-

Joseph Tomkinson, who first pared down and then rebuilt Impac Mortgage Holdings in the aftermath of the housing crisis, is stepping down as the company's chairman and CEO.

March 21 -

Incenter Mortgage Advisors is putting up for bid a $712.8 million package of government-sponsored enterprise and Ginnie Mae mortgage servicing rights concentrated in the Southeast.

March 2 -

The servicing business drove Nationstar Mortgage Holdings' fourth-quarter profitability and will be a major factor going forward after the company is acquired by WMIH.

March 1 -

From accelerating its subservicing transformation to overcoming regulatory obstacles, here's a look at three reasons behind Ocwen Financial Corp.'s $360 million acquisition of PHH Corp.

February 27 -

From origination to payoff, blockchain technology makes data more reliable and secure to enhance and improve mortgage lending.

February 23 Fiserv

Fiserv -

Ocwen Financial Corp. fired Otto Kumbar, executive vice president of lending, as the company significantly reduces its origination business.

February 13 -

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

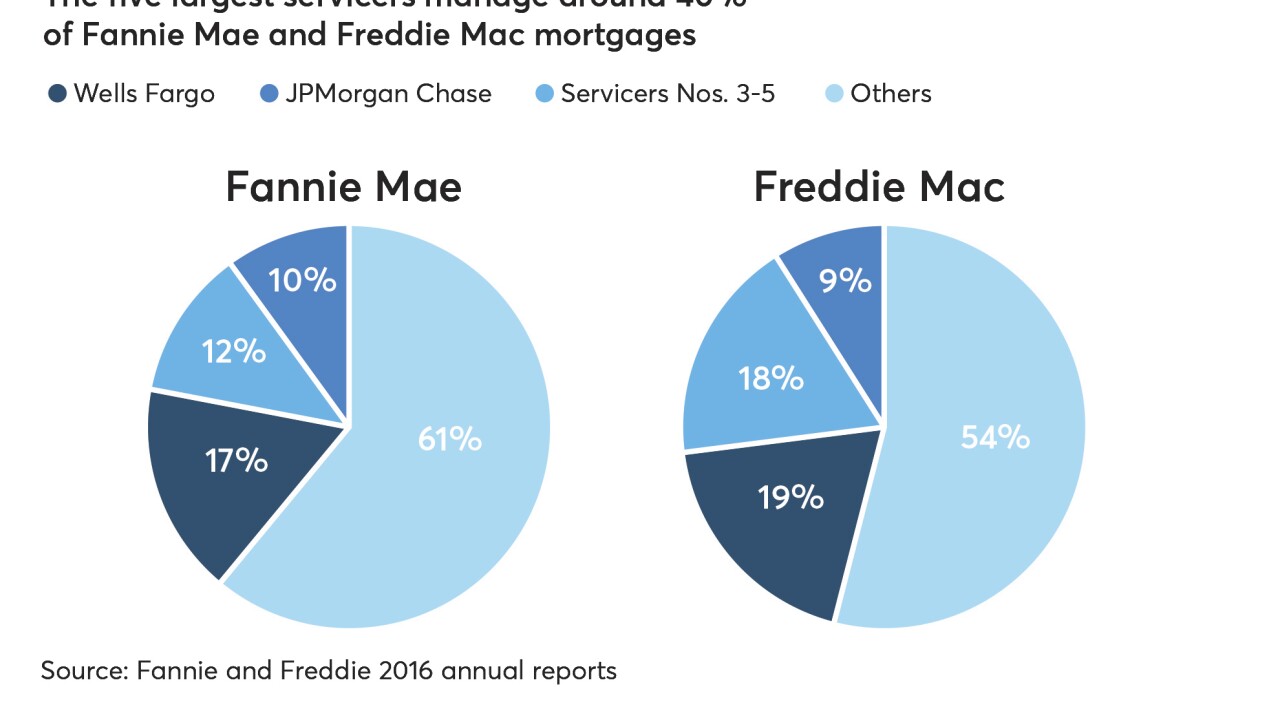

Wary of concentration risk, secondary market participants are backing initiatives to give more players a piece of the action.

