-

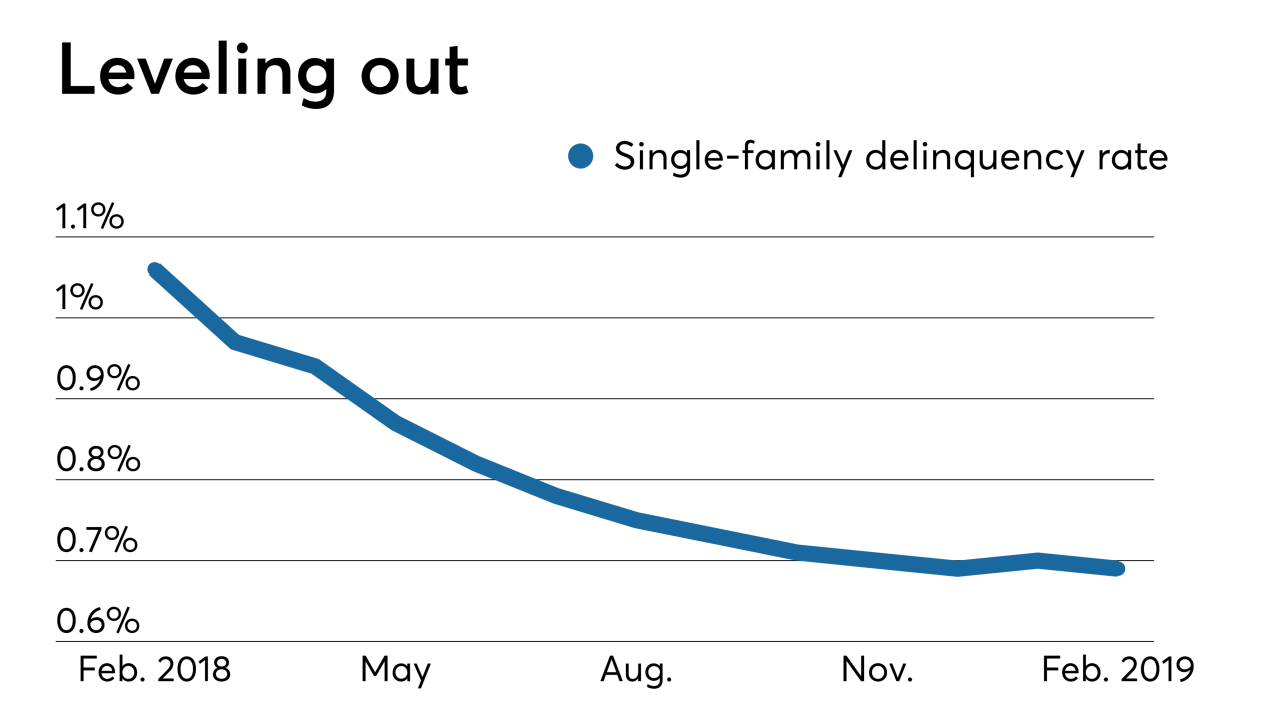

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

Home retention actions for loans owned by Fannie Mae and Freddie Mac declined in the fourth quarter and that trend is likely to continue given the strong economy.

March 26 -

Independent mortgage bankers lost the largest amount for originating a loan in the fourth quarter since this data has been tracked, as costs rose and volume dropped, according to the Mortgage Bankers Association.

March 26 -

With a second defendant pleading guilty to conspiracy, it was learned that a Watertown, N.Y., apartment complex is among dozens of rental properties in that state and several others that allegedly received $500 million in fraudulent bank loans.

March 25 -

Mortgage industry hiring and new job appointments for the week ending March 22.

March 22 -

While fading 9.53% annually, February mortgage delinquencies posted a month-over-month increase for the first time in 12 years, according to Black Knight.

March 21 -

The money for a proposed $300 million sports complex at a foreclosed famed New York Catskills Mountain hotel was not produced by a March 22 deadline.

March 21 -

Ohio has become the latest state to start including mortgage servicing rights holders in its increased regulation of nonbank servicers.

March 20 -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc.