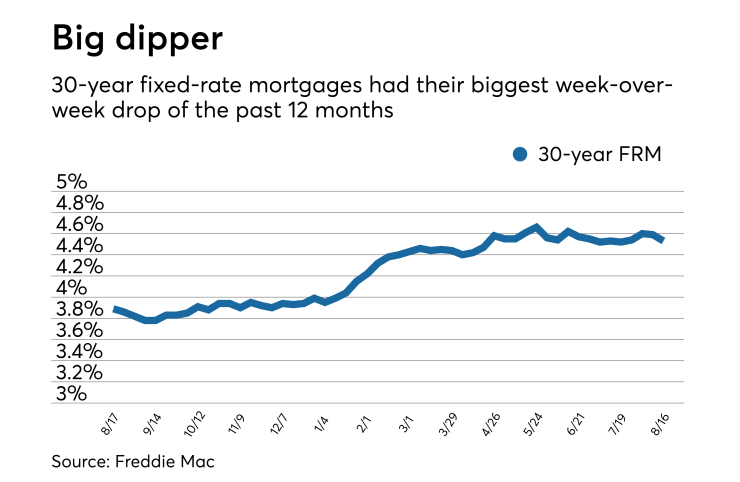

Average mortgage rates fell, including the largest week-over-week drop in the past 12 months, according to Freddie Mac. Despite the all-around drop, mortgage application volume

| | 30-Year FRM | 15-Year FRM | 5/1-Year ARM |

Average Rates | 4.53% | 4.01% | 3.87% |

Fees & Points | 0.5 | 0.5 | 0.4 |

Margin | N/A | N/A | 2.75 |

"This stability in borrowing costs comes despite the highest core inflation rates since 2008 and turbulence in the currency markets," said Freddie Mac Chief Economist Sam Khater in a press release. "Unfortunately, this pause in rates is not leading to increasing home sales."

"Purchase mortgage applications trailed year-ago levels again last week, and it's clear that in some markets the combination of ascending home prices, limited affordable inventory and this year's higher rates are curtailing homebuyer demand," Khater added.

The 30-year fixed-rate mortgage averaged 4.53% for the week ending Aug. 16,

Yields on the 10-year Treasury note, a key indicator in pricing 30-year fixed-rate mortgages, continued to fall since last week and hovered below 2.9%.

The 15-year fixed-rate mortgage also declined, falling 4 basis points this week and averaged 4.05%. The 15-year fixed-rate mortgage averaged 3.16% at this time last year.

The average five-year Treasury-indexed hybrid adjustable-rate mortgage fell by 3 basis points, to 3.87%. The five-year adjustable-rate mortgage averaged 3.16% a year ago.

"Mortgage rates fell last week driven by financial market flight to safety as the Turkish lira plummeted. Economic developments there typically do not pose broader risks, but the shockwaves were larger now for two reasons: concern about the exposure of European banks to Turkish assets and the developments coming with little other news to move markets," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Aug. 15.

"Beyond international news, financial markets are likely to watch U.S. housing market data due over the next week. The housing market has been strong for much of the economic recovery, but recent soft home sales numbers have spooked markets and prompted fears of a broader economic slowdown. July data should provide greater clarity on the health of the U.S. housing market and its implications for the broader economy," he said.