 -

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

September 20 -

While new-home construction and sales should rise in the next 18 months, next year's mortgage origination volume estimate was cut slightly as the economy is expected to slow down soon, said Fannie Mae.

September 17 -

Mortgage rates jumped 6 basis points over the past week, which led to the largest year-over-year gain in over four years, according to Freddie Mac.

September 13