-

Tough competition for home listings makes consumers more likely to misrepresent themselves on loan applications.

December 1 -

Default risks soar in minority neighborhoods during challenging economic times because, data shows, homes there are overpriced relative to incomes. Zoning and other changes could make loans more affordable by boosting housing stock and driving down prices.

November 25 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

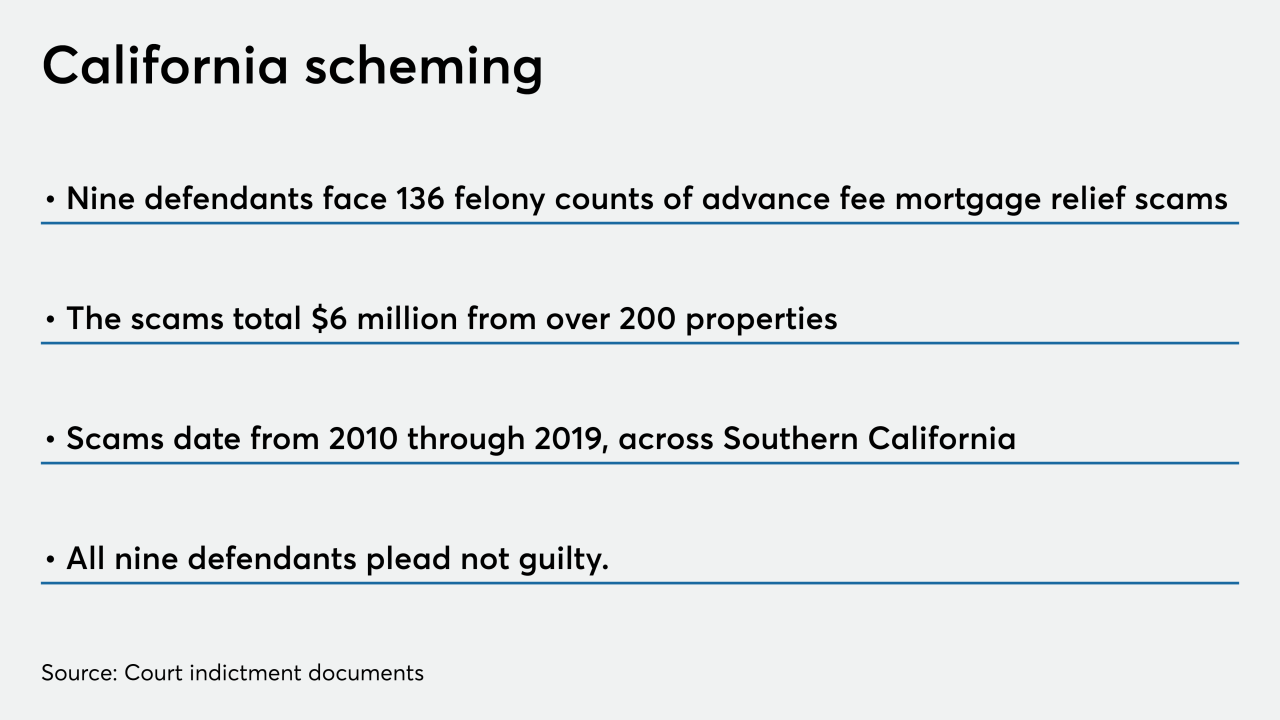

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

While sales increased 24% over August, they were still down 78% from the prior year, Auction.com reported.

November 24 -

The center’s annual study shows the extent to which larger multi-unit properties are insulated from distress.

November 23 -

The forbearance rate continued recovering in lockstep with employment improvement, according to the Mortgage Bankers Association.

November 23 -

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13 -

When new lending volumes start to recede, even with the FOMC’s actions, the shoals of credit and operational risk lurking just beneath the surface will emerge, columnist and analyst Chris Whalen says.

November 12 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The sector’s leaders are hoping for better in 2021, while not forgetting lessons learned about the market’s risks in 2020.

November 12 -

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12