February 6 -

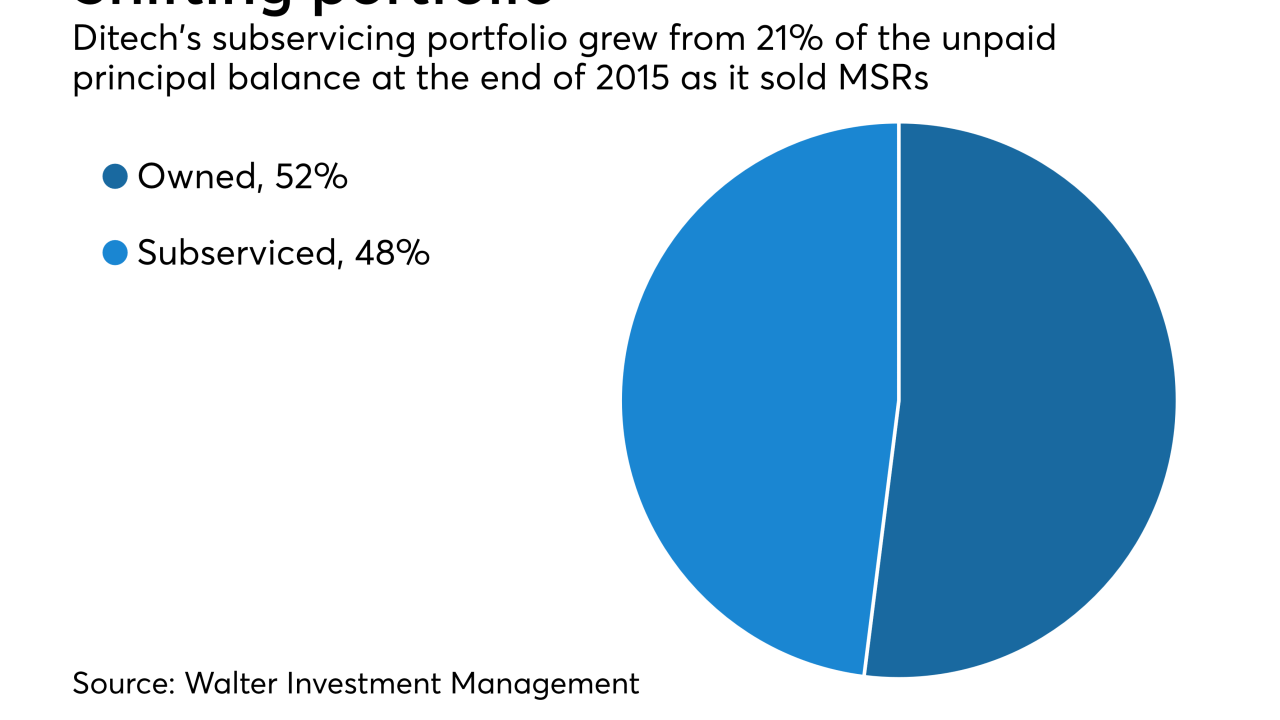

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

The mortgage industry should expect significant volatility that could result in a wave of lender consolidation in 2018, warns an analyst at risk management technology vendor LoanLogics.

January 31 -

Flagstar Bancorp swung to a fourth-quarter loss as the company took an $80 million noncash charge to earnings because of the tax reform bill.

January 23 -

Ocwen Financial is receiving a lump-sum payment of $280 million from New Residential under the latest restructuring of the mortgage servicing rights sale.

January 19 -

Bank of America's mortgage banking business reported a loss for the fourth quarter driven largely by representations and warrants provisions.

January 17 -

Citigroup's fourth-quarter residential mortgage banking revenue was 22% lower from the previous year because the company sold the vast majority of its servicing rights.

January 16 -

JPMorgan Chase reported lower mortgage banking revenue in the fourth quarter as the returns from its servicing business declined from the previous year.

January 12 -

Situs agreed Friday to buy mortgage servicing rights valuation and brokerage firm MountainView Financial Solutions in a deal set to close this month.

January 5 -

MountainView is brokering a nonrecourse $3.5 billion package of Fannie Mae and Freddie Mac mortgage servicing rights on behalf of an unnamed seller.

January 5 -

The largest residential mortgage servicers will get even larger in 2018, benefiting from consolidation and the outsourcing of servicing rights acquired by companies without their own platforms.

December 26