-

Mortgage industry hiring and new job appointments for the week ending Nov. 6.

November 6 -

Growing equity levels increased the share of equity-rich and pulled borrowers out from underwater in the third quarter, according to Attom Data Solutions.

November 5 -

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Meanwhile, the delinquency rate is up 89% year-over-year, according to Black Knight.

November 2 -

The origination boom generated another profit for the company in the third quarter, when also it obtained a novel source of liquidity to support its servicing operations.

October 30 -

The agency’s final rule modernizing the Fair Debt Collection Practice Act limits calls to seven per week, but collectors won stronger protections from liability claims and other key changes to the original proposal.

October 30 -

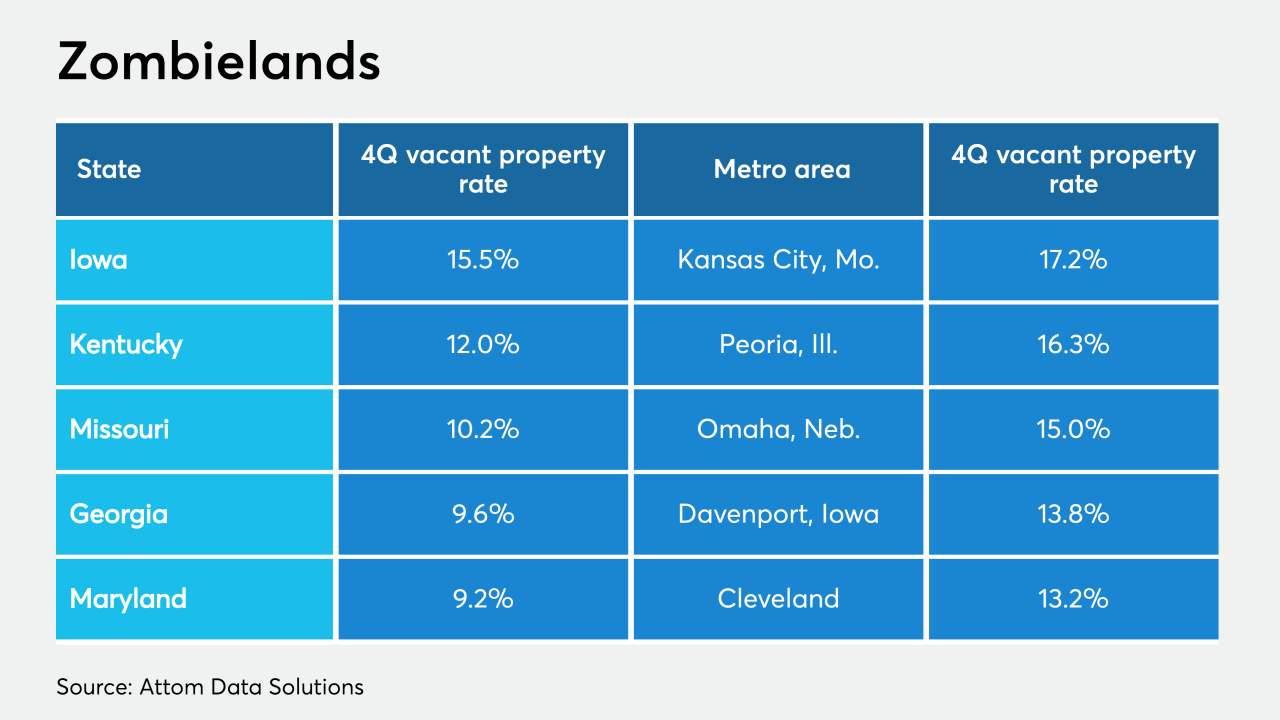

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

How we resolve millions of delinquent mortgages due to COVID is the only question that matters.

October 30 Whalen Global Advisors LLC

Whalen Global Advisors LLC