-

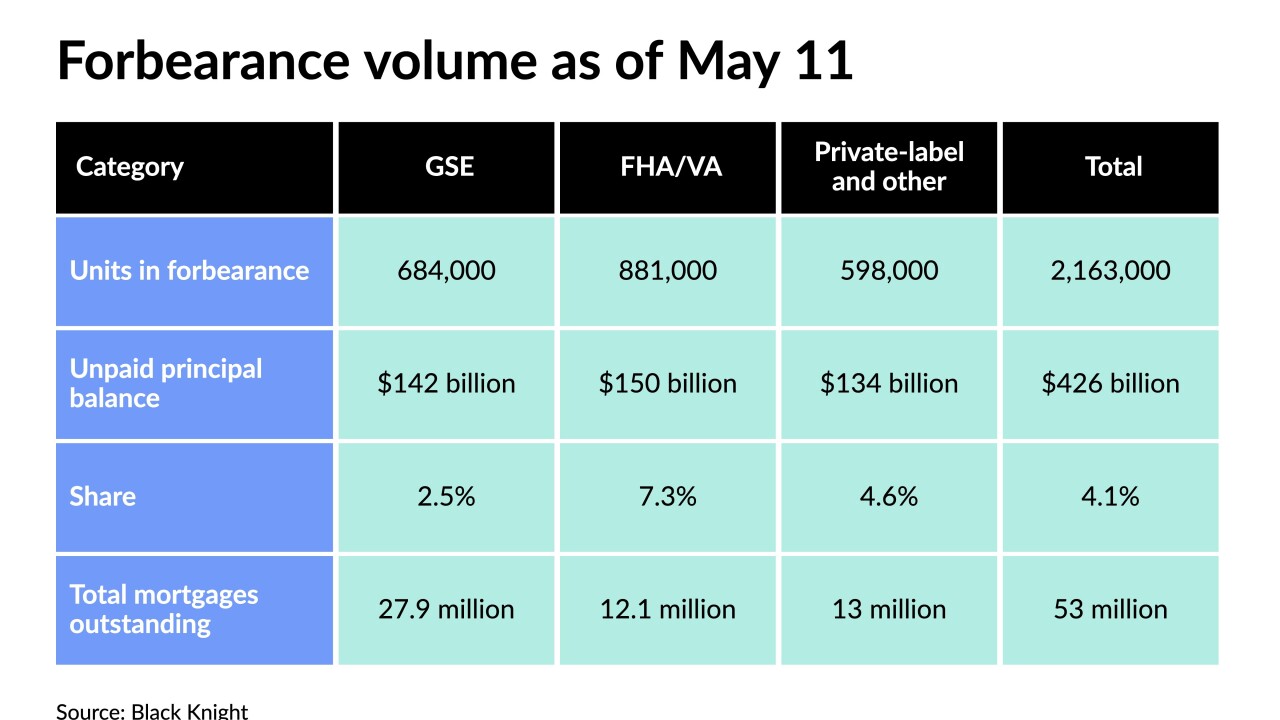

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

The individuals allegedly defrauded Freddie Mac and CBRE Capital Markets by misrepresenting information used to refinance a small-balance loan.

May 20 -

The rate of new forbearance requests as a share of portfolio volume also dropped to its lowest point since March, the Mortgage Bankers Association reported.

May 18 -

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

Expansion of an existing translation clearinghouse is among steps that could be taken, the Mortgage Bankers Association suggested in a letter sent to the leaders of the House Financial Services Committee on Wednesday.

May 12 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Unimproved parcels such as empty lots, parking spaces and even driveway lots that are not given a property address are often missed in tax line setups, particularly if the tax service is using technology that speeds up the process, writes the senior vice president of LERETA.

May 12 LERETA

LERETA -

Collectors are mulling a procedural overhaul after a three-judge panel said the practice of using vendors to inform consumers about outstanding debts is illegal. The case may also complicate the CFPB's upcoming rule on electronic messaging.

May 11 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The defendants face 133 felony counts that include allegedly stealing identities to commit mortgage fraud between 2014 and 2020, resulting in the theft of $15 million.

May 7