-

With historic barriers of systemic discrimination, predatory lending and wealth inequities to overcome, change will take time, but leaders from National Association of Real Estate Brokers and other groups propose lenders take these steps now.

February 19 -

Also: New Residential, Fannie Mae and Freddie Mac release Q4 earnings reports

February 12 -

Ocwen Financial, Interfirst Mortgage, Marcus & Millichap and others announce new leadership hires.

February 12 -

As 2021 shapes up to be a robust year for mortgage volumes, local lenders discuss the 12 metro areas that are expected to get the most interest from buyers, according to Zillow.

February 8 -

Open Mortgage, Aces Quality Management, Verity Global Solutions, Cherry Creek Mortgage and InterLinc Mortgage Services all announced hirings and promotions.

January 29 -

Plus, 4Q earnings show strong mortgage volumes, growth forecasted for jumbo loan market and more.

January 22 -

The administration faces a slew of immediate financial policy tasks, such as passing a new round of small-business aid, charting a course for Fannie Mae and Freddie Mac and filling vacant agency leadership posts.

January 20 -

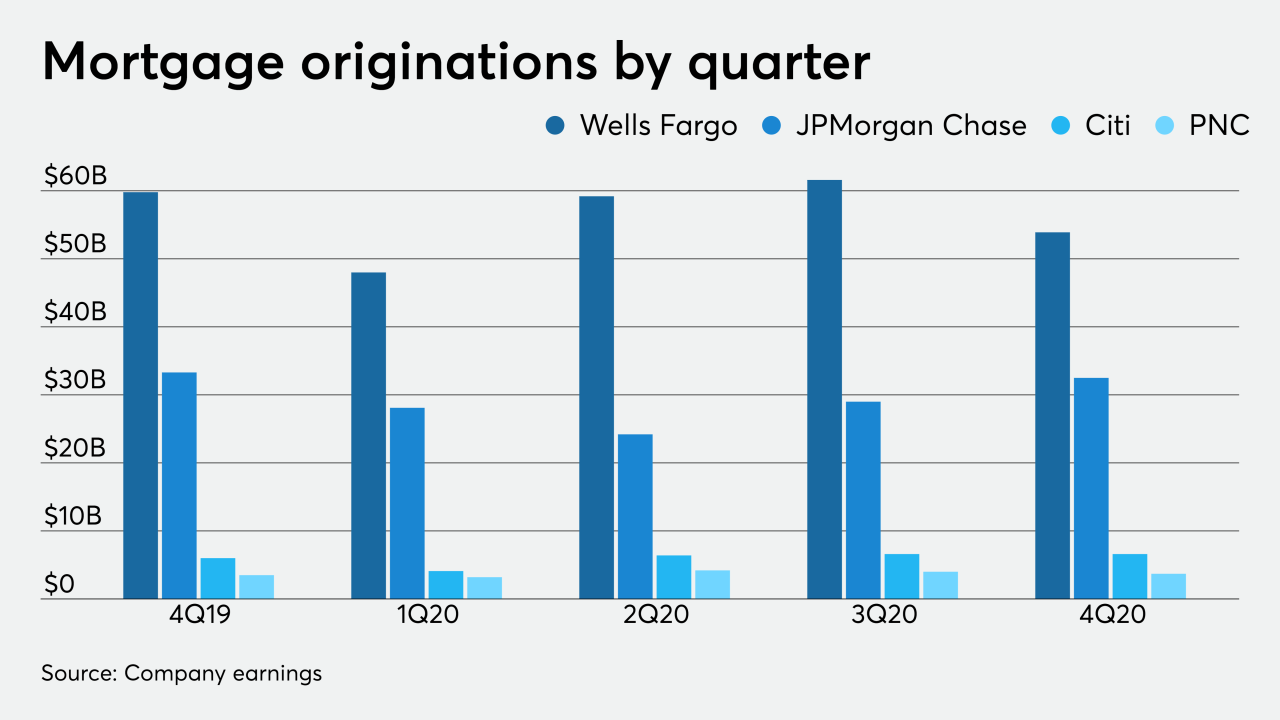

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

If you haven't met Suzanne Shank you should. She is the chair and CEO of Siebert Williams Shank & Co. LLC, the nation’s largest female-and minority-owned, privately held finance firm, which she started with the legendary Muriel Siebert. Join us in an intimate conversation and hear her perspective on some of the most critical issues of the day.

January 6 -

The Fed’s decision to lower rates amid a pandemic proved serendipitous for home lenders who benefited from a refinance boom last year, but they may need to make adjustments in the coming months.

January 5