Want unlimited access to top ideas and insights?

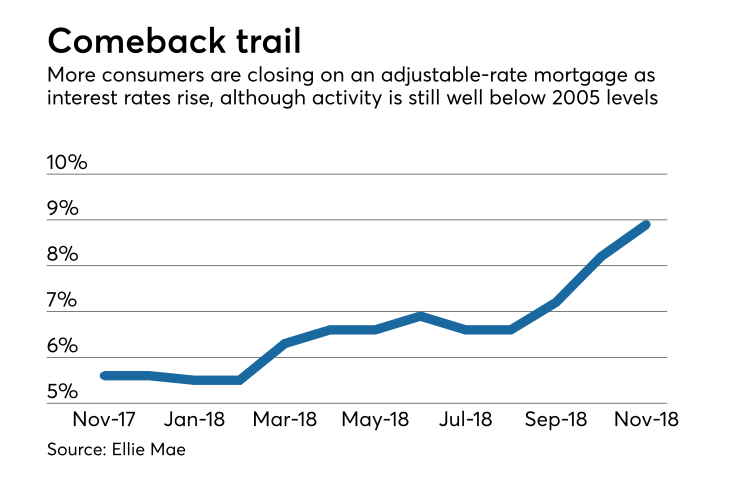

Adjustable-rate mortgages in November had their highest share of closed loans since Ellie Mae started tracking this data in 2011 as rates for 30-year loans reached 5.15%.

According to the Origination Insight Report, ARMs made up 8.9% of closed loans during the month. But the current share pales compared with ARM originations during the housing boom. During the week of March 25, 2005, 36.6% of applications by unit and 52% by dollar volume were for ARMs, according to Mortgage Bankers Association data.

In October,

During November and December, the ARM share of applications ranged from 7.3% to 7.9%, a level it reached again on

"As interest rates continue to rise, we are seeing the percentage of ARMs rise in lockstep," Jonathan Corr, president and CEO of Ellie Mae, said in a press release. "As expected, we are also continuing to see the percentage of refinances remain low — 30% in November — due to higher interest rates."

In December, rates

In October, refis had a 32% share, while one year ago they had a 39% share.

Average time to close a loan rose to 46 days from 45 the previous month, with the average for purchase loans rising two days to 48.

The average borrower credit score remained at 727 for the third consecutive month, with the average loan-to-value ratio at 79% for the fourth month in a row. The housing expense debt-to-income ratio remained at 26% while the total DTI was 39%.