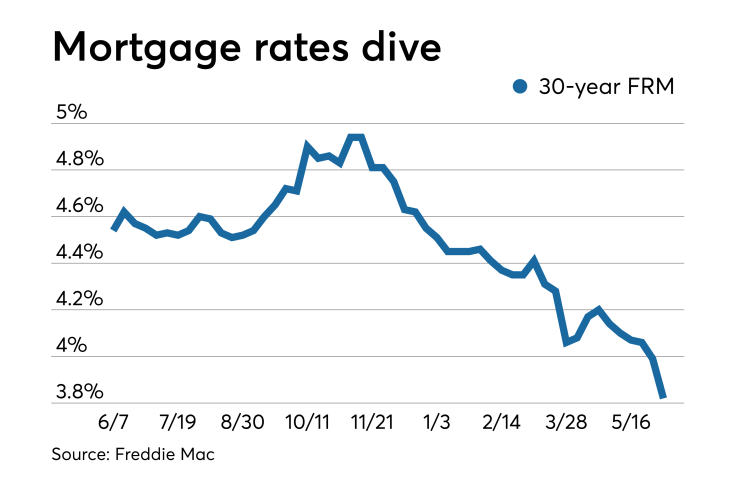

Mortgage rates fell to their lowest level since September 2017, with the 30-year down 17 basis points as worries over foreign trade policy continued to roil the markets, according to Freddie Mac.

| 30-Year FRM | 15-Year FRM | 5/1-Year ARM | |

| Average Rates | 3.82% | 3.28% | 3.52% |

| Fees & Points | 0.5 | 0.5 | 0.4 |

| Margin | N/A | N/A | 2.75 |

"During the past few weeks, the way mortgage rates have reacted to trade-related news has been muted compared to that of Treasury yields, but that pattern changed this week," Matthew Speakman, an economic analyst at Zillow, said when that company released its rate tracker. "Friday's unexpected announcement that the Trump administration planned to raise tariffs on goods imported from Mexico roiled markets and dragged longer-term bond yields to fresh 20-month lows.

"Mortgage rates followed suit, hitting their lowest levels since late 2017. Increasingly, investors appear to be pricing-in the notion that trade-related uncertainty is no longer a temporary concern," he continued.

On the other hand, those trade tensions are

"While the drop in mortgage rates is a good opportunity for consumers to save on their mortgage payment, our research indicates that there can be a wide dispersion among mortgage rate offers. By shopping around and getting a single additional mortgage rate quote, a borrower can save an average of $1,500," Sam Khater, Freddie Mac's chief economist, said in a press release.

"These low rates are also good news for current homeowners. With rates dipping below 4%, there are over $2 trillion of outstanding conforming conventional mortgages eligible to be refinanced — meaning the majority of what was originated in 2018 is now eligible."

The 30-year fixed-rate mortgage fell for the sixth consecutive week. It averaged 3.82% for the week ending June 6,

The 15-year fixed-rate mortgage averaged 3.28%, down from last week when it averaged 3.46%. A year ago at this time, the 15-year fixed-rate mortgage averaged 4.01%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.52% with an average 0.4 point, down from last week when it averaged 3.6%. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.74%.

The June 7 jobs report could determine where mortgage rates are heading in the short term.

"Rates did edge higher in recent days, however, in response to Federal Reserve Chairman Jerome Powell's suggestion that a cut to the federal funds rate may be necessary in the near term." Speakman said. "And more rate movements are likely on the way, as influential economic data releases — most notably Friday's all-important jobs report — are scheduled for the coming days.

"Wednesday's private payrolls data greatly underwhelmed and given the recent strength that we’ve seen in the labor market a poor jobs report on Friday would likely send mortgage rates down further and add to the mounting pressure on the Fed to cut interest rates," he continued.