-

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

The agency is looking to clarify existing regulations around how these accounts are handled, based on questions it received.

June 4 -

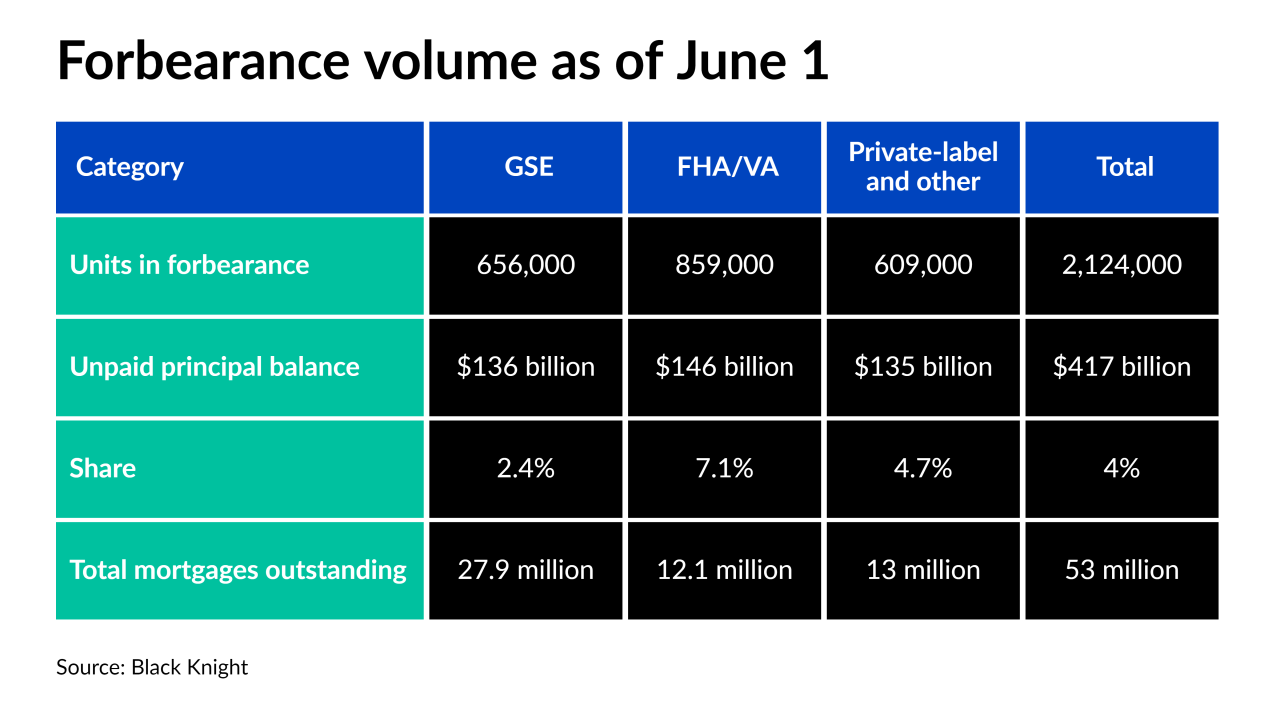

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

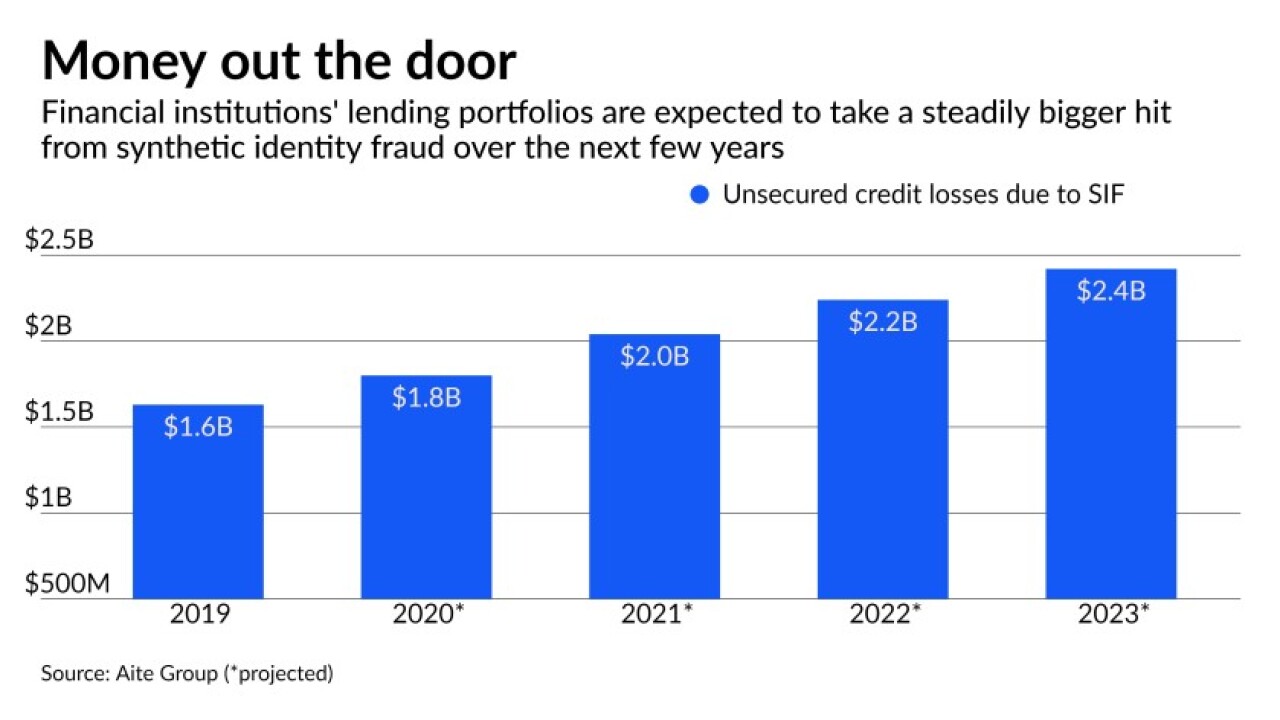

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

The plan "is part of a larger democratic attack on home ownership that includes an increase in the taxes on capital gains as well as an end to 1031 exchanges for the sale of property," writes the head of Whalen Global Advisors.

May 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

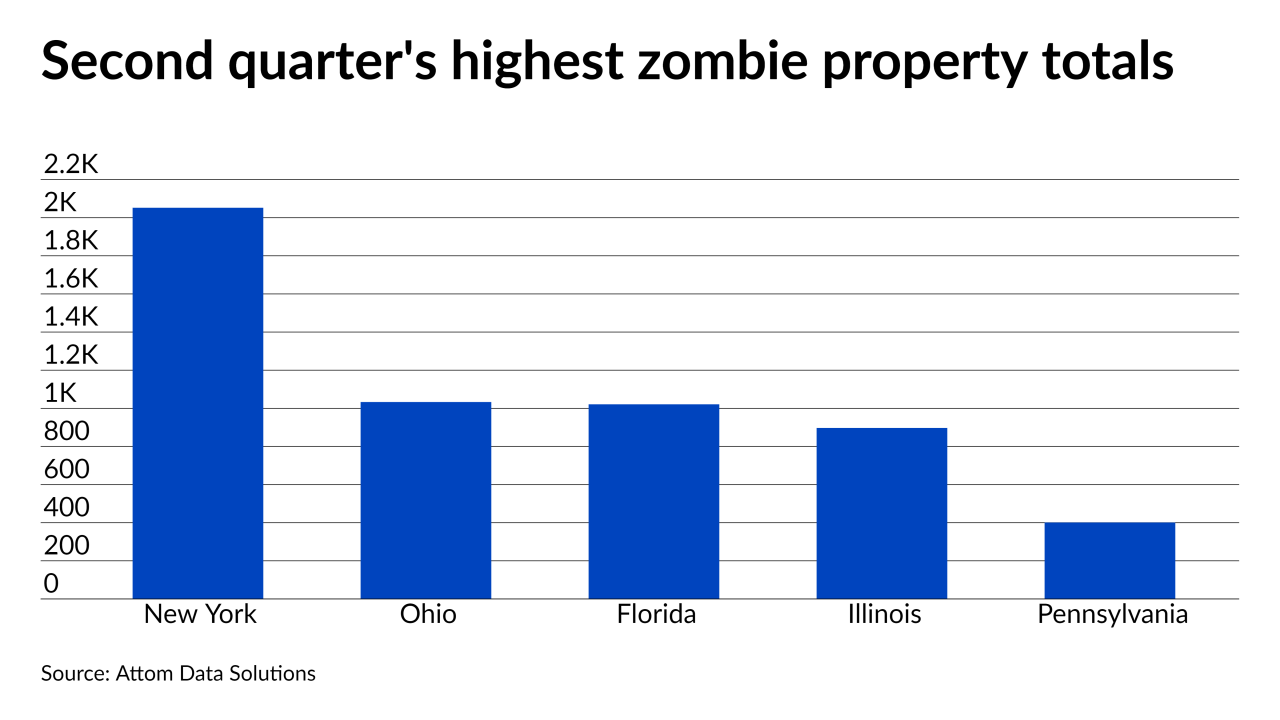

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

The transaction goes a long way toward the company’s goal to amass MSRs with a total unpaid principal balance of up to $150 billion.

May 25 -

While last year’s high valuations protected the wealth embedded in consumer residences, a new report suggests that they can also be an indication of rising risk.

May 24 -

The CFPB missives are an early and unmistakable warning that the era of COVID-19 flexibility is over, write two partners and a law clerk from Buckley LLP.

May 21 Buckley LLP

Buckley LLP