-

Rising home prices along with a changing perception of the U.S. economy reduced consumer confidence in the housing market to the lowest point of 2018, according to Fannie Mae.

January 7 -

It's not clear exactly what might pull investor sentiment and 10-year Treasury yields, which rates for the 30-year mortgage are benchmarked to, off the current lows.

December 31 -

Contract signings to purchase previously owned homes unexpectedly fell for a second month in November, offering yet another sign that the housing market is struggling.

December 28 -

The mortgage industry heads into 2019 with little relief from the market strains of the past three years. To succeed — or at least survive — lenders must confront major questions about demand, affordability and market consolidation.

December 26 -

Mortgage servicing assets are poised for gains in 2019. But as higher average mortgage rates spur lenders to sell servicing rights and diversify their loan offerings, servicers' work will also get more complicated and costly.

December 24 -

Mortgage rates continued to drop this week with the positive effects already aiding housing, according to Freddie Mac.

December 20 -

Next year is unlikely to offer relief from higher rates or housing supply shortages, according to the consensus forecast from 24 of the Securities Industry and Financial Markets Association's member firms.

December 14 -

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

Mortgage rates dropped significantly due to economic fears driving the markets following several weeks of little or no movement, according to Freddie Mac.

December 13 -

Average mortgage rates plunged after the United Kingdom first voted to leave the European Union. With uncertainty now growing about how Brexit will actually happen, here's a look at the implications for the housing market and mortgage lending.

December 12 -

Investors in agency mortgage-backed securities will find next year to be "anything but smooth sailing" as Federal Reserve rate hikes and balance sheet reduction will lead to an increase in real rates and volatility while pushing spreads wider, Bank of America said.

December 7 -

Despite increasing mortgage rates and a tepid housing market, positive consumer perception of the economy carried over to home buying during November, according to Fannie Mae.

December 7 -

Mortgage rates dropped this past week as investors pulled money from the stock market over global trade worries and instead purchased bonds, according to Freddie Mac.

December 6 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

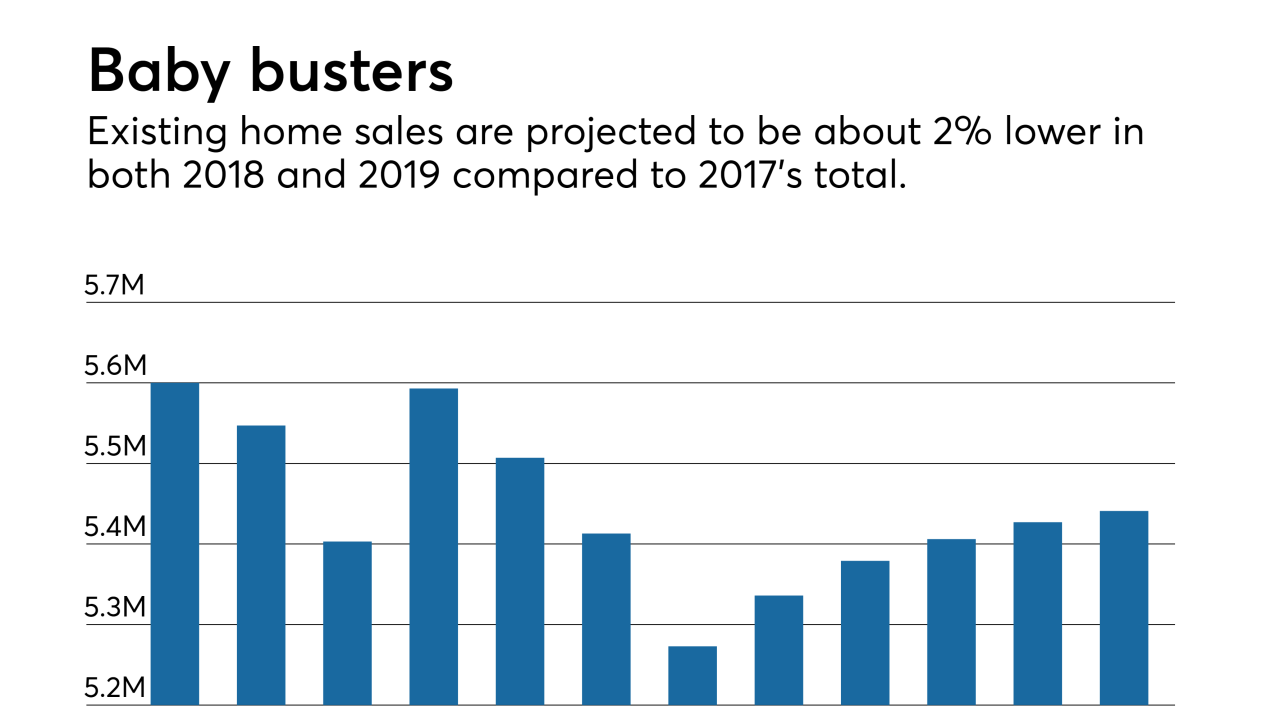

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

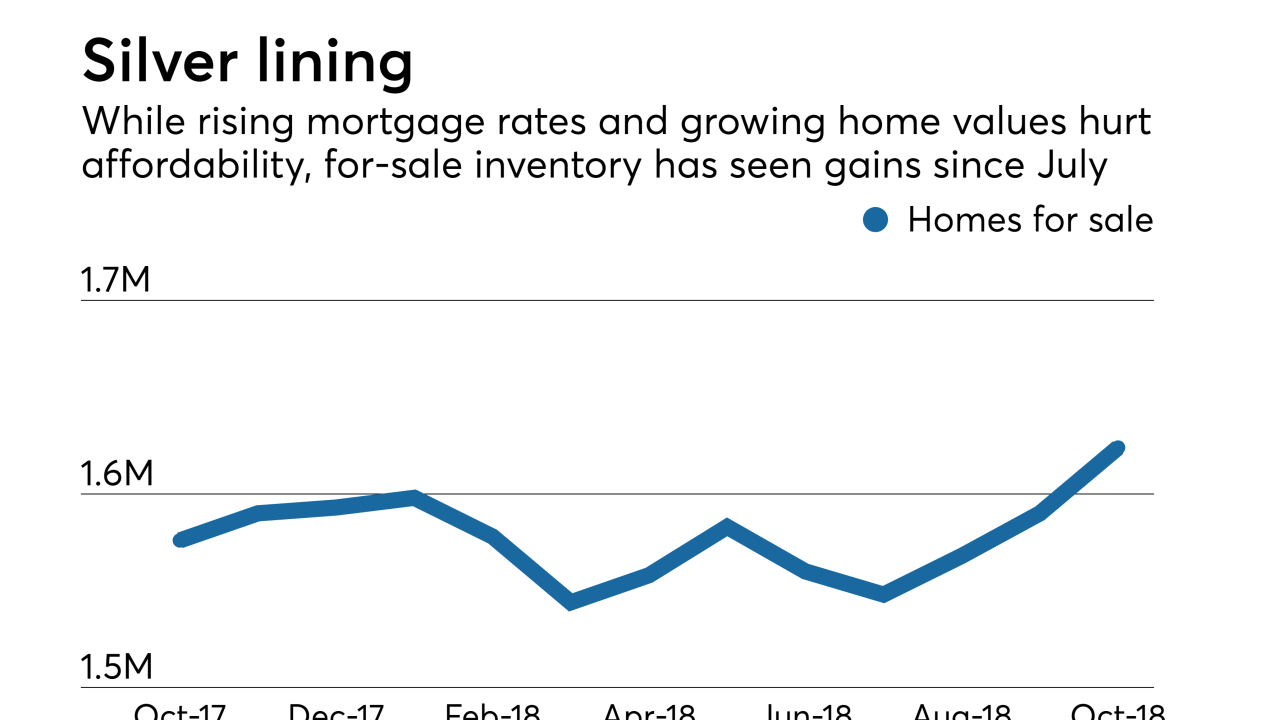

Affordability will take a hit and rent prices are expected to go higher next year behind rising mortgage rates, but they'll bring positive developments, according to Zillow.

November 28 -

While a downturn is expected to come for the housing market, it could be more of a side-step than falling off a cliff, according to the latest Barclays Global Economics Weekly report.

November 26 -

While the housing market perennially decelerates in the winter, it can be a wonderland for potential homebuyers, according to Attom Data Solutions.

November 21 -

Falling oil prices and continued volatility in the stock market resulted in the largest week-to-week decline in mortgage rates in over three years, according to Freddie Mac.

November 21 -

While it's normally a time the market slows down for mortgage lenders relative to the rest of the year, this winter shouldn't be used to hibernate, according to Attom Data Solutions.

November 20