Lenders constantly look for ways to save money and streamline mortgage processes, leaning on everything from

Machine learning provides another possible avenue Black Knight is quantifying the savings for its latest technology. The software and data provider, through independent research by a third party, found its

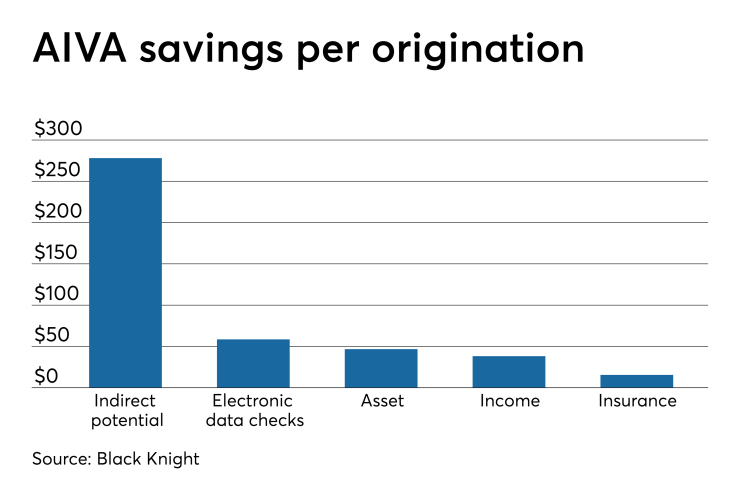

The reduced costs come from fewer hours worked, income and asset reviews, and automated data collection.

As of the end of 2018,

"Through the independent analysis of an unbiased third party, we have been able to show that lenders can expect to see significant savings by incorporating AIVA into their origination process," Anthony Jabbour, chief executive officer of Black Knight, said in a press release.

"Leveraging AIVA results in significant cost savings, provides the ability to redirect tens of thousands of man hours to items more focused on satisfying customers and produces a return on investment nearing 500%."

For a top-50 lender by volume doing several thousand originations a month, the projected net impact amounts to $1.98 million in the first year. Additionally, savings compound the longer the program is deployed. The average annual savings comes out to $3.13 million over the course of five years, topping out at $4.01 million in year five.

But implementing