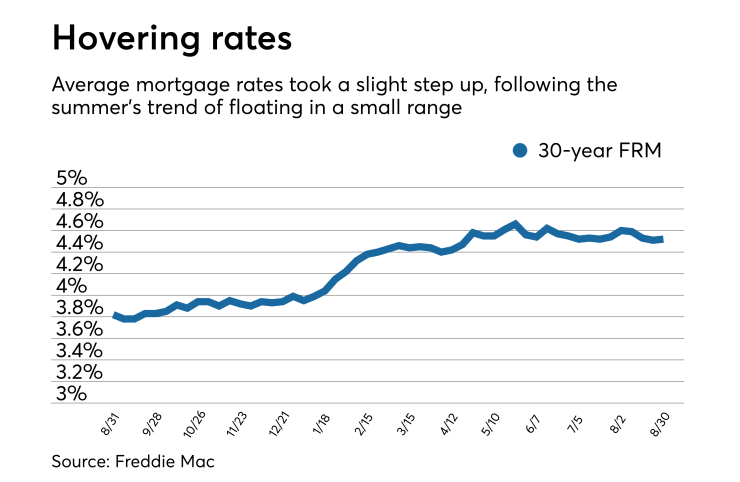

Mortgage rates took small steps up

| | 30-Year FRM | 15-Year FRM | 5/1-Year ARM |

Average Rates | 4.52% | 3.97% | 3.85% |

Fees & Points | 0.5 | 0.5 | 0.3 |

Margin | N/A | N/A | 2.77 |

The 30-year fixed-rate mortgage averaged 4.52% for the week ending Aug. 30, a slight tick up from last week when it averaged 4.51%. A year ago at this time, the 30-year fixed-rate mortgage averaged 3.82%.

"The 30-year fixed-rate mortgage barely inched up this week, continuing the summer trend of essentially being flat," Sam Khater, Freddie Mac's chief economist, said in a press release.

"While sales and price growth have softened these last few months, this leveling of rates may be helping more buyers reach the market. Purchase mortgage applications this week were once again modestly above year ago levels."

The 15-year fixed-rate mortgage averaged 3.97%, down 1 basis point from last week. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.12%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage changed the most, going up 3 basis points to a 3.85% average. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.14%.

"Mortgage rates drifted upward over the past week as financial markets rallied on news that the United States and Mexico have agreed to the broad outlines of a new trade agreement," Aaron Terrazas, Zillow's senior economist, said when that company released its own rate tracker on Aug. 29.

"Financial markets are typically quiet going into the Labor Day holiday, but that could change next week with several high profile Fed speeches on the calendar for Tuesday and Wednesday."