-

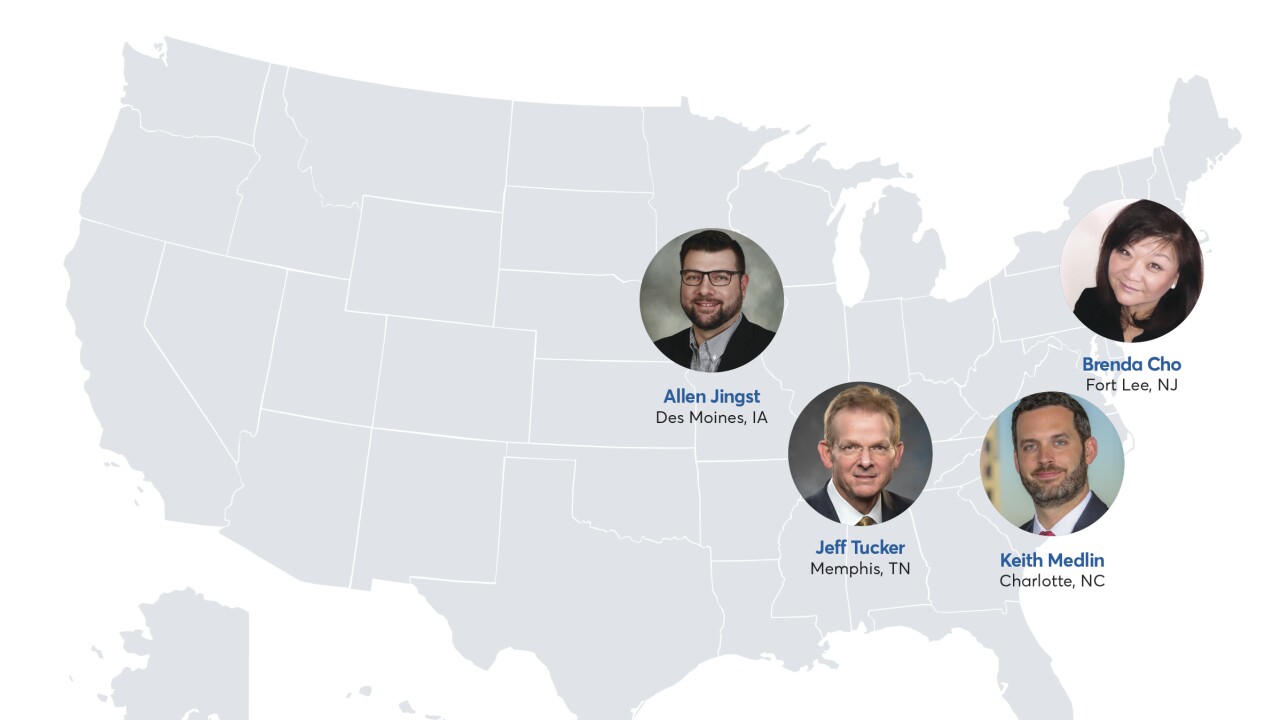

Mortgage industry hiring and new job appointments for the week ending April 26.

April 26 -

Plenty of homeowners succumbed to foreclosure when the housing bubble burst, but the effects on Hispanic and black communities in particular were heightened, with many still suffering, according to Zillow.

April 25 -

Even after integrating the 52 Wells Fargo branches acquired in December as part of its efforts to diversify beyond home lending, Flagstar Bancorp's first-quarter earnings were driven by increased mortgage revenue.

April 23 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

Consumers increasing their online shopping for homes and loans is a reason why mortgage servicers' retention rates haven't improved much since the downturn, according to a marketing technology firm executive.

April 22 -

Mortgage industry hiring and new job appointments for the week ending April 19.

April 19 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Surging loan production expenses and low revenue killed profits in 2018 for loans originated by independent mortgage bankers and subsidiaries of chartered banks, according to the Mortgage Bankers Association.

April 17