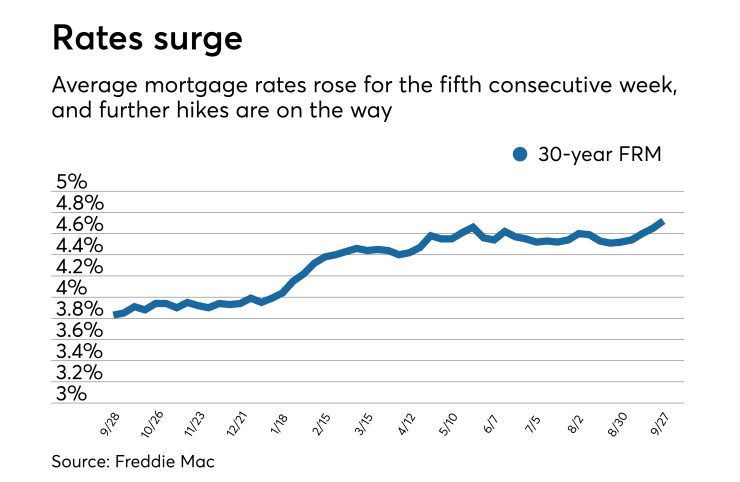

The strong U.S. economy pushed mortgage rates in the past week to their highest level in over seven years, and further hikes are on the way, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 4.72% | 4.16% | 3.97% |

| Fees & Points | 0.5 | 0.5 | 0.3 |

| Margin | N/A | N/A | 2.76 |

The 30-year fixed-rate mortgage averaged 4.72% for the week ending Sept. 27,

"The robust economy, rising Treasury yields and the anticipation of more short-term rate hikes caused mortgage rates to move up," Sam Khater, Freddie Mac's chief economist, said in a press release. "Even with these higher borrowing costs, it's encouraging to see that prospective buyers appear to be having a little more success. With inventory constraints and home prices starting to ease, purchase applications have now trended higher on an annual basis for six straight weeks."

The 15-year fixed-rate mortgage this week averaged 4.16%, up from last week when it averaged 4.11%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.13%.

"Consumer confidence is at an 18-year high, and job gains are holding steady. These two factors should keep demand up in coming months, but at the same time, home shoppers will likely deal with even higher mortgage rates," Khater added.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.97% with an average 0.3 point, up from last week when it averaged 3.92%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.2%.

"Mortgage rates held at five-year highs after the Federal Reserve offered few surprises after their