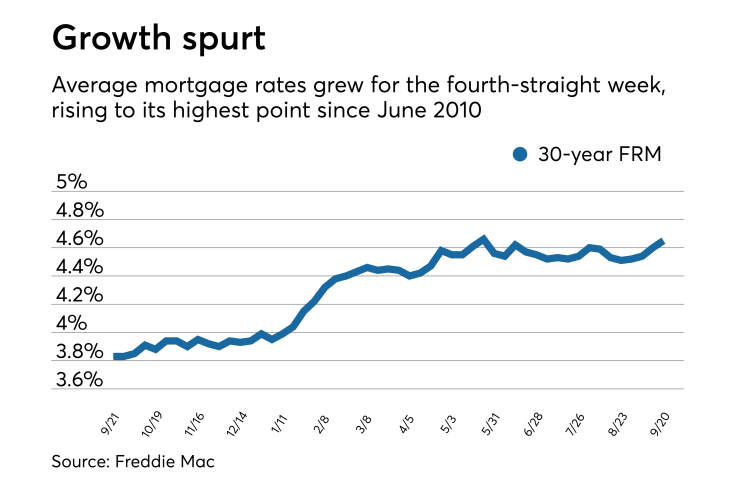

Mortgage rates increased 5 basis points this week, up for the fourth week in a row with momentum building for further hikes, according to Freddie Mac.

| | 30-Year FRM | 15-Year FRM | 5/1-Year ARM |

Average Rates | 4.65% | 4.11% | 3.92% |

Fees & Points | 0.5 | 0.5 | 0.4 |

Margin | N/A | N/A | 2.76 |

The 30-year fixed-rate mortgage averaged 4.65% for the week ending Sept. 20,

“Mortgage rates are drifting upward again and represent continued affordability challenges for prospective buyers – especially first-time buyers,” Sam Khater, Freddie Mac's chief economist, said in a press release. “Borrowing costs are moving right now for three main reasons: the very strong economy, higher U.S. government debt issuances and global trade tensions.”

The 15-year fixed-rate mortgage also grew 5 basis points this week, averaging 4.11%. A year ago at this time, the 15-year fixed-rate mortgage averaged 3.13%.

“Amidst this four-week climb in mortgage rates, the welcoming news is that

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.92%, a drop of 1 basis point from last week. A year ago at this time, the five-year adjustable-rate mortgage averaged 3.17%.

“Mortgage rates shot upward this week and are approaching their five-year peak, a surge that many analysts regard as overdue,” Aaron Terrazas, senior economist at Zillow said when that company released its own rate tracker on Sept. 19.

“A recent slew of strong economic data, combined with remarkably high consumer confidence in the American economy, gives the Federal Reserve little reason to alter its scheduled rate increases in the near future. Markets are likely to pay particular attention to [the Sept. 20 release of] existing home sales data.

"Rates have appeared resilient to recent weak housing data, but recent housing market indicators have been weaker than anticipated and another round of soft housing data could signal a broader slowing in that critical sector of the American economy,” Terrazas said